Service & Supply | Top Story | Oilfield Services | Exclusives / Features | Oil & Gas Prices

Schlumberger: Frac Market Drops Significantly

At the 8th Annual Cowen Energy and Natural Resources Conference, Schlumberger EVP Patrick Schorn talked about the state of the industry.

He specifically noted how the frac market slump and plummeting commodity prices are putting numerous companies in a tough position.

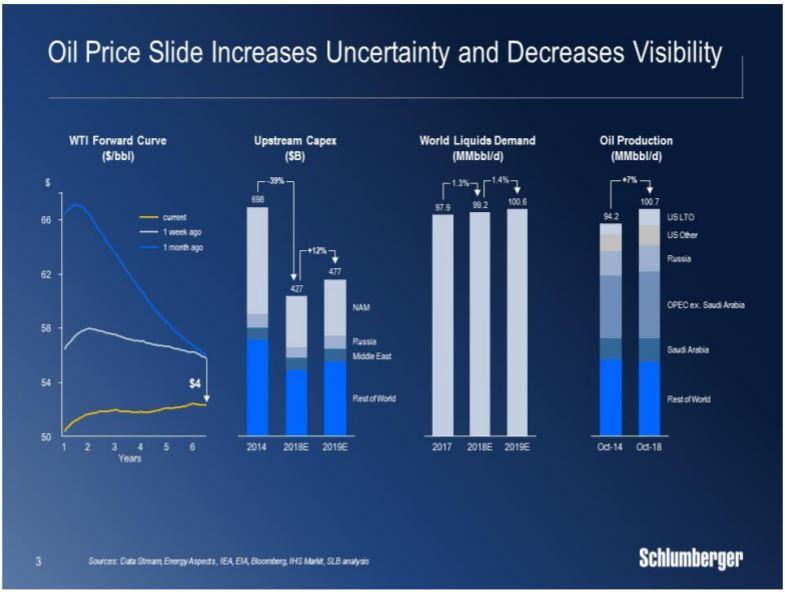

Schorn commented: "Since the peak at the beginning of October, the oil price has dropped by around 30%, driven by a surge of US production from the GOM and the Permian, record high production from the core part of OPEC, US dispensations to the Iran oil export sanctions, and the ongoing trade war dispute between US and China.

"These elements have all had a significantly negative impact on oil market sentiment, even though market fundamentals have not dramatically changed."

Frac Market Activity Dropping "Significantly"

In regard to the frac markets, Schorn noted that Schlumberger is "seeing a significantly larger drop in activity than we expected, which is leading to a larger drop in pricing."

As a result, Schlumberger is expecting a -15% sequential drop in North America revenue for 4Q. However, Schorn noted that the company believes the drop is "temporary."

Looking into 2019 - E&Ps to "Take Conservative Approach"

Schorn noted that during 1H2019, the industry is "unlikely to repeat" the activity surge that was seen in the first half of 2018. He said that oil price volatility and reduction in visibility will likely cause E&Ps to take a more conservative approach next year, but Schorn noted that activity could "accelerate in the second half of [2019]."

Schorn commented: "The recent volatility in oil prices has introduced more uncertainty to the outlook for 2010 E&P spend. Faced with this, our customers will likely respond by taking a more conservative approach to the start of 2019, as they await current market dynamics to play out."

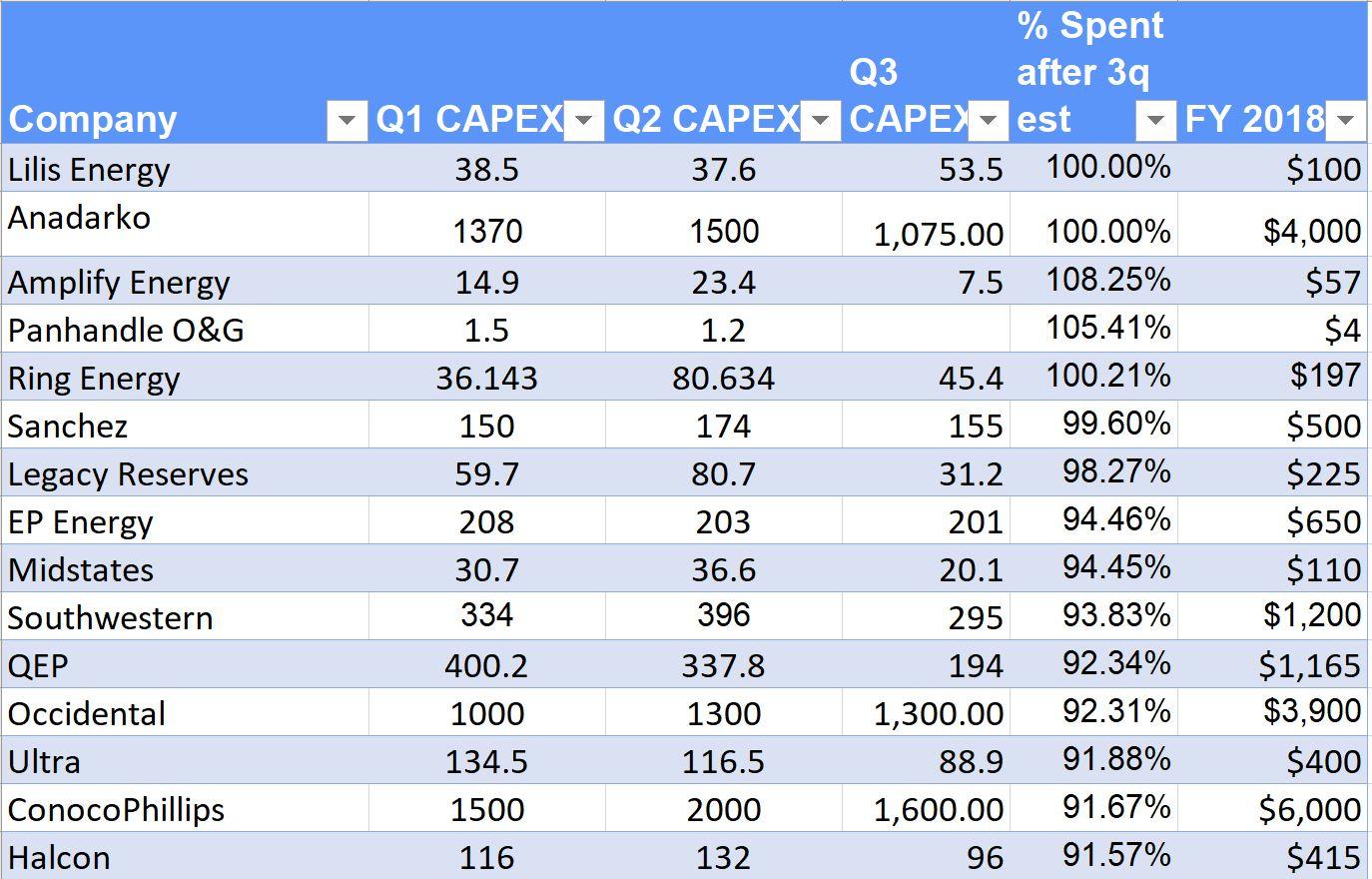

As most of you might remember, Shale Experts correctly pointed out that based on data from its Capital & Activity Tracker we were going to see significant reduction in Q4 activity and here is why. Below is a snippet from our New Capital & Activity Tracker database that clearly shows many operators already spent their entire 2018 budget by the end of Q3 2018. The only alternative left in Q4 was for most of these companies to slow activity.

The "Capital & Activity Tracker" is a New Premium Service launched by Shale Experts that allows companies to track and predict when their will be a slow down or increase in operator activity. To learn more about this new service please contact us at 713-876-7700.

Related Categories :

Frac Markets

More Frac Markets News

-

What to Expect From Frac Activity in 2H'23 & 2024 -

-

Top Frac Companies Talk Slowdown In Gas Basin; Oversupplied Permian -

-

E&P Companies Talk Increase In 2023 Plans; Rigs, Frac Crews and Capital Budgets -

-

ProFrac Holding Corp. Second Quarter 2022 Results

-

ProPetro Holding Corp. Second Quarter 2022 Results

Ark-La-Tex News >>>

-

Seventeen (17) E&Ps; To Use 47 Frac Crews To Complete 2,800 Wells In 2024

-

These Permian Operators Plan to Complete/Frac 2,100 Wells IN 2024

-

Large E&P Chops Permian/Anadarko Basin Frac Activity by 30% In 2024

-

Permian E&P Ups 2024 Well Completed by +27% vs. 2023

-

Contrary to The Noise, U.S. Oil Production will Likely Growth 4-5% In 2024; A look Inside -