Exploration & Production | Well Cost | Top Story | Quarterly / Earnings Reports | Third Quarter (3Q) Update | Production Rates | Forecast - Production | Capital Markets | Capital Expenditure | Drilling Program

Tamarack Reevaluates 2015 Budget

Tamarack Valley Energy Ltd. has announced that a successful drilling program in the Wilson Creek area contributed to estimated average production of 7,950 boe/d during the last week of October with additional behind pipe production capability of approximately 400 boe/d.

In addition, Tamarack has drilled 9 net Cardium wells in Wilson Creek so far during the fourth quarter that the Company expects to have on production by year end. On September 3, 2014, the Company increased its 2014 estimated exit production guidance by approximately 30% to 9,500 boe/d from the previously announced 7,300 to 7,500 boe/d range. Tamarack is on target to meet its revised exit rate of 9,500 boe/d (approximately 60% oil & natural gas liquids) and is forecasting Q4 2014 annualized net debt to cash flow to be 1.5 times.

Third Quarter 2014 Highlights

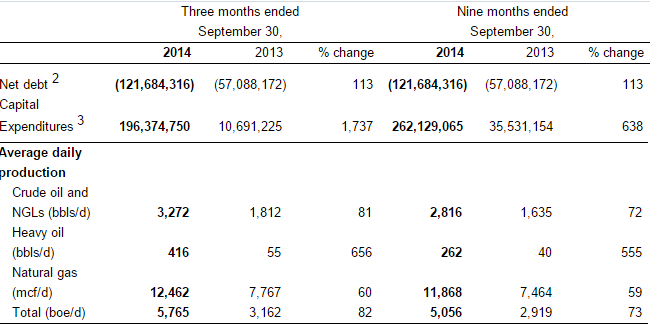

- Record funds from operations (excluding transaction costs associated with the Wilson Creek acquisition) of $19.3 million ($0.30 per share on a diluted basis), an 8% increase (3% per share) from $17.8 million ($0.29 per share on a diluted basis) in Q2 2014. Funds flow from operations including transaction costs was $15.8 million ($0.25 per share on a diluted basis)

- Record production of 5,765 boe/d in Q3 2014, an 11% increase from 5,203 boe/d in Q2 2014 and a 10% production per share increase over Q2 2014

- Oil and liquids weighting increase to 64% in Q3 2014 from 61% in Q2 2014

- Third quarter drilling activity of 9 (7.5 net) Cardium wells in the Wilson Creek area, 1 (1.0 net) well in Alder Flats and 3 (3.0 net) heavy oil wells in Hatton

- Exited October with production averaging 7,950 boe/d during the last week, with approximately 400 boe/d behind pipe

2015 Guidance Update

On September 3, 2014 the Company announced preliminary 2015 guidance that was based on an Edmonton par price average of $89.00/bbl and AECO price average of $3.57/GJ. Since that time Edmonton par prices have declined by 10 to 15%, causing the Company to re-evaluate its preliminary 2015 capital expenditure plan. Preserving a strong balance sheet will give Tamarack the flexibility to pursue opportunities in a low commodity price environment.

The Company will continue to execute the Wilson Creek area Q4 2014/Q1 2015 drilling program as previously disclosed and is targeting a first quarter 2015 plan to average at least 9,500 boe/d while reducing estimated net debt to annualized funds from operations to 1.3 times or less at current prices. The Company will release its 2015 guidance after finalizing its 2015 budget.

Operations Update

Since the end of the third quarter, the Company has drilled 9 net wells in the Wilson Creek area, which it expects to begin fracture stimulation operations by the end of November, 2014. Tamarack still has 3 operated rigs active in Wilson Creek, where it expects to drill another 4 to 5 wells and 1 well in Alder Flats. Of the 15 net Cardium wells it plans to have drilled by the end of the year, only 11 net wells are expected to be on production contributing to the Company's 9,500 boe/d exit rate. The other 3 to 4 wells will be fracture stimulated and brought on production in early Q1 2015. Of the additional behind pipe production capability of approximately 400 boe/d, the Company expects to have 200 boe/d of it on production by the end of the year, with the rest of the production coming on in Q1 2015.

During the third quarter, Tamarack succeeded in reducing drilling times by 25%, with a record well being drilled in 8.5 days from spud to rig release. The Company is very encouraged by these drilling cost reductions and expects to be able to duplicate this result with pad program drilling on the contiguous Wilson Creek land block. Tamarack is also working on cost reduction measures for the fourth quarter 11 well fracture stimulation program taking advantage of multi-well pads and the re-use of slick water fracture fluids. Further cost reductions are also being realized by the addition of owned infrastructure acquired with the Wilson Creek asset. The Company expects to reduce well equipping costs by approximately $300,000 per well by tying in wells to existing owned infrastructure rather than equipping them as single-well batteries. All of these capital reductions will allow the Company to continue to achieve 12 to 14 month payouts on Cardium drills despite the recent reduction of crude oil prices.

Option Grant

The Company also announces that, in accordance with the Company's previously approved stock option plan, it has today granted, in aggregate, 7,000 options to purchase common shares in the capital of the Company to an officer of the Company. The Options each have an exercise price of $4.38 per share, are exercisable for a period of 5 years and vest in one third (1/3) increments on the first, second and third anniversaries from the date of grant. This grant of Options is subject to acceptance by the TSX Venture Exchange.

4.jpg&new_width=60&new_height=60&imgsize=false)

6.jpg&new_width=60&new_height=60&imgsize=false)