Drilling / Well Results | Quarterly / Earnings Reports | Environmental, Health & Safety | Second Quarter (2Q) Update | Financial Results | Hedging | Capital Markets | Drilling Activity

Paramount Resources Second Quarter 2020 Results

Paramount Resources reported its Q2 2020 results.

Highlights:

- Sales volumes averaged 68,839 Boe/d (39 percent liquids) in the second quarter of 2020 compared to 70,022 Boe/d (38 percent liquids) in the first quarter.

- At Wapiti, second quarter sales volumes increased 107 percent to 14,940 Boe/d (64 percent liquids) compared to the first quarter as run time at the third-party processing facility improved.

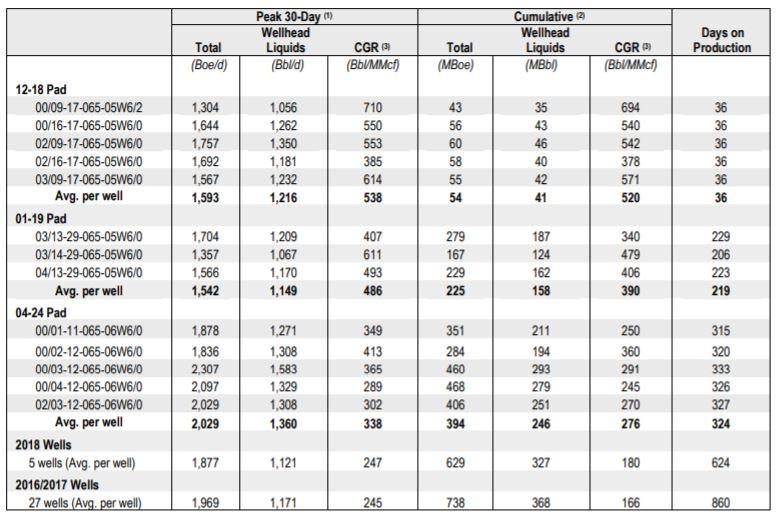

- At Karr, the five wells on the 12-18 pad were flowed through test facilities partway through the quarter and were brought on production through permanent facilities in early July. Average gross peak 30-day production per well was 1,593 Boe/d, including 1,216 Bbl/d of wellhead liquids, with an average wellhead CGR of 538 Bbl/MMcf. (1)

- Average sales volumes in the quarter were impacted by shut-ins and curtailments.

- Second quarter operating costs were $62.6 million ($9.99/Boe), a reduction of about 30 percent quarter-over-quarter. Approximately 30 to 50 percent of this reduction is attributable to sustainable improvements in the Company’s cost structure.

- Paramount’s netback was $21.7 million in the second quarter of 2020 compared to $44.5 million in the first quarter of 2020, reflecting the impact of substantially lower commodity prices which were only partially offset by cost improvements. (2)

- Adjusted funds flow was $19.0 million or $0.14 per share.(2) Cash from operating activities was ($14.2) million in the second quarter of 2020, largely because of changes in working capital.

- Second quarter capital spending totaled $41.4 million, primarily related to drilling and completion activities at Karr and drilling operations at Wapiti.

- The Company has realized significant cost savings in its capital program through its continuing focus on well design, increased efficiencies and lower vendor rates, while not compromising on completion effectiveness:

- All-in lease construction, drilling, completion, equip and tie-in (collectively, “DCET”) costs for the five-well (three Middle Montney and two Lower Montney) Karr 12-18 pad averaged $8.8 million per well, $0.7 million lower than prior estimates. This represents a 27 percent reduction compared with average DCET costs for all Karr wells in 2018 and 2019.

- Drilling operations were concluded in the second quarter on the five-well (three Upper Montney and two Middle Montney) Karr 5-16 West pad. Average drilling costs of $2.7 million per well were in line with recent pacesetters at Karr.

- Completion activities at the five-well (all Middle Montney) Karr 2-1 pad have recently been concluded and preliminary lease construction, drilling and completion costs are coming in at a pacesetting estimate of $7.0 million per well.

- At Wapiti, drilling operations were completed on the five-well (two Middle Montney and three Lower Montney) 5-3 West pad, with estimated costs averaging $3.1 million per well.

- The expansion of the third-party Karr 6-18 facility was completed in July. The additional raw gas and liquids processing capacity adds flexibility to the Company’s Karr operations, including minimizing the impact of future disruptions at other accessible third-party processing facilities.

- Paramount has received approval for up to $8 million of funding under the Alberta Site Rehabilitation Program and applied for funding under similar programs in BC and Saskatchewan. The majority of activities to be funded under the Alberta Site Rehabilitation Program are expected to occur in 2021.

- The Company advanced its project to replace 200 high-bleed controllers with low-bleed units at well sites in the Grande Prairie area in 2020, with 164 low-bleed units installed to date. The project is anticipated to eliminate approximately 8,600 tonnes of greenhouse gas (“GHG”) emissions annually. In addition, reduced trucking of produced water following the start-up of two new water disposal wells at Karr is expected to eliminate approximately 13,500 tonnes per year of GHG emissions (the equivalent of removing approximately 2,900 passenger cars from use) while also reducing operating costs.

Corporate:

- Paramount is on track to achieve its previously announced 2020 cost reduction targets of $25 million in operating costs and $15 million in general and administrative expenses.

- The Company is maintaining its 2020 capital guidance of $165 million and allocating the significant capital savings it is realizing to advance certain projects that had previously been planned for 2021. Paramount continues to evaluate the merits of accelerating additional projects as market conditions evolve.

- Approximately 4,300 Boe/d of production currently remains shut-in and Paramount continues to review opportunities to bring volumes back online as conditions improve.

- Sales volumes are anticipated to average between 65,000 Boe/d and 70,000 Boe/d in the second half of 2020.

- Reflective of the macro economic environment and significant reduction in commodity prices, in June 2020 Paramount’s senior secured revolving bank credit facility was amended to provide a period of financial covenant relief to and including June 30, 2021 and to amend the size of the facility to $1.0 billion. Long-term debt at June 30, 2020 was $754.9 million.

- In July 2020 the Company’s unsecured demand revolving letter of credit facility was increased from $40 million to $70 million.

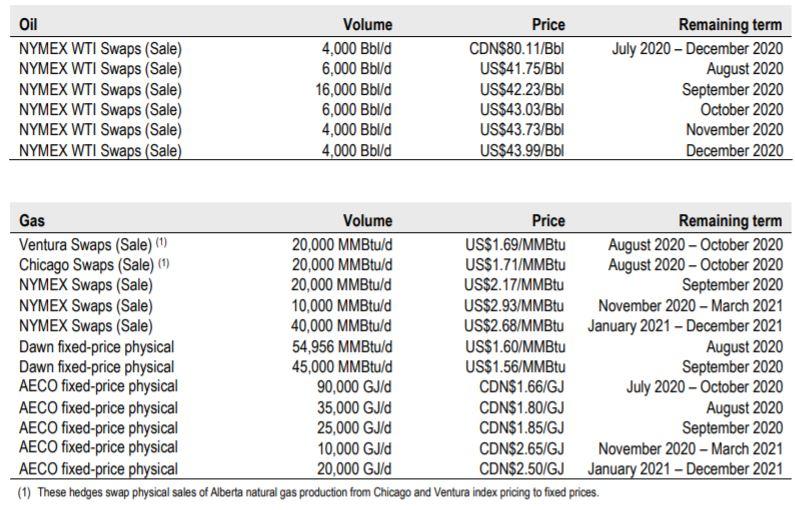

- The Company has entered into additional 2020 natural gas and liquids hedges to mitigate volatility and protect cash flows. See “Hedging” below for a summary of the Company’s current hedge position.

- Paramount continues to respond to the COVID-19 pandemic. At the beginning of June, Paramount implemented a plan to safely transition its Calgary head office employees from remote work back to the office.

Review of Operations

KarrSecond quarter sales volumes at Karr averaged 16,009 Boe/d compared to 20,885 Boe/d in the first quarter. Sales volumes were impacted by a seven-day planned outage (including ramp-down and ramp-up periods) at the third-party Karr 6-18 facility related to the completion of expansion activities and the temporary shut-in of certain offsetting wells due to completion activities at the 12-18 and 2-1 pads, as well as by natural declines.

In addition to previously installed gas lift and related compression at pads near the southwest terminus of Paramount’s gathering system, work is ongoing to mitigate current and future potential back-out issues in the Karr gathering system as new production continues to be brought online. This includes additional booster compression that is scheduled to be brought into service midway through the third quarter to mitigate production currently backed-out.

Substantial operating cost savings have been realized with the addition of the Company’s two new water disposal wells that were brought into service near the end of the first quarter. These wells have accommodated the disposal of substantially all produced water from Karr area wells and resulted in approximately $4 million in operating costs savings compared to the previous quarter from the elimination of trucking and third-party disposal fees. These wells are expected to meet Karr area development needs for the foreseeable future.

Final DCET costs for the 12-18 pad came in at a pacesetting $8.8 million average per well, $0.7 million per well lower than previously estimated. This represents a 27 percent reduction compared with average DCET costs for all Karr wells in 2018 and 2019. The wells (three Middle Montney and two Lower Montney) flowed through testers partway through the quarter and began producing through permanent facilities in early July. Average gross peak 30-day production per well was 1,593 Boe/d, including 1,216 Bbl/d of wellhead liquids, with an average wellhead CGR of 538 Bbl/MMcf. (1)

Paramount completed the drilling of five wells (three Upper Montney and two Middle Montney) on the 5-16 West pad during the second quarter. Average drilling costs of $2.7 million per well are in line with the pacesetting results at the 2-1 pad drilled in the fourth quarter of 2019. The successful negotiation of lower vendor rates and the continuous improvement from prior drilling operations helped achieve this result. Paramount plans to complete, tie-in, and bring on production all five wells on the 5-16 West pad in 2021.

Completion activities at the five-well Middle Montney Karr 2-1 pad have recently been concluded and preliminary lease construction, drilling and completion costs are coming in at a pacesetting estimate of $7.0 million per well. Paramount continues to aggressively pursue capital cost savings without compromising on completion effectiveness. The Company plans to tie-in and bring on production the wells on the 2-1 pad in the third quarter.

The Karr 6-18 third-party processing facility expansion has been completed and commercial operations commenced in July 2020. The facility now has 150 MMcf/d of total raw gas handling capacity, including 70 MMcf/d of sour raw gas processing, and 30,000 Bbl/d of raw hydrocarbon liquids handling capacity. The additional gas and liquids processing capacity will allow the Company to grow future production as well as minimize the impact of future disruptions at the other accessible third-party processing facilities.

The following table summarizes the performance of the wells on the 12-18, 1-19, and 4-24 pads, as well as the five wells drilled in 2018 and the 27 wells drilled in the 2016/2017 capital program at Karr:

Second quarter sales volumes at Wapiti averaged 14,940 Boe/d (64 percent liquids) compared to 7,209 Boe/d (66 percent liquids) in the first quarter. Run time at the third-party operated processing facility was significantly improved compared with previous quarters.

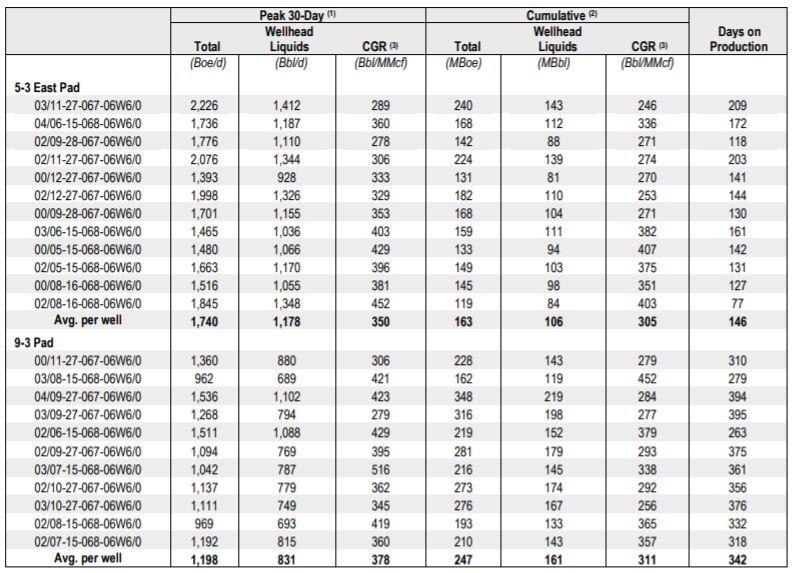

All 12 wells on the 5-3 East pad are now flowing through permanent production facilities as additional third-party effluent gathering system capacity came online during the second quarter.

Paramount completed the drilling of five wells (two Middle Montney and three Lower Montney) on the 5-3 West pad at an average cost of $3.1 million per well in the second quarter. Plans to complete and bring on production these wells and drill the remaining six wells on the eight-well 6-4 pad have been deferred. A tenure well drilled and completed in 2015 is planned to be brought on production in the third quarter.

The following table summarizes the performance of wells on the 5-3 East and 9-3 pads:

Kaybob Region sales volumes averaged 29,561 Boe/d (26 percent liquids) in the second quarter compared to 32,700 Boe/d (29 percent liquids) in the first quarter. This decrease was mainly attributable to natural declines and shut-ins during the second quarter.

Paramount holds material positions in Duvernay and Montney Oil resource plays in the Kaybob Region that will compete for capital in the medium term. The Company continues to actively evaluate longer-term full field development plans for these plays.

Central Alberta & OtherCentral Alberta and Other Region sales volumes averaged 8,239 Boe/d (12 percent liquids) in the second quarter compared to 9,108 Boe/d (14 percent liquids) in the first quarter. Sales at Birch were impacted by planned and unplanned plant outages in the second quarter.

Paramount holds a material, contiguous Duvernay position at Willesden Green and continues to actively evaluate longer-term full field development plans of the asset.

Greenhouse Gas Reductions

As part of Paramount’s continued commitment to responsible energy development, the Company has been participating in GHG emission reduction programs and investing in new equipment to reduce GHG emissions from its operations.

The Company is continuing upgrades at various sites to replace its remaining high-bleed controllers with modern low-bleed units. A total of 200 low-bleed units are expected to be installed in the Grand Prairie Region in 2020, with 164 installed to date. These new units are expected to eliminate approximately 8,600 tonnes of GHG emissions per year and generate approximately $0.5 million in GHG credits under current regulations through 2022.

Reduced trucking of produced water with the start-up of two new water disposal wells at Karr is expected to eliminate approximately 13,500 tonnes per year of GHG emissions (the equivalent of removing approximately 2,900 passenger cars from use) while also reducing operating costs.

Hedging

The tables below set out the Company’s hedge position:

Related Categories :

Second Quarter (2Q) Update

More Second Quarter (2Q) Update News

-

SM Energy Hits Record Output; Driven by Uinta

-

Expand Energy Talks, Wells, Frac Crews, Production For 2H-2025 -

-

Comstock Rides Higher Gas Prices, Operational Momentum in Q2 2025

-

A Quarter of Quiet Strength: CNX’s Patient Ascent in Appalachia -

-

Liberty Energy: Navigating the Frac Downturn with Efficiency, Innovation, and Strategic Focus -

Canada News >>>

-

Topaz Energy Expands Montney Royalty Footprint -

-

Vermillion Closes Saskatchewan Asset Sale -

-

MEG Energy Rejects Strathcona Resources' $6 Billion Takeover Offer

-

Large Permian E&P Cuts Capex;Outlines New D&C Plans, 2024

-

Petrus Resources Ltd. First Quarter 2023 Results

4.jpg&new_width=60&new_height=60&imgsize=false)

6.jpg&new_width=60&new_height=60&imgsize=false)