Hedging | Capital Markets | Capital Expenditure | Drilling Program - Wells | Drilling Program-Rig Count | Capital Expenditure - 2022

Oasis IDs 2022 Budget; Increasing Capex 74% YOY, Flat Production

Oasis Petroleum Inc. provided its return of capital plan, announced preliminary 2021 results, and issued its 2022 outlook.

2022 Plans

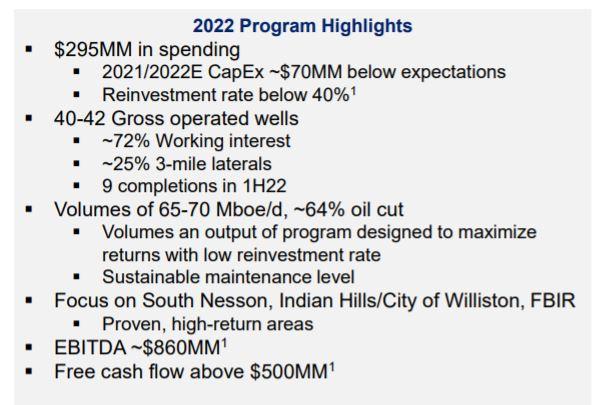

- Capex: $295 million - up 74% vs. 2021

- D&C: $250 million (85%)

- Other: $45 million (15%)

- Production: 65-70 MBOEPD (64% oil) - comparable to exit levels in 4Q21

- Well Plans: Complete 40-42 gross wells

- Approximately 25% of wells completed in 2022 are expected to be 3-mile laterals

Preliminary 4Q21 Results

Oasis is providing select preliminary unaudited financial results and operational updates for 4Q21:

- Produced 68.8 MBoepd in 4Q21 with oil volumes of 44.4 Mbopd, within the Company's guidance range;

- E&P CapEx was between $44MM and $48MM in 4Q21, 29% below guidance. Oasis' FY21 CapEx was between $168MM and $172MM, down 10% from the October update and 24% from the guidance adjusting for A&D activity;

- Generated significant free cash flow during 4Q21. As of 12/31/21, Oasis had approximately $172MM of cash, $400MM of long-term debt and no amounts drawn on its $900MM borrowing base ($450MM of elected commitments);

- Received $19MM distribution from OMP in November 2021;

- Pro forma net debt of approximately $68MM as of 12/31/21, including the $160MM received on 2/1/22 for the OMP merger with Crestwood;

- In 4Q21, Oasis amended certain transactions with hedge counterparties to modify the 2022 swap price from $50/bbl WTI to $70/bbl WTI for hedges totaling 19Mbopd. The amount paid for modification of these hedges totaled $138.5MM

Danny Brown, Oasis' Chief Executive Officer, said, "Preliminary fourth quarter results demonstrate our commitment to cost control and return of capital to shareholders. Capital expenditures and expenses were favorable to expectations while delivering volumes inside of guidance with strong price realizations."

Oasis ran two rigs and completed twelve wells in Indian Hills during 4Q21. During 2021, Oasis completed 23 gross operated wells in the Williston Basin vs. prior expectations of 23-25.

Hedging

As of February 9, 2022, the Company had the following outstanding commodity derivative contracts, which settle monthly and are priced off of WTI for crude oil and NYMEX Henry Hub for natural gas:

|

1H22 |

2H22 |

1H23 |

2H23 |

||||

|

Crude Oil (volume in MBopd) |

|||||||

|

Fixed Price Swaps |

|||||||

|

Volume |

19.0 |

19.0 |

14.0 |

14.0 |

|||

|

Price ($ per Bbl) |

$70.00 |

$70.00 |

$50.00 |

$50.00 |

|||

|

Two-Way Collars |

|||||||

|

Volume |

15.0 |

12.0 |

12.0 |

12.0 |

|||

|

Floor ($ per Bbl) |

$49.00 |

$50.00 |

$45.00 |

$45.00 |

|||

|

Ceiling ($ per Bbl) |

$66.28 |

$66.90 |

$64.88 |

$64.88 |

|||

|

Total Crude Oil Volume |

34.0 |

31.0 |

26.0 |

26.0 |

|||

|

Natural Gas (Volume in MMBtu/d) |

|||||||

|

Fixed Price Swaps |

|||||||

|

Volume |

30,000 |

||||||

|

Price ($ per Btu) |

$2.82 |

||||||

|

Total Natural Gas Volume |

30,000 |

During 4Q21, Oasis had cash derivative settlements of negative $110.1MM, and Oasis amended certain transactions with hedge counterparties to modify the 2022 swap price from $50/bbl WTI to $70/bbl WTI for hedges totaling 19Mbopd. The amount paid for modification of these hedges totaled $138.5MM. The December 2021 derivative contracts settled at a net loss of $27.5MM paid in January 2022 and will be included in the Company's 1Q22 derivative settlements.

Return of Capital Program

Oasis' return of capital plan remains true to the Company's strategic goals, which include exercising capital discipline and delivering both return on, and of, capital to shareholders. Oasis is committed to returning $280MM of capital to shareholders over the next year ($70MM per quarter) through an increase to the aggregate base dividend from $40MM to $45MM per year, variable dividends, and incremental share repurchases.

Oasis repurchased 680,235 shares during 4Q21 for $85.4MM, completing the prior $100MM repurchase program. With the lower share count, the board of directors of Oasis has increased the quarterly base dividend 17% to $0.585 per share for 4Q21 for shareholders of record as of February 21, 2022, payable on March 4, 2022. The aggregate base dividend is expected to remain at $11.3MM per quarter in 2022, and any additional share repurchases will be accretive to dividends per share.

Brown commented: "Capital discipline and shareholder returns are central tenants of our strategy. Given our high quality assets with low breakeven pricing, and very strong financial position, this fixed-dollar program demonstrates our commitment to shareholder returns while retaining flexibility to participate in industry consolidation or fund organic growth opportunities should prices and conditions warrant. Oasis returned over $210MM of capital to shareholders in 2021 and the new program builds on that strong foundation with an approximate 33% year-over-year increase."

Oasis expects to return capital proportionately each quarter through 2022. After the end of each quarter, including after 4Q21, Oasis expects to announce a variable dividend based on $70MM minus cash utilized to pay the base dividend and to repurchase shares during the prior quarter.

The Oasis board of directors has authorized a new $150MM share repurchase program, which replaces the $100MM historical program that was fully utilized in 2021. The new share repurchase program will be in place until the end of 2022 and is expected to be upsized if fully utilized.

Net Proved Reserves

The Company's estimated net proved reserves and related PV-10 at December 31, 2021 ("YE21") are based on reports prepared by DeGolyer and MacNaughton, independent reserve engineers. In preparing its reports, DeGolyer and MacNaughton evaluated properties representing all of the Company's PV-10 at YE21 in accordance with rules and regulations of the Securities and Exchange Commission applicable to companies involved in crude oil and natural gas producing activities. The following reserve information does not give any effect to or reflect Oasis's commodity hedges and utilizes an average NYMEX WTI crude oil price of $66.55 per barrel and an average natural gas price of $3.64 per MMBtu. These prices were adjusted by lease for quality, transportation fees, geographical differentials, marketing bonuses or deductions and other factors affecting the price received at the wellhead. All of the Company's estimated proved undeveloped reserves at YE21 are expected to be developed within five years. Oasis's estimated net proved crude oil and natural gas reserves at YE21 were 250.9 million barrels of oil equivalents ("MMBoe") and consisted of 174.3 million barrels of crude oil and 459.3 billion cubic feet of natural gas. The table below summarizes the Company's estimated net proved reserves and related PV-10 at YE21:

|

December 31, 2021 |

|||

|

Net Estimated Reserves (MMBoe) |

PV-10 (in millions) |

||

|

Proved Developed |

174.4 |

$ 2,474.5 |

|

|

Proved Undeveloped |

76.5 |

$ 640.9 |

|

|

Total Proved |

250.9 |

$ 3,115.4 |

|

PV-10 is a non-GAAP financial measure and generally differs from Standardized Measure, the most directly comparable GAAP financial measure, because it does not include the effect of income taxes on discounted future net cash flows. The reserves and PV-10 numbers presented above assume no ownership of OMP assets.

Related Categories :

Capital Expenditure - 2022

More Capital Expenditure - 2022 News

-

Capex Plans Jump After 2Q: Nearly 30 E&P Companies Raise 2022 Budgets -

-

Civeo Corp. Second Quarter 2022 Results; Raises Guidances

-

2022 Guidance Growth: Several Operators Bolster Capex, Production Outlook -

-

PDC Updates Budget Following Great Western Deal; Adds $50MM

-

Enerplus Bets on Bakken for 2022; Drill 50 Wells, 1.5 Rigs -

Permian News >>>

-

Why Surface-Only Inventory Predictions Are a Fool’s Errand

-

Occidental Eyes $10 Billion OxyChem Sale Amid Debt and Capital Discipline Push -

-

Permian Gas Gets New Highway: Transwestern’s 1.5 Bcf/d Desert Southwest Expansion -

-

WaterBridge Infrastructure Brings Delaware Basin Water Model to Wall Street -

-

OPEC+ Nudges Supply Higher: Why This Weekend’s Hike Echoes 2020—But Isn’t 2020

Rockies News >>>

-

SM Energy Hits Record Output; Driven by Uinta

-

The Permian Play: How ExxonMobil Is Rewriting the Shale Narrative -

-

Large Cap E&P To Reduce Drilling & Completion Activity in 2026 -

-

$2.4B Deal Gives MPLX Sour Gas Edge in Permian -

-

Liberty Energy: Navigating the Frac Downturn with Efficiency, Innovation, and Strategic Focus -