Quarterly / Earnings Reports | Second Quarter (2Q) Update | Financial Results | Capital Markets | Impairment

Shell Second Quarter 2020 Results

Shell reported its second quarter 2020 results.

Royal Dutch Shell Chief Executive Officer Ben van Beurden said: “Shell has delivered resilient cash flow in a remarkably challenging environment. We continue to focus on safe and reliable operations and our decisive cash preservation measures will underpin the strengthening of our balance sheet.

"Our high-quality integrated portfolio, disciplined execution and forward-looking strategy enable sustained competitive free cash flow generation.”

Cost reduction developments:

- Underlying opex reduced by $1.1 billion compared with Q1 2020; delivering reduction target of $3 - $4 billion.

- Cash capex reduced by $1.4 billion compared with Q1 2020; manage cash capex to $20 billion or lower in 2020.

- Impairments of $16.8 billion post-tax (6.1% of average capital employed), reflecting revised price and margin assumptions.

- Gearing increase includes 2.8% impact from impairments and pension remeasurement.

- Net debt increase includes additional leases of $0.8 billion.

- Gearing and Net debt impacted by negative working capital movements of $4.0 billion.

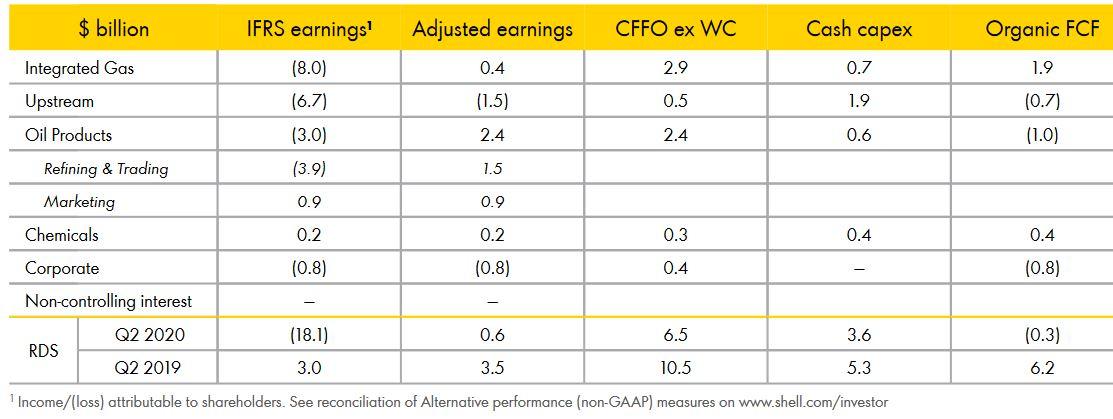

Q2 2020 Financials

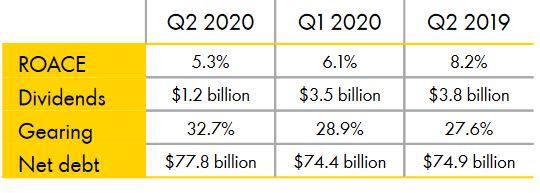

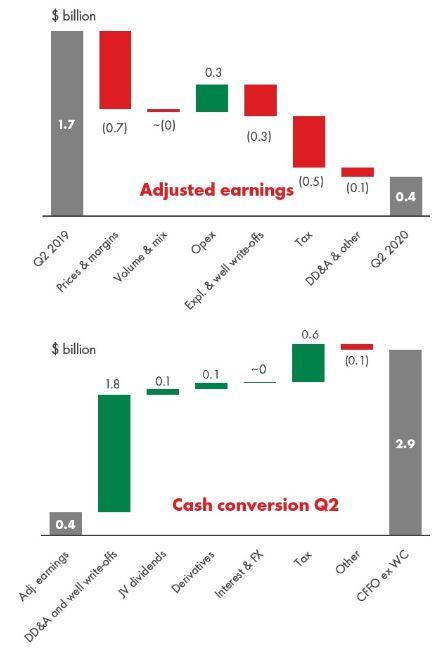

Integrated Gas / New Energies

- COVID-19 pandemic-related demand decline led to lower LNG and gas-to-liquids revenues, mostly due to lower realised prices.

- LNG trading and optimisation results marginally below average.

- Additional well write-offs and deferred tax charges had a negative impact of $0.6 billion on Adjusted earnings, but no cash impact.

Q3 2020 Outlook

- Production: 820 - 880 thousand boe/d. Liquefaction: 7.6 - 8.2 million tonnes. Due to price lag in oil-linked LNG term contracts, the impact of low oil prices is expected to become more significant in the third quarter.

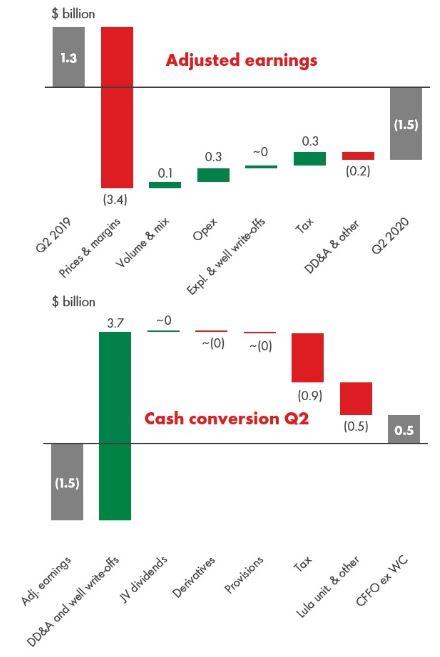

Upstream Q2 Results

- Weak macroeconomic environment driving lower Upstream Adjusted earnings.

- Despite strong Upstream operational performance, production 7% lower compared with Q2 2019 due to divestments and OPEC+ curtailments.

- Upstream sales volumes up due to timing of liftings mainly in Brazil.

Outlook for Q3

- Production: 2,100 - 2,400 thousand boe/d.

Outlook reflects expected OPEC+ and economic curtailments for entire quarter.

Oil Products

- Earnings underpinned by very strong crude and oil products trading and optimisation as well as lower opex spend.

- Lower Oil Products and Marketing sales volumes when compared with Q2 2019 due to weak macro and COVID-19, some recovery in June.

- Oil Products sales volumes ~39% lower. Largest declines in Aviation, Retail and Refining & Trading.

Q3 2020 Outlook

- Sales volumes: 4,000 - 5,000 thousand b/d.

- Refinery utilisation: 68% - 76%.

Corporate

- Gearing increased in Q2 by 3.8%. Impairments represent 2.1% and pension remeasurement 0.7%.

- Net debt increased in Q2 by $3.4 billion to $77.8 billion.

- Long-term debt issuance in Q2 of $9.1 billion equivalent. Shell also signed a new $12 billion revolving credit facility in April 2020.

2020 Outlook

- Adjusted earnings: net expense of $3,200 - $3,500 million for the full year 2020. This excludes the impact of currency exchange rate effects.

Q2 2020 Portfolio Developments

Nigeria: all conditions met for Final Investment Decision (FID) and contracts awarded on a new LNG processing unit, known as Train 7, at Nigeria LNG (Shell interest 25.6%), which will add 8 million tonnes per annum (mtpa) of capacity to the Bonny Island facility.

USA: agreement to sell Appalachia shale gas position for $541 million, with an effective date of January 1, 2020 and expected to complete in Q3 2020.

Impairments: $16.8 billion ($22.3 billion pre-tax), of which Integrated Gas $8.2 billion ($11.2 billion pre-tax), mainly relating to the QGC Integrated Gas project in Australia and Prelude floating LNG in Australia; Upstream $4.7 billion ($6.3 billion pre-tax), mainly relating to unconventional assets in North America, offshore assets in Brazil and Europe, a project in Nigeria (OPL245), and an asset in the US Gulf of Mexico; Oil Products $4.0 billion ($4.9 billion pre-tax), mainly relating to refineries in Europe and North America; and Corporate $5 million ($9 million pre-tax).

Related Categories :

Second Quarter (2Q) Update

More Second Quarter (2Q) Update News

-

SM Energy Hits Record Output; Driven by Uinta

-

Expand Energy Talks, Wells, Frac Crews, Production For 2H-2025 -

-

Comstock Rides Higher Gas Prices, Operational Momentum in Q2 2025

-

A Quarter of Quiet Strength: CNX’s Patient Ascent in Appalachia -

-

Liberty Energy: Navigating the Frac Downturn with Efficiency, Innovation, and Strategic Focus -

Permian News >>>

-

Why Surface-Only Inventory Predictions Are a Fool’s Errand

-

Occidental Eyes $10 Billion OxyChem Sale Amid Debt and Capital Discipline Push -

-

Permian Gas Gets New Highway: Transwestern’s 1.5 Bcf/d Desert Southwest Expansion -

-

WaterBridge Infrastructure Brings Delaware Basin Water Model to Wall Street -

-

OPEC+ Nudges Supply Higher: Why This Weekend’s Hike Echoes 2020—But Isn’t 2020

Permian - Delaware Basin News >>>

-

SM Energy Hits Record Output; Driven by Uinta

-

The Permian Play: How ExxonMobil Is Rewriting the Shale Narrative -

-

Large Cap E&P To Reduce Drilling & Completion Activity in 2026 -

-

$2.4B Deal Gives MPLX Sour Gas Edge in Permian -

-

Liberty Energy: Navigating the Frac Downturn with Efficiency, Innovation, and Strategic Focus -