Exploration & Production | Drilling / Well Results | Top Story | Key Wells | Capital Markets | Capital Expenditure

Swift Cuts CapEx for 2015; Tests Four New Eagle Ford Wells

Swift Energy Company announced a revised 2015 capital budget range of $100 - $125 million in response to recent hydrocarbon price declines. This revised level of activity is projected to yield between 11.2 and 11.4 million barrels of oil equivalent (MMBoe) of production.

Terry Swift, CEO of Swift Energy, commented, "Our revised budget, representing a 70-75% decrease in spending from 2014, reflects the lower commodity price environment we face in 2015 and demonstrates our response during this down cycle. We continue to work with our vendors and suppliers to reduce service costs and are taking steps to materially reduce field level operating and corporate overhead expenses."

Operations Update

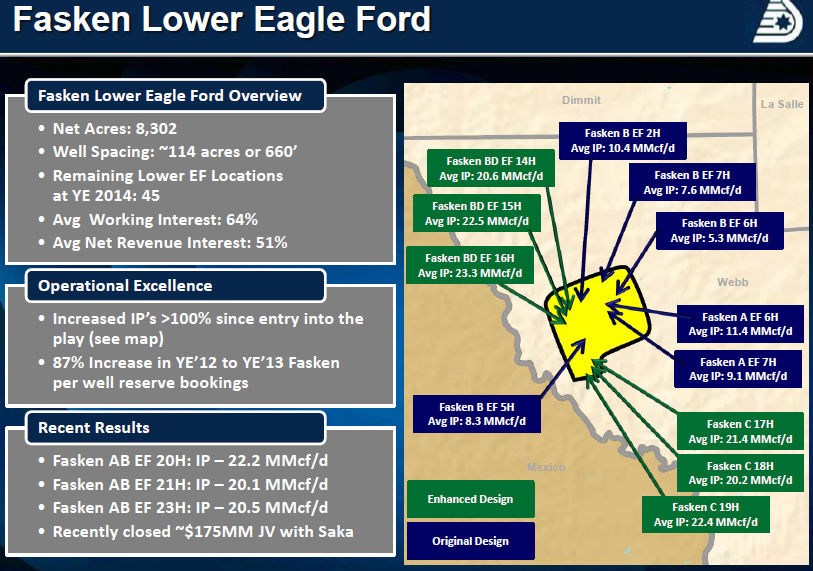

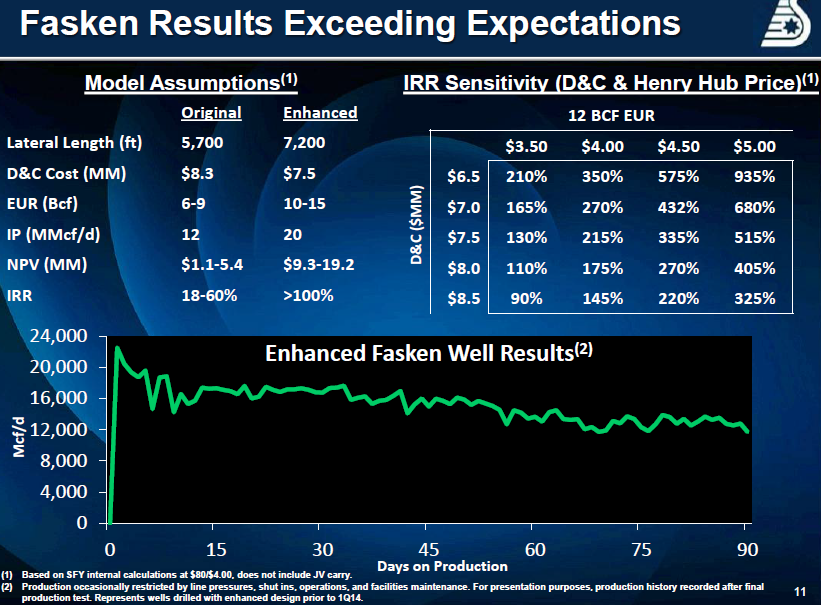

Swift Energy also announced today that it has tested four new Eagle Ford wells in the Fasken area in Webb County, Texas. The Fasken 27H, 28H, 29H and 30H were all recently completed with an average initial production rate of 20.8 million cubic feet of gas per day.

Terry Swift commented further, "We are pleased with our drilling and completion efforts in Fasken, as we have now drilled 14 consecutive wells with average initial production tests in excess of 20 MMcf/d. These results demonstrate that deploying customized, engineered completions in horizontal laterals drilled in precise target zones of the Eagle Ford shale improve the productivity of our wells."

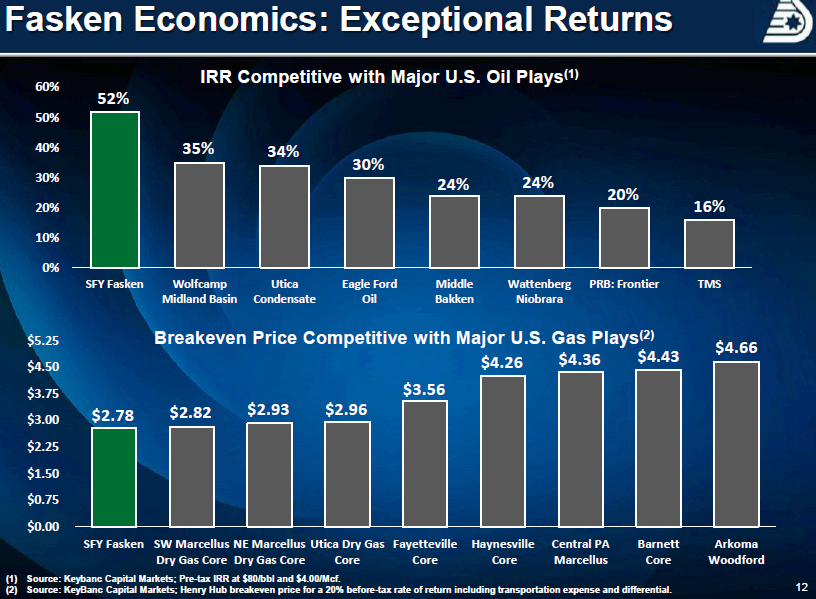

Breakeven price based on 20% rate of return.

Related Categories :

Gulf Coast - South Texas News >>>

-

Chesapeake Energy Q4, Full Year 2022 Results; IDs $1.8B 2023 Capex

19.jpg&new_width=60&new_height=60&imgsize=false)

-

Amplify Energy Adds Finance Exec to Board -

-

Japanese Conglomerate Exits Shale Biz with Sale of Eagle Ford Asset -

-

ConocoPhillips Fourth Quarter, Full Year 2020 Results -

-

Chesapeake IDs 2021 Budget; Focuses on Appalachia, Ark-La-Tex Assets