Top Story | Deals - Acquisition, Mergers, Divestitures | Exclusives / Features

Report: Carrizo and SM Energy Mulling Possible Merger Deal

Carrizo Oil & Gas and SM Energy are said to be in "early stage discussions" regarding a potential merger deal between the two companies, according to a report by Bloomberg.

The development was reported by "people familiar with the matter." Both companies declined to comment.

Shale Experts CEO Rons Dixon noted that a deal between the two would be a strange one: "While Carrizo and SM's assets are both concentrated in the Eagle Ford and Permian, they are located in different areas of the plays. The most striking contrast is with the Permian assets - with SM focused in the Midland Basin and Carrizo in the Delaware.

"Additionally, their Eagle Ford production vastly differs in terms of mix - SM being predominantly gassy while Carrizo is oilier (more on that below).

"The only benefit I can think of regarding a Carrizo / SM merger would be scale."

Carrizo and SM's Assets: Acreage, Production, Etc.

If Carrizo and SM were to merge, the combined entity would boast nearly 370,000 net acres: ~240,000 Eagle Ford / ~128,000 in the Permian (see maps below).

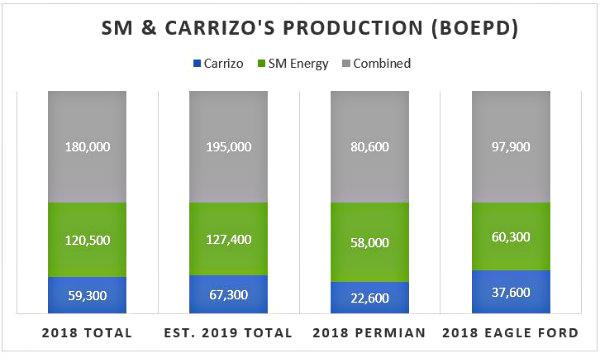

We also took a look at what their combined production profile would look like:

- Year-End 2018 Actuals: A combined production profile of ~180,000 BOEPD (Carrizo has 59,300 BOEPD / SM has 120,500 BOEPD)

- 2019 Expectations: A combined profile of ~195,000 BOEPD (Carrizo estimates 67,300 BOEPD for 2019 / SM is estimating 127,400 BOEPD)

Gassy vs. Oil Production in Eagle Ford: An interesting thing to note is that SM's Eagle Ford production is predominantly gassy while Carrizo's is very much more oil-forward.

- Carrizo's Eagle Ford production mix is 78% oil

- SM's Eagle Ford production mix is 93% gas

*Note: The numbers in the chart above are approximate

Both companies have released their 2019 capital plans, which total $1,585MM at the midpoint (Carrizo at $550MM / SM at $1,035MM).

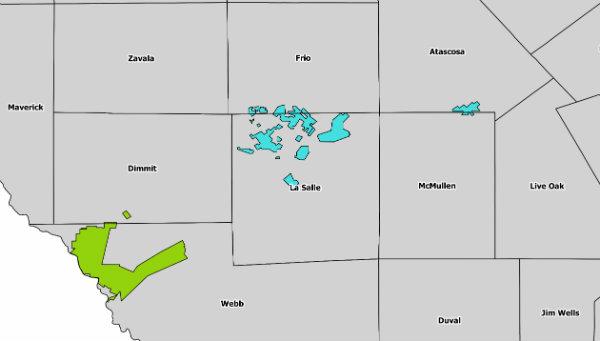

Map: Carrizo + SM Energy Acreage

Here is a map of what the combination of Carrizo and SM's asset would look like (further down we outline their individual acreage positions).

*Blue: Carrizo / Green: SM Energy

EAGLE FORD:

PERMIAN (MIDLAND & DELAWARE)

CARRIZO ACREAGE ONLY:

Carrizo has 76,500 net acres in the Eagle Ford across Atascosa, Frio, Zavala, Dimmit, La Salle and McMullen counties.

Their 46,000 net Permian acres are centered in the Delaware Basin in Culberson, Reeves and Ward counties.

SM ENERGY ACREAGE ONLY:

SM has 163,000 net acres in the Eagle Ford in Dimmit and Webb counties, part of which is under a JV agreement.

The company has 82,000 net acres in the Midland Basin across Midland, Upton, Martin and Howard counties.

Eagle Ford Deal Market Heating Up?

Earlier this month, Shale Experts predicted that several E&Ps will move to sell off their Eagle Ford assets this year. This is likely due to the companies shifting their core focus to other assets.

In addition, Bloomberg reported this week that Equinor (formerly Statoil) is exploring the sale of its Eagle Ford division, noting that they now regard the asset as "non-core."

While the M&A sector has been unusually quiet in Q1 2019, there were a couple deals struck in the Eagle Ford this quarter:

- Inpex made its US tight oil entrance, acquiring Eagle Ford assets from GulfTex Energy earlier this month

- Harvest Oil & Gas sold off its stake in Eagle Ford-focused Magnolia for $51.7MM

Related Categories :

Exclusives / Features

More Exclusives / Features News

-

OPEC+ Nudges Supply Higher: Why This Weekend’s Hike Echoes 2020—But Isn’t 2020

-

Silent Surge: Operator Tops Antero in Utica Well Performance -

-

Gas Players : A Comparative Analsysis -

-

The Permian Play: How ExxonMobil Is Rewriting the Shale Narrative

-

Liberty Energy: Navigating the Frac Downturn with Efficiency, Innovation, and Strategic Focus -

Gulf Coast News >>>

-

Why Surface-Only Inventory Predictions Are a Fool’s Errand

-

Occidental Eyes $10 Billion OxyChem Sale Amid Debt and Capital Discipline Push -

-

Permian Gas Gets New Highway: Transwestern’s 1.5 Bcf/d Desert Southwest Expansion -

-

WaterBridge Infrastructure Brings Delaware Basin Water Model to Wall Street -

-

OPEC+ Nudges Supply Higher: Why This Weekend’s Hike Echoes 2020—But Isn’t 2020