Drilling & Completions | Well Lateral Length | Drilling / Well Results | Top Story | Quarterly / Earnings Reports | First Quarter (1Q) Update | IP Rates-30-Day | Capital Markets | Capital Expenditure | Drilling Activity

SM's Permian Completions Jump +71% YOY as Eagle Ford Drops 60%; Touts Latest IP30s

SM Energy Co. reported its Q1 2019 results. Highlights from its report and presentation are below.

Q1 Summary: Permian Ops Up +71% YOY as Eagle Ford Drops -60%

- Well Activity: Drilled 35 / Completed 29 wells in Q1 - Drilling was down -15% and completions were up +32% YOY

- Permian: Drilled 28 / Completed 27 - up +6% and +71% YOY, respectively

- Eagle Ford: Drilled 7 / Completed 2 - down -13% and -60% YOY, respectively

- Q1 D&C Spending: $316 million - down -14% YOY

- Q1 Production: Total equivalent production averaged 118.7 MBOEPD - up +5% YOY

Touts Latest Midland Well Results - Wolfcamp, Spraberry

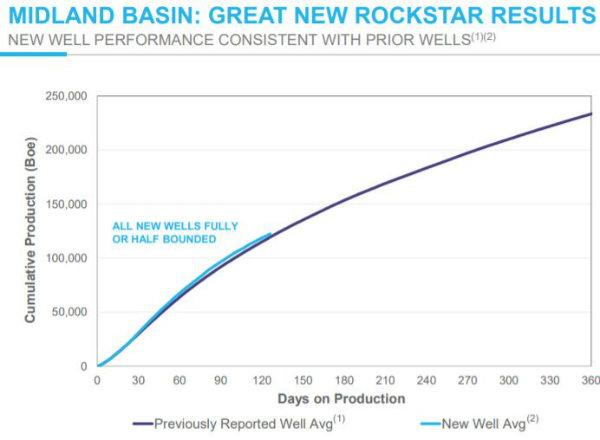

Results from 20 new RockStar wells, having an average lateral length of 10,714 feet, have reached their 30-day peak IP rates that averaged 1,430 Boe/d per well and 88% oil. This includes wells across three intervals, all of which wells are fully or half bounded (16 fully bounded).

- 11 Wolfcamp A wells averaging 1,645 Boe/d per well

- 4 Wolfcamp B wells averaging 1,350 Boe/d per well

- 5 Lower Spraberry wells averaging 1,021 Boe/d per well

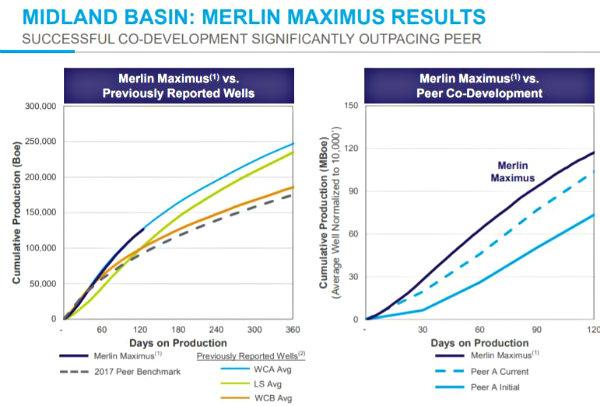

19 of the wells are part of the Merlin Maximus development, with all 24 producing wells expected to meet 30-day peak IP rates by the end of the second quarter.

- One of the wells is a successfully executed 15,000 foot lateral in the Lower Spraberry

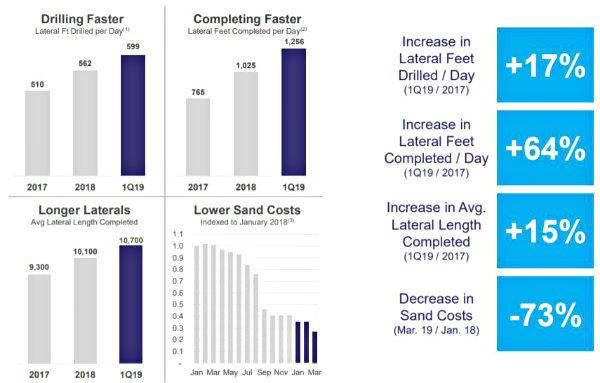

Latest Drilling Efficiency Improvements

The company also noted its faster drill times, longer laterals and other efficiencies achieved in Q1:

South TX Drilling

A second Austin Chalk test in South Texas is showing encouraging preliminary results with current rates of more than 3,500 Boe/d (three-stream) and liquids content exceeding 55%. This second Austin Chalk well has an effective lateral length of 12,875 feet. The Austin Chalk presents the potential for higher margin/higher return wells due to higher liquids revenue and lower transportation costs per Boe.

Related Categories :

First Quarter (1Q) Update

More First Quarter (1Q) Update News

-

Petrus Resources Ltd. First Quarter 2023 Results

-

Cardinal Energy Ltd. First Quarter 2023 Results

-

Headwater Exploration Inc. First Quarter 2023 Results

-

Rubellite Energy Inc. First Quarter 2023 Results

-

Bonterra Eneergy Corporation First Quarter 2023 Results

Gulf Coast News >>>

-

Seventeen (17) E&Ps; To Use 47 Frac Crews To Complete 2,800 Wells In 2024

-

These Permian Operators Plan to Complete/Frac 2,100 Wells IN 2024

-

Large E&P Chops Permian/Anadarko Basin Frac Activity by 30% In 2024

-

Permian E&P Ups 2024 Well Completed by +27% vs. 2023

-

Contrary to The Noise, U.S. Oil Production will Likely Growth 4-5% In 2024; A look Inside -