Quarterly / Earnings Reports | Debt | Second Quarter (2Q) Update | Deals - Acquisition, Mergers, Divestitures | Capital Markets | Capital Expenditure

Spyglass Planning Divestments as Debt Looms

Spyglass Resources Corp. has announced unaudited interim financial and operating results for the quarter ended June 30, 2015.

Second Quarter Summary

- Spyglass announced a revised credit facility on June 30, 2015, resulting in the classification of the Company's bank debt as a current liability. As such, the Company continues to include a note on going concern uncertainty in its financial statements. Spyglass continues to meet all of its obligations with respect to ongoing operations.

- In an effort to further reduce debt, Spyglass intends to come to market later this year with a broad disposition package incorporating both core and non-core assets. Management's attention remains on managing the resources of the Company through a difficult commodity price environment, reviewing recapitalization opportunities and ongoing property dispositions.

- Production for the second quarter of 2015 averaged 9,849 boe/d, a decrease from 14,474 boe/d in the second quarter of 2014 reflecting the Company's successful asset disposition program.

- Capital expenditures for the second quarter of 2015 were $2.3 million primarily related to maintenance capital.

- Non-core asset dispositions in the second quarter of 2015 totalled $2.7 million.

- Operating costs for the second quarter of 2015 were $17.04 per boe, as compared to $18.27 per boe in the second quarter of 2014. Operating costs, on an absolute dollar basis, improved in the second quarter of 2015 by $8.8 million (37 percent) as compared to the same period last year, as a result of the Company's asset disposition program coupled with ongoing cost reduction initiatives.

- Net debt at June 30, 2015 was $184.5 million, comprised of $176.4 million in bank debt and additional working capital deficit of $8.1 million (excluding the current portion of risk management contracts), down from $195.7 million in the first quarter of 2015 and $270.8 million in the second quarter of 2014.

Outlook

- Drastically lower commodity prices continue to present a challenging business environment for the Company as 2015 progresses. Spyglass has prudently managed costs through reductions in staffing levels, renegotiating contract rates with business partners, temporary salary reductions and running a minimal capital program.

- Management anticipates that the 2015 capital program will be $11 million, an increase from the previously disclosed $8 million, primarily focused on maintenance capital expenditures.

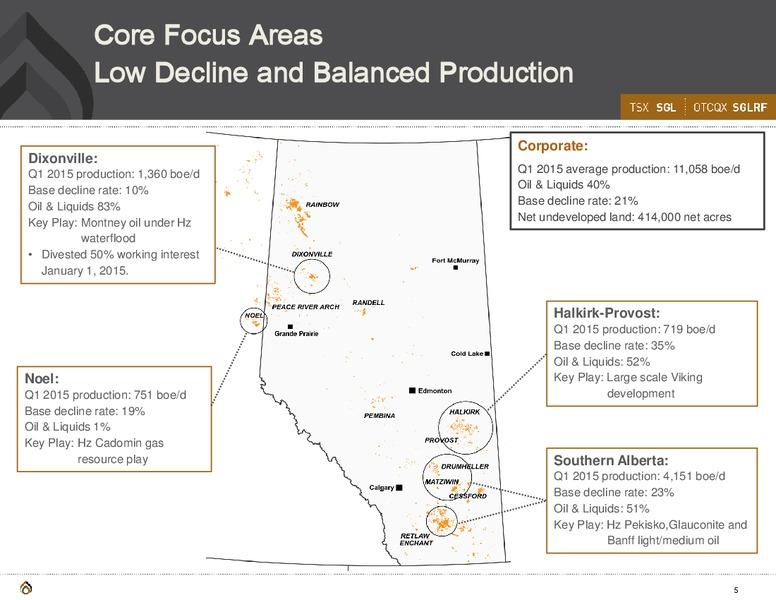

- The capital program coupled with the Company's relatively low 21 percent decline rate is expected to result in average production of approximately 9,000 boe/d for the year.

Risk Management Update

Spyglass uses a commodity price risk management program to mitigate the impact of crude oil and natural gas price volatility on cash flow which is intended to support the capital program. Spyglass hedges production up to 24 months forward, using a combination of fixed price and participating products. During the second quarter of 2015 the Company did not enter into any additional risk management contracts. Management continues to evaluate further risk management contracts to protect a portion of its crude oil and natural gas production and plans to enter into commodity swaps into 2016, complying with covenants contained in the Company's credit facility.

Related Categories :

Debt

More Debt News

-

Ring Energy Details Preliminary 1Q22 Results; Production Beats Expectations

-

Marathon Oil Third Quarter 2021 Results

-

Continental Resources Second Quarter 2021 Results

-

Extraction Oil & Gas First Quarter 2021 Results

-

SandRidge Energy First Quarter 2021 Results

Canada News >>>

-

Large Permian E&P Cuts Capex;Outlines New D&C Plans, 2024

-

Petrus Resources Ltd. First Quarter 2023 Results

4.jpg&new_width=60&new_height=60&imgsize=false)

-

Cardinal Energy Ltd. First Quarter 2023 Results

-

Headwater Exploration Inc. First Quarter 2023 Results -

6.jpg&new_width=60&new_height=60&imgsize=false)

-

Rubellite Energy Inc. First Quarter 2023 Results

3.jpg&new_width=60&new_height=60&imgsize=false)