Quarterly / Earnings Reports | Fourth Quarter (4Q) Update | Financial Results | Capital Markets | Capital Expenditure | Drilling Program - Wells | Drilling Program-Rig Count | Capital Expenditure - 2021

Oxy Keeping Capex, Production Levels Steady for 2021; Q4 Results

Occidental reported its Q4 / full year 2020 results as well as its 2021 capital plans.

2021 Plans

- Capex: $2.9 billion - 4% increase vs. 2020 capex of $2.8B

- D&C: $1.624 billion (56%)

- Facilities: $667 million (23%)

- Base Maintenance: $290 million (10%)

- Exploration: $174 million (6%)

- Other: $145 million (5%)

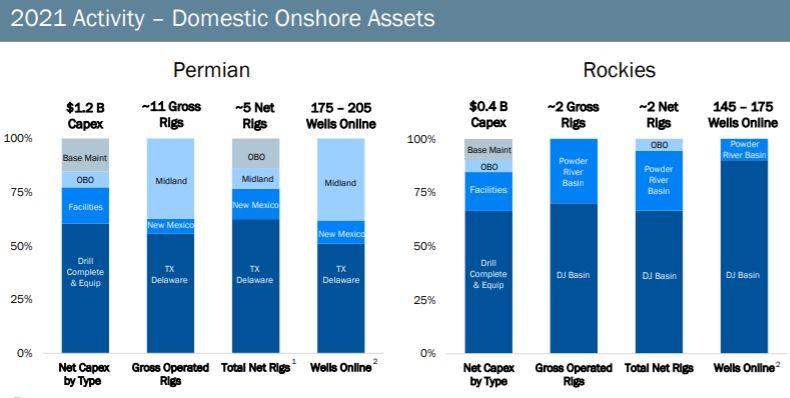

By Play:

- Permian: $1.2 billion to Permian

- Rockies (PRB, DJ Basin): $400 million

- Wells Online: 320-380 wells

- Permian: 175-205 wells

- Rockies: 145-175 wells

- Rigs: 13 gross (7 net)

- Permian: 11 gross (5 net)

- Rockies: 2 gross (2 net)

- Production: 1,140 MBOEPD (53% oil) - flat from 2020 levels

- Permian: 485 MBOEPD

- Rockies & Other: 278 MBOEPD

- GOM: 141 MBOEPD

- International: 236 MBOEPD

2020 Results

Oxy announced a net loss attributable to common stockholders for the fourth quarter of 2020 of $1.3 billion, or $1.41 per diluted share, and an adjusted loss attributable to common stockholders of $731 million, or $0.78 per diluted share. Fourth quarter after-tax items affecting comparability of $581 million included a loss of $820 million related to the sale of non-core assets in the Permian Basin.

- Used net proceeds from asset sales and cash on hand to repay $2.3 billion of debt in the fourth quarter

- Raised $2.0 billion in senior unsecured debt and extended $2.0 billion of near-term maturities in the fourth quarter

- Exceeded global production guidance and continued to deliver operational excellence in the fourth quarter

- Production of 1,143 Mboed from continuing operations, exceeding midpoint of guidance by 13 Mboed

- Permian Resources exceeded high-end of guidance, producing 382 Mboed

- Continued to lower costs and achieved capital synergies for well cost savings in the Texas Delaware and DJ Basins

President and Chief Executive Officer Vicki Hollub said: “We remain committed to strengthening our balance sheet and transitioned into 2021 with an improved financial position by achieving our 2020 divestiture target, reducing debt and successfully extending debt maturities. In the fourth quarter, our businesses again outperformed as our teams continue to leverage our technical expertise to mitigate production decline while relentlessly lowering costs.”We continue to make progress on our debt structure and have significantly exceeded our cost savings targets while delivering operational excellence across our business," said President and Chief Executive Officer Vicki Hollub. "These decisive financial and operational actions reflect our leadership as a low-cost operator, positioning us for success when market conditions improve."

Oil and Gas

Oil and gas pre-tax loss on continuing operations for the fourth quarter was $1.1 billion, compared to a pre-tax loss of $1.1 billion for the third quarter of 2020. The fourth quarter results included a pre-tax loss of $820 million related to the sale of non-core assets in the Permian Basin. Excluding items affecting comparability, fourth quarter oil and gas results improved over the third quarter due to higher commodity prices. For the fourth quarter of 2020, average WTI and Brent marker prices were $42.66 per barrel and $45.24 per barrel, respectively. Average worldwide realized crude oil prices increased by approximately 5 percent from the prior quarter to $40.77 per barrel. Average worldwide realized NGL prices increased by approximately 1 percent from the prior quarter to $14.95 per barrel of oil equivalent (BOE). Average domestic realized gas prices increased by approximately 31 percent from the prior quarter to $1.55 per Mcf.

Excluding Colombia, which was sold in December, total average daily production for the fourth quarter was 1,143 thousand of barrels of oil equivalent per day (Mboed), which exceeded the midpoint of guidance by 13 Mboed. Permian Resources exceeded the high end of guidance with production of 382 Mboed and all other domestic operations came in near the high end of guidance with production of 518 Mboed. International average daily production volumes were 243 Mboed.

OxyChem

Chemical pre-tax income of $192 million for the fourth quarter exceeded guidance. Compared to prior quarter income of $178 million, the improvement in fourth quarter income resulted primarily from higher vinyl margins, partially offset by lower realized caustic soda prices.

Midstream and Marketing

Midstream and marketing pre-tax loss for the fourth quarter was $90 million, compared to a loss of $2.8 billion for the third quarter of 2020. Excluding items affecting comparability, midstream and marketing pre-tax fourth quarter results reflected higher non-cash mark-to-market losses in the marketing business. Excluding WES equity income, midstream and marketing pre-tax loss for the fourth quarter was $234 million.

Related Categories :

Capital Expenditure - 2021

More Capital Expenditure - 2021 News

-

Pine Cliff Energy Ups Spending, Production Plans by 10% for 2022

-

Whitecap Resources Unveils 2022 Budget; Up 12% vs. 2021

-

Southwestern Closes Acquisition of Indigo Natural Resources; Ups Capex

-

Altura Energy First Quarter 2021 Results

-

Razor Energy Corp. First Quarter 2021 Results

Gulf of Mexico News >>>

-

WaterBridge Infrastructure Brings Delaware Basin Water Model to Wall Street -

-

OPEC+ Nudges Supply Higher: Why This Weekend’s Hike Echoes 2020—But Isn’t 2020

-

SM Energy Hits Record Output; Driven by Uinta

-

The Permian Play: How ExxonMobil Is Rewriting the Shale Narrative -

-

Large Cap E&P To Reduce Drilling & Completion Activity in 2026 -

International News >>>

-

$2.4B Deal Gives MPLX Sour Gas Edge in Permian -

-

Liberty Energy: Navigating the Frac Downturn with Efficiency, Innovation, and Strategic Focus -

-

Baker Hughes Solid Y/Y Performance Amidst US Frac Market Slowdown -

-

Halliburton Warns of Deepening U.S. Frac Slowdown -

-

Oilfield Service Report : 13 New Leads/Company Formation & Contacts YTD