Exploration & Production | Top Story | Production | Forecast - Production | Capital Markets | Capital Expenditure

Stone Plans Conservative Budget for 2015; GoM Focus

Stone Energy Corp. announced estimated year-end proved reserves and production volumes for 2014, and provided its capital expenditure budget, initial production and cost guidance for 2015 and operational updates.

Highlights:

- Year-end 2014 estimated proved reserves were 152 Mmboe, which represents a 5.5% increase compared to year-end 2013 estimated proved reserves.

- Fourth quarter 2014 production averaged approximately 42.5 MBoe per day (255 Mmcfe per day).

- Full year 2014 production averaged approximately 42.6 MBoe per day (256 Mmcfe per day), which included the impact of several divestitures of non-core assets during the year.

- The Board of Directors authorized a 2015 capital expenditure budget of $450 million.

Chairman, President and Chief Executive Officer David Welch stated, "In 2014, we achieved a number of important milestones for Stone Energy. We drilled two deep water wells at Cardona and initiated production before year-end. We drilled a successful deep water exploration well at Amethyst and sanctioned a development plan. In Appalachia, we drilled another 38 wells in the Marcellus shale and averaged over 100 Mmcfe per day for the year, while our successful Utica test well confirmed the play on our acreage position for future development. We shed non-core assets to raise funds and focused on the deep water and Appalachia, while significantly lowering our operating cost and reducing P&A exposure. We maintained our liquidity position with over $250 million in cash and an undrawn $500 million bank facility at year-end to help navigate through the current challenging markets. Finally, we have reacted quickly to the commodity price collapse by significantly reducing capital expenditures, operating costs and overhead, and simplifying the organization."

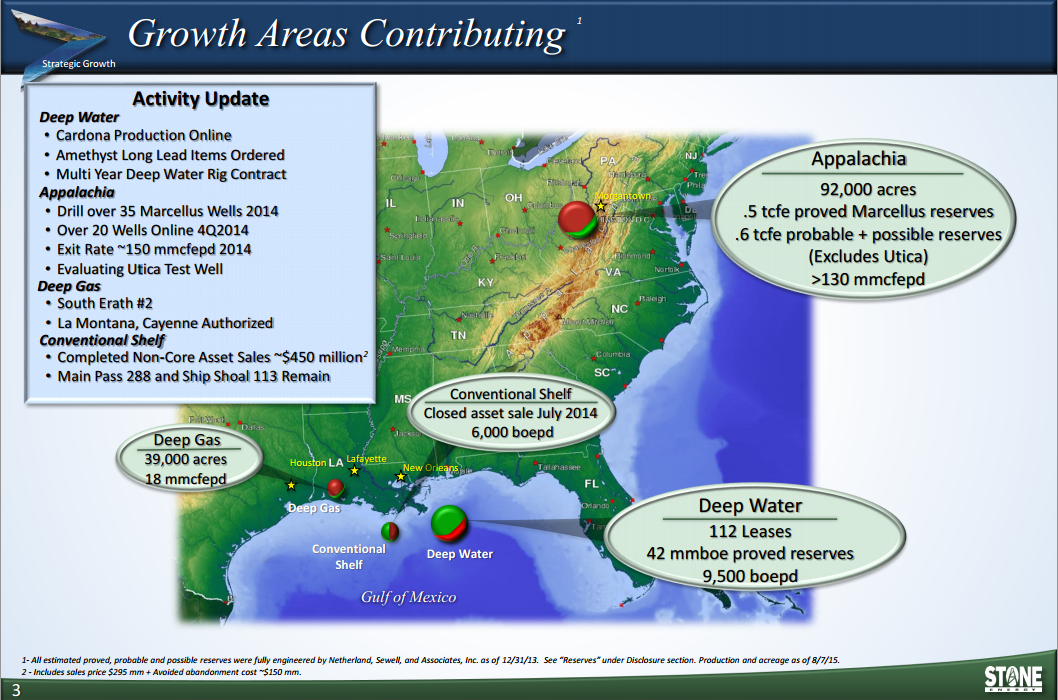

Areas of Operations

2015 Capital Expenditure Budget

Stone's Board of Directors has authorized a 2015 capital expenditure budget of $450 million, which assumes planned sales of minority working interests in certain targeted assets. The budget also excludes acquisitions and capitalized SG&A and interest. The budget is allocated approximately 75% to Deep Water/Gulf Coast, 8% to Appalachia, 4% to Business Development and 13% to Abandonment expenditures. The capital budget and allocation of capital across the various areas is subject to change based on several factors, including commodity pricing, liquidity, permitting times, rig availability, regulatory, non-operator decisions and the sales of working interests in certain targeted assets.

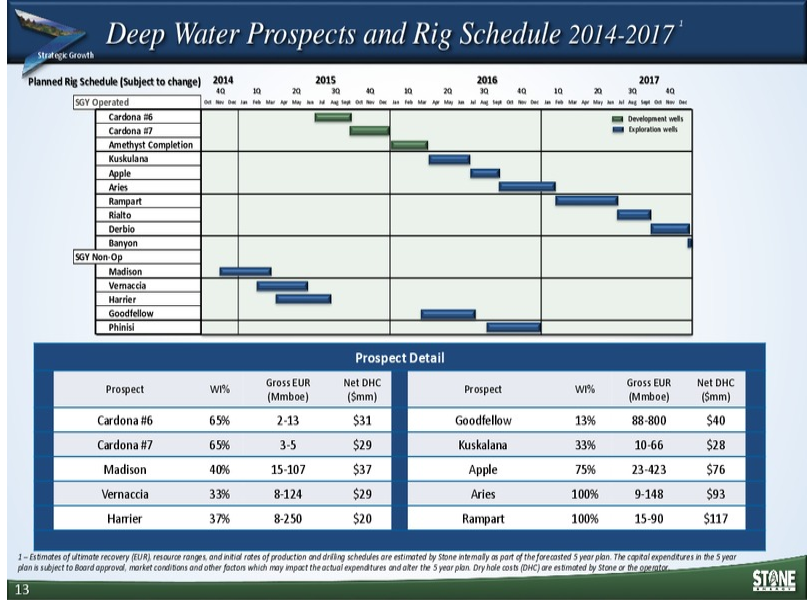

The Deep Water capital budget is focused on development and exploration drilling, facility installations for development work, completion operations, and seismic and lease acquisition. Stone expects to participate in drilling two non-operated exploration wells in the first quarter of 2015, drill the Cardona #6 well, and complete the Amethyst discovery well and install a flowline back to the Pompano platform. A portion of the budget is also allocated to the expected fourth quarter of 2015 arrival of the platform rig for the Pompano platform drilling program.

The Appalachia capital budget includes securing additional core lease-hold interests and drilling several Marcellus wells in the first quarter before releasing the Marcellus drilling rig. No further Marcellus drilling is projected for the rest of the year. Late in the fourth quarter of 2015, Stone expects to receive a dual-purpose Utica/Marcellus rig for a 2016 drilling program that is capable of drilling in either shale formation.

Capital dedicated to the GOM conventional shelf will be primarily used for recompletions, improvements to existing infrastructure and required plug and abandonment operations. For increased efficiencies, the conventional shelf and deep gas operating groups have been consolidated within the deep water operations. The remainder of the capital budget is focused on onshore business development opportunities.

Capital expenditures for 2014 are expected to total approximately $875 million, which excludes capitalized SG&A and interest and is lower than the $895 million authorized by the Board.

Source : Stone Energy Nov 2014 / PetroleumResearch.org

Operational Update

The deep water Cardona project commenced initial production in December of 2014 with the separate testing of both wells. The two wells are currently flowing to the Pompano facility at a gross rate of approximately 10,000 Boe per day (65% operated working interest). Pressure maintenance and reservoir management have been the primary focus during this initial production phase. Stone also plans to participate in two exploration wells in the first quarter of 2015, the Harrier prospect (37% working interest and operated by ConocoPhillips) and the Vernaccia prospect (32% working interest and operated by Eni), both potential tie-backs to the Pompano facility. The deep water Madison prospect, located on Mississippi Canyon 479 and operated by Noble Energy, did not encounter commercial hydrocarbons and will be plugged and abandoned. Stone holds a 40% non-operated working interest in the Madison project.

The previously announced successful Utica exploration well, with a 3,605 foot lateral, has been producing since December 1, 2014 and has averaged approximately 15 Mmcf per day since inception. A new dual-purpose Utica/Marcellus drilling rig has been contracted with delivery expected in late 2015. The current Marcellus rig will be released next month.

As of December 31, 2014, the cash and restricted cash position was approximately $250 million and the $500 million credit facility remained undrawn except for $19.2 million in letters of credit which had been issued pursuant to the facility. In October 2014, the $500 million borrowing base was affirmed by the bank group with the next redetermination scheduled for May 2015.