Service & Supply | Oilfield Services | Frac Markets - Frac Trends | Job Cuts / Downsize / Layoff | Capital Markets | Capital Expenditure | Capex Decrease

NexTier Oilfield Draw Down Credit Line; Cut Staff; Frac Crews

NexTier Oilfield Solutions a frac company said it is taking the following steps to manage through these volatile times.

Cut capex : significantly reduce and refine its 2020 total capital expenditures, which it now expects to total between $100 million and $120 million

Cut staff : NexTier is further adjusting its organization to better align with market demand, including right-sizing of overhead costs, facility consolidation, and variable cost reductions in-line with activity declines

Draw down its bank line : To further strengthen financial strength and flexibility, NexTier has proactively borrowed a portion of its revolving credit facility availability in recent days, resulting in cash of greater than $460 million and, in conjunction with the remaining availability under its revolving credit facility, current liquidity in excess of $550 million.

Idle frac fleets : NexTier is idling a portion of its previously active hydraulic fracturing fleet

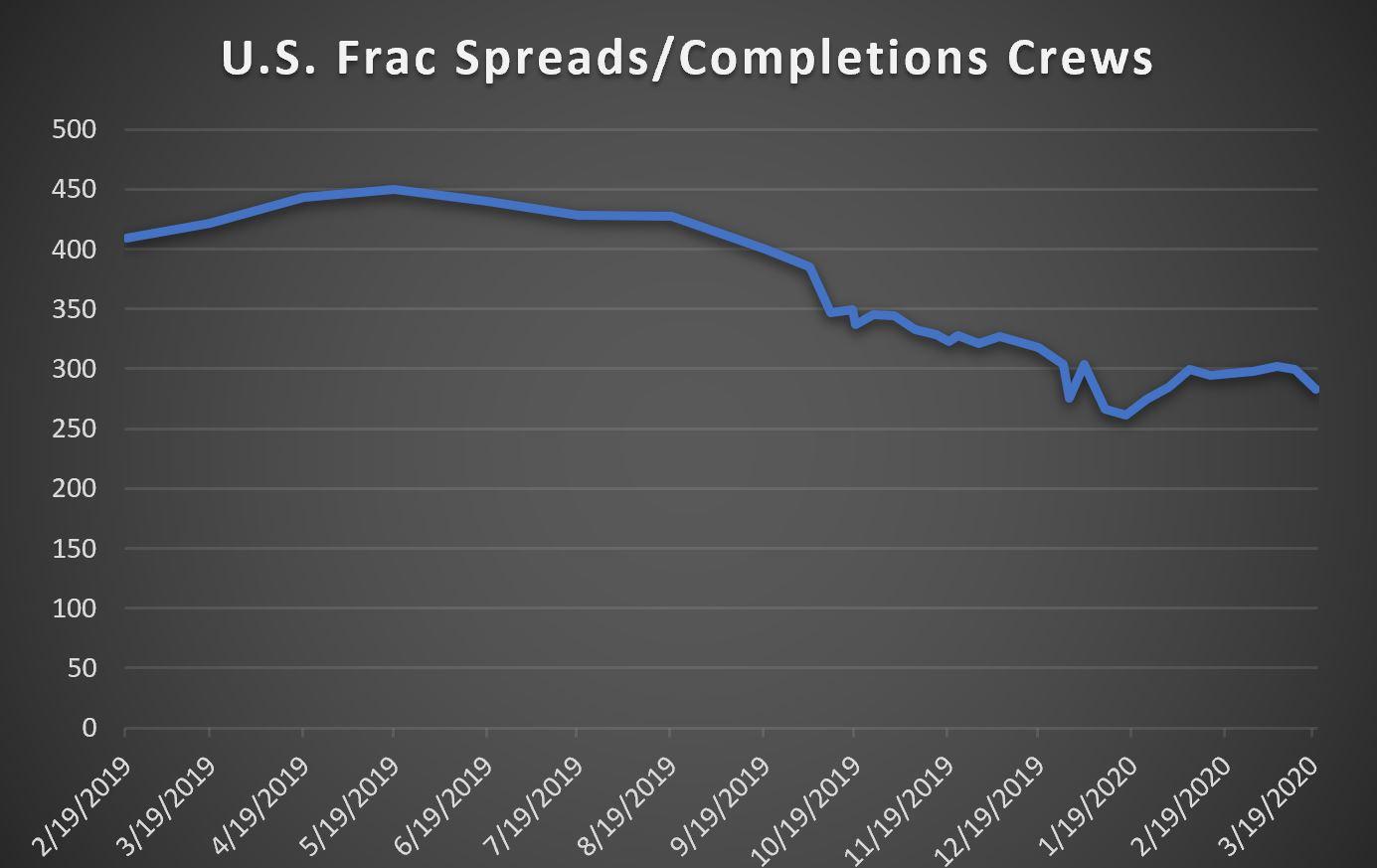

The company has seen demand for its services fall. Shale Experts continue to believe we will see 50% of the Frac Crews/Completion Crews not working by 2H2020

Source : Shale Experts Frac Database;

"We are acting decisively and swiftly to protect our financial strength and flexibility, while upholding our customer commitments of delivering leading service quality and safety performance," said Robert Drummond, President and Chief Executive Officer. "While our proven management system, business model of partnering with like-minded customers, and talented team drive differentiation versus peers, we are not immune to the unprecedented downturn currently facing the industry. In addition to our immediate response, we maintain additional flexibility to further flex our platform through further reductions in capex and cost structure, should market conditions dictate. We have a proven track-record of making difficult decisions swiftly to best position NexTier for the long-term. By prioritizing these responsive actions, I am confident NexTier will continue to distinguish itself as a leader in U.S. land well completions, while positioning us to take advantage of future market opportunities as conditions improve."

Related Categories :

Capex Decrease

More Capex Decrease News

-

Diamondback Energy Second Quarter 2021 Results

-

Oasis Adjusts 2021 Plans After Permian Asset Sale; Capex Cut 10%

-

Advantage Oil & Gas Adjusts 2021 Outlook as Drilling Outperforms

-

WPX Energy Third Quarter 2020 Results; Merger with Devon on Track

-

Murphy Oil Second Quarter 2020 Results; Trims Another $40MM from Capex

Gulf Coast News >>>

-

Why Surface-Only Inventory Predictions Are a Fool’s Errand

-

From Hedge Funds to Supermajors: Everyone Wants Hub-Linked Gas

-

Occidental Eyes $10 Billion OxyChem Sale Amid Debt and Capital Discipline Push -

-

Permian Gas Gets New Highway: Transwestern’s 1.5 Bcf/d Desert Southwest Expansion -

-

WaterBridge Infrastructure Brings Delaware Basin Water Model to Wall Street -