Ovintiv Inc. (formerly Encana) is making moves to put its Eagle Ford assets on the market, according to a report by Reuters.

Citing two people familiar with the matter, the sale is part of the company's initiative to reduce its debt load (which comes in at just above $7.0 billion as of Q3 2020).

The company originally purchased the Eagle Ford assets in May 2014 via a $3.1 billion deal with Freeport McMoRan Inc.

Back in 2019, Shale Experts predicted that the company may explore such a sale after the company announced that it had "cored up" its asset portfolio, increasing concentration in the Permian Basin, Anadarko Basin and Montney plays. It has designated its other assets (including the Eagle Ford, Uinta, Bakken and Duvernay) as "base assets."

Earlier this year, Ovintiv cut a portion of its workforce based at its offices in The Woodlands, Texas (as well as its Calgary, Canada office).

Ovintiv's Eagle Ford Assets

- Acreage: ~42,000 net acres.

- Production: 14.9 MMBbls/d (as of Q3 2020)

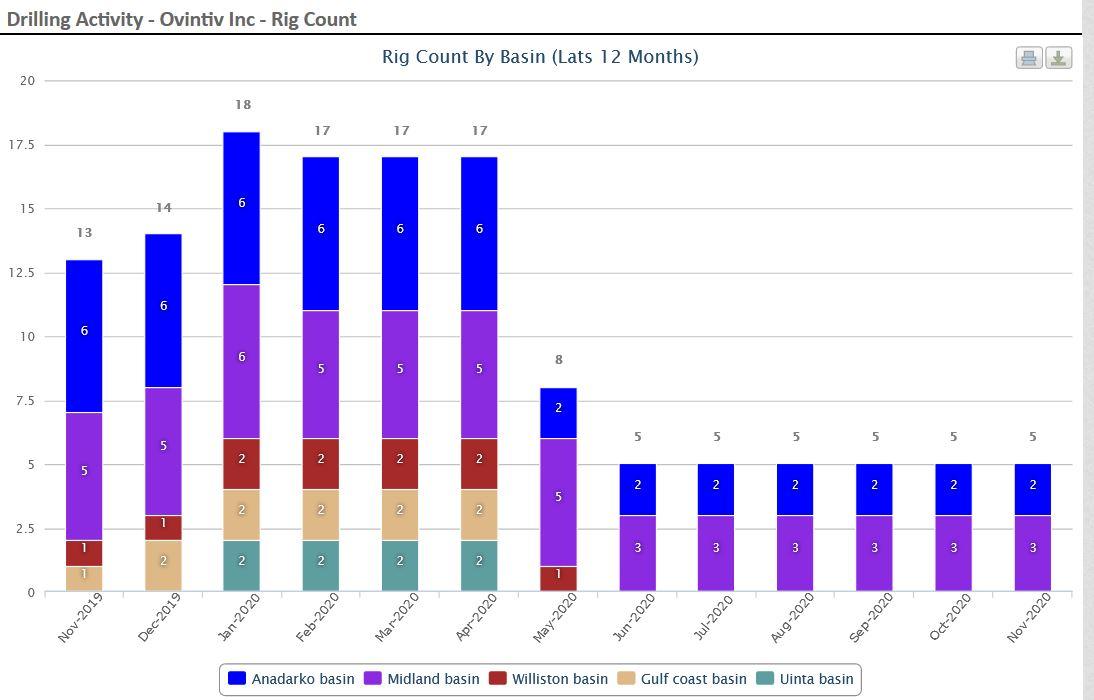

- Rig Activity: The company cut its two rigs in the region in April of 2020 (see chart below - Eagle Ford is represented by the tan color)

Related Categories :

Deals - On The Market

More Deals - On The Market News

-

Chesapeake Engages Evercore to Market Eagle Ford Portfolio

-

Exxon Puts Gas-Heavy Appalachian Assets Up for Sale

-

Large PE-Backed Permian E&P Looking for Buyer; Deal Value Could Top $2.0B -

-

Supermajor Mulling Sale of Permian Basin Portfolio; Could Fetch Up to $10B

-

Bakken Operators Looking to Divest 36,000 Barrels Per Day -

Gulf Coast News >>>

-

Why Surface-Only Inventory Predictions Are a Fool’s Errand

-

OPEC+ Nudges Supply Higher: Why This Weekend’s Hike Echoes 2020—But Isn’t 2020

-

SM Energy Hits Record Output; Driven by Uinta

-

Refracs That Compete: Eagle Ford Wells Return to Life

-

Large Cap E&P To Reduce Drilling & Completion Activity in 2026 -

Gulf Coast - South Texas News >>>

-

Liberty Energy: Navigating the Frac Downturn with Efficiency, Innovation, and Strategic Focus -

-

Baker Hughes Solid Y/Y Performance Amidst US Frac Market Slowdown -

-

Halliburton Warns of Deepening U.S. Frac Slowdown -

-

PE Firm Seeds Four New E&P Startups in Strategic Push In 2025 -

-

Schlumberger Shows Steady Resilience Amid Market Volatility -