Drilling & Completions | Well Lateral Length | Key Wells | Hedging | Capital Markets | Drilling Activity

Ring Restarts D&C Ops with New San Andres Well; Updates Hedge Book

Ring Energy, Inc. has initiated drilling operations on its first new horizontal well in ten months.

The Badger 709 B #6XH was spud early Wednesday morning, December 2, 2020, on Ring's Northwest Shelf leasehold in Yoakum County, Texas.

The well will be a one-and-a-half-mile horizontal San Andres oil well drilled to a vertical depth of approximately 5,000'.

Hedging Update

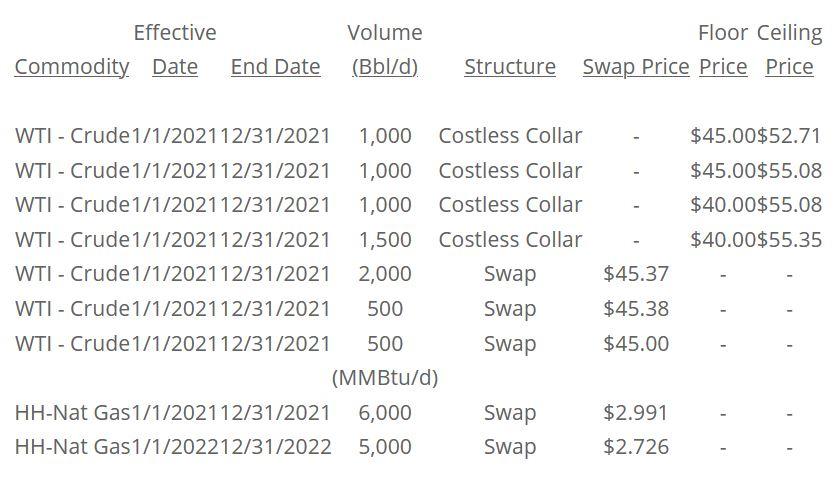

Additionally, Ring Energy, Inc. entered into swap derivative contracts for 2,000 Bopd for calendar year 2021 at a price of $45.37/BO, and two 500 Bopd swaps for calendar year 2021 at a price of $45.38/BO and $45.00/BO, respectively.

This brings Ring's total calendar year 2021 oil hedge position to 7,500 Bopd.

Paul D. McKinney, Chief Executive Officer and Chairman of the Board, commented, "We are excited to end the year drilling on our NWS properties where we can generate exceptional rates-of-return greater than 90% at prevailing oil and natural gas prices. After drilling the Badger #6XH, the drilling rig will move to another horizontal San Andres location currently under construction with plans to drill another well after the New Year. These wells will be paid for out of cash surplus currently on hand." Mr. McKinney continued by commenting, "We have added more to our hedge position for 2021. It is important during volatile markets like these to protect our future cash flows and strengthen our balance sheet. We intend to allocate the majority of our future cash flow to paying down debt with the remainder being invested in capital projects that maintain or improve our daily production and create additional liquidity.

"Our Bank Borrowing Base Redetermination continues on schedule and we anticipate the results before the Christmas holidays."

Related Categories :

Drilling Activity

More Drilling Activity News

-

Chevron Fourth Quarter, Full Year 2022 Results

-

Civitas Resources Third Quarter 2022 Results

-

Murphy Oil Third Quarter 2022 Results

-

California Resources Third Quarter 2022 Results

-

Coterra Energy Third Quarter 2022 Results

Permian News >>>

-

Why Surface-Only Inventory Predictions Are a Fool’s Errand

-

Occidental Eyes $10 Billion OxyChem Sale Amid Debt and Capital Discipline Push -

-

Permian Gas Gets New Highway: Transwestern’s 1.5 Bcf/d Desert Southwest Expansion -

-

WaterBridge Infrastructure Brings Delaware Basin Water Model to Wall Street -

-

OPEC+ Nudges Supply Higher: Why This Weekend’s Hike Echoes 2020—But Isn’t 2020