General News | Forecast - Production | Oil & Gas Prices

Operators Cite Investor Pressure for Production Growth Restraint

The latest survey by the Dallas Fed has unveiled that most E&P companies cite investor pressure as the primary reason for meager production growth.

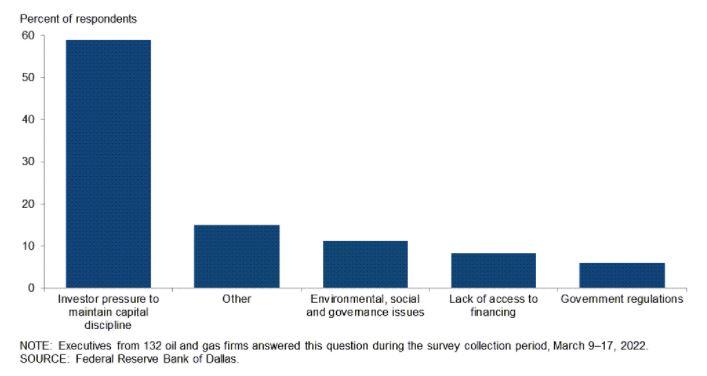

60% of Execs Cite Investor Pressure for Low Production Gains

Per the survey, nearly 60% of executives stated that investor pressure to maintain capital discipline is the primary reason that publicly traded oil producers are restraining growth despite high oil prices.

The next highest reason cited was "other", with 15%.

- For respondents who said “other,” the primary reasons were personnel shortages, limited availability of equipment and supply-chain issues. An additional reason cited was uncertainty regarding future oil prices and whether they would stay high.

Oil Price Needed for Growth

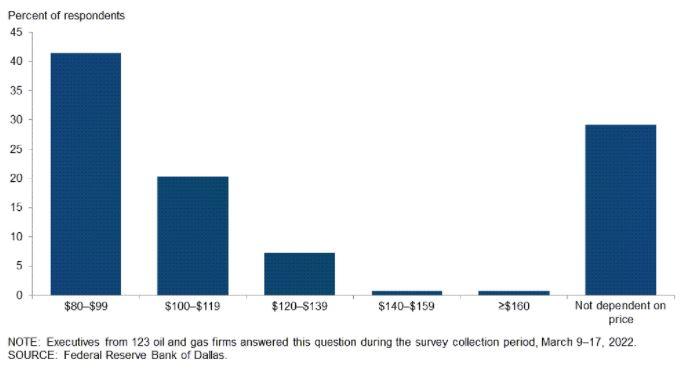

Just over 40% percent of executives believe the WTI crude oil price necessary to get publicly traded U.S. producers back into growth mode is between $80 and $99 per barrel.

Approximately 29%, believe the shift to growth mode will not be dependent on the price of oil.

Related Categories :

General News

More General News News

-

Phillips 66 Makes Offer to Buy DCP Midstream for $34.75/Share

-

Hamm Family Proposes Taking Continental Resources Private for $25B

-

Exxon, Hess to Proceed with Yellowtail Development Offshore Guyana

-

Citing Ukraine Invasion, BP to Dump 19.75% Stake in Rosneft, Exit Board

-

Northern Oil's Stock Moves from NYSE American to NYSE Exchange

United States News >>>

-

Petrus Resources Ltd. First Quarter 2023 Results

4.jpg&new_width=60&new_height=60&imgsize=false)

-

Battalion Oil Corporation First Quarter 2023 Results

5.jpg&new_width=60&new_height=60&imgsize=false)

-

Amplify Energy Corporation First Quarter 2023 Results -

-

Denbury Inc., First Quarter 2023 Results

-

Evolution Petroleum Corporation Fiscal Third Quarter 2023 Results