Drilling & Completions | Finance & Investing | Quarterly / Earnings Reports | Second Quarter (2Q) Update | Financial Results | Hedging | Capital Markets | Drilling Activity

Range Resources Second Quarter 2022 Results

Range Resources Corp. announced its second quarter 2022 financial results.

Second Quarter 2022 Highlights:

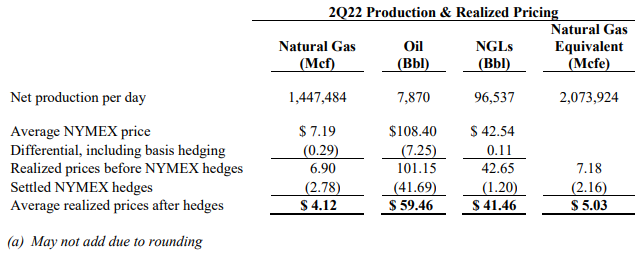

- Realizations before NYMEX hedges of $7.18 per mcfe, highest since 2008

- Natural gas differentials, including basis hedging, averaged ($0.29) per mcf to NYMEX

- Pre-hedge NGL realization of $42.65 per barrel, a premium of $0.11 per barrel above Mont Belvieu equivalent

- Production averaged 2.1 Bcfe per day, approximately 70% natural gas

- Second quarter capital spending was $127 million, approximately 27% of the 2022 budget

- Repurchased 4.5 million shares at an average of $28.85 per share

- Reduced total debt outstanding by $217 million following the retirement of 2022 senior notes in April

- In June, received $29.5 million contingent payment from North Louisiana divestiture

Commenting on the quarter, Jeff Ventura, the Company's CEO said, "In the midst of a global energy crisis, the need for oil and gas production from the United States is more important than ever. In order for U.S. supply to meet growing domestic and global demand, however, there must be support for the required infrastructure, including permit approvals and construction of pipelines, compression, processing facilities and LNG export terminals. Range is well positioned to serve and benefit from this call on American natural gas supply given our access to multiple domestic and international markets for natural gas and NGLs and, more importantly, our multi-decade core inventory life in Appalachia.

As a result of increased commodity prices and continued efficient operations, Range delivered record free cash flow in the second quarter, allowing us to further reduce outstanding debt while increasing returns of capital to shareholders. At the end of the quarter, Range's leverage ratio was a record low for the Company at 1.2x, and as we rapidly approach our long-term balance sheet targets over the coming quarters, we will be well positioned to return additional capital to shareholders in the form of dividends and continued share repurchases. We continue to view share repurchases as a compelling investment, given what we see as a significant disconnect between Range's share price and the underlying value of our assets at current commodity futures pricing."

Second Quarter 2022 Results

GAAP revenues for second quarter 2022 totaled $1.23 billion, GAAP net cash provided from operating activities (including changes in working capital) was $325 million, and GAAP net income was $453 million ($1.77 per diluted share). Second quarter earnings results include a $240 million mark-to-market derivative loss due to the increases in commodity prices.

Non-GAAP revenues for second quarter 2022 totaled $1.06 billion, and cash flow from operations before changes in working capital, a non-GAAP measure, was $519 million. Adjusted net income comparable to analysts' estimates, a non-GAAP measure, was $315 million ($1.27 per diluted share) in second quarter 2022.

Second quarter 2022 natural gas, NGLs and oil price realizations (including the impact of cash-settled hedges and derivative settlements) averaged $5.03 per mcfe.

- The average natural gas price, including the impact of basis hedging, was $6.90 per mcf, or a ($0.29) per mcf differential to NYMEX. Natural gas prices and basis differentials have strengthened in recent months, and as a result, the Company is updating guidance for average 2022 natural gas differentials versus NYMEX to an expected range of ($0.30) to ($0.38) per mcf. At the midpoint, the improvement in Range's natural gas differential guidance since February equates to over $30 million of incremental cash flow in 2022.

- Pre-hedge NGL realizations were $42.65 per barrel, an improvement of $2.62 per barrel compared to the first quarter of 2022 and an $0.11 premium over Mont Belvieu equivalent. Second quarter NGL realizations were driven by higher ethane prices and an improving market for propane and heavier NGL products. The Company continues to expect a differential of $0.00 to $2.00 per barrel above the Mont Belvieu equivalent barrel for full-year 2022.

- Crude oil and condensate price realizations, before realized hedges, averaged $101.15 per barrel, or $7.25 below WTI (West Texas Intermediate). Range continues to expect the 2022 condensate differential to average $6.00-$8.00 below WTI.

Capital Expenditures

Second quarter 2022 drilling and completion expenditures were $119 million. In addition, during the quarter, $7.5 million was invested in acreage leasehold and gathering systems. Second quarter capital spending represents approximately 27% of Range's total capital budget in 2022. Total capital expenditures year to date were $244 million at the end of the second quarter. Range expects capital expenditures to decline in the second half of the year, and as a result, Range reiterates full-year 2022 capital spending guidance of $460 million to $480 million with expectations at the upper end of the guidance.

Financial Position and Share Buyback

As of June 30, 2022, Range had total debt outstanding of less than $2.4 billion, consisting of $2.38 billion of senior notes and $1 million outstanding on the bank credit facility with $1.2 billion of committed borrowing capacity. On a trailing twelve-month basis, Range's leverage ratio, defined as Net-Debt-to-EBITDAX, was approximately 1.2x, with further improvement expected over the coming quarters as debt is further reduced.

During the second quarter, Range purchased 4.5 million shares at an average price of approximately $28.85 per share. At the end of the quarter, Range had approximately 248 million shares outstanding and $354 million remaining on the Company's $500 million share repurchase program. Range also expects to initiate a dividend in third quarter, at an annualized rate of $0.32 per share.

In June, Range received $29.5 million in contingent payments pertaining to the North Louisiana divestiture. Range has the potential to receive an additional $45.5 million in contingent payments based on commodity prices in 2022 and 2023, which at the end of the second quarter, had a fair value of approximately $34.8 million.

Operational Activity

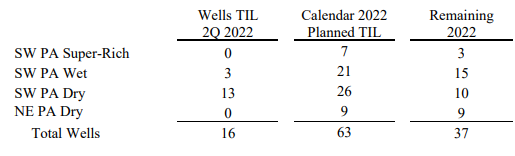

The table below summarizes expected 2022 activity regarding the number of wells to sales in each area.

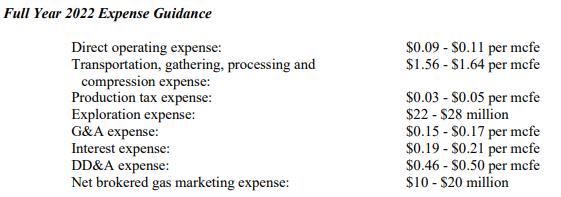

As expected, gathering, processing and transportation (GP&T) expense per mcfe increased versus the prior quarter as a result of higher pricing for natural gas and NGLs and the percentage of proceeds contract structure. Higher GP&T expense from rising commodity prices is more than offset by significantly higher revenue, resulting in continued improvement in cash flow versus the prior quarter. Range expects GP&T expense per mcfe to decline significantly in the second half of 2022, primarily as a result of higher production volume. Based on recent futures pricing for natural gas and NGLs, Range continues to expect full-year 2022 GP&T expense to average $1.56 to $1.64 per mcfe.

Guidance 2022

Capital & Production Guidance

As previously noted, Range is targeting holding production approximately flat at 2.12 2.16 Bcfe per day, with ~30% attributed to liquids production for the full year 2022. Range's 2022 all-in capital budget is $460 million - $480 million with expectations at the upper end of the guidance.

Hedging Status

Range hedges portions of its expected future production volumes to increase the predictability of cash flow and to help improve and maintain a strong, flexible financial position. Please see the detailed hedging schedule posted on the Range website under Investor Relations - Financial Information.

Range has also hedged Marcellus and other basis differentials for natural gas to limit volatility between benchmark and regional prices. The combined fair value of natural gas basis hedges as of June 30, 2022, was a net gain of $2.5 million.

Related Categories :

Second Quarter (2Q) Update

More Second Quarter (2Q) Update News

-

SM Energy Hits Record Output; Driven by Uinta

-

Expand Energy Talks, Wells, Frac Crews, Production For 2H-2025 -

-

Comstock Rides Higher Gas Prices, Operational Momentum in Q2 2025

-

A Quarter of Quiet Strength: CNX’s Patient Ascent in Appalachia -

-

Liberty Energy: Navigating the Frac Downturn with Efficiency, Innovation, and Strategic Focus -

Northeast News >>>

-

Why Surface-Only Inventory Predictions Are a Fool’s Errand

-

Silent Surge: Operator Tops Antero in Utica Well Performance

-

Gas Players : A Comparative Analsysis

-

Expand Energy Talks, Wells, Frac Crews, Production For 2H-2025 -

-

A Quarter of Quiet Strength: CNX’s Patient Ascent in Appalachia -

Northeast - Appalachia News >>>

-

Liberty Energy: Navigating the Frac Downturn with Efficiency, Innovation, and Strategic Focus -

-

Baker Hughes Solid Y/Y Performance Amidst US Frac Market Slowdown -

-

Halliburton Warns of Deepening U.S. Frac Slowdown -

-

EQT's Completion Efficiency Drove Outperformance In 2Q

-

Oilfield Service Report : 13 New Leads/Company Formation & Contacts YTD