Exploration & Production | Finance & Investing | Top Story | Capital Markets

The 3 E&P Companies That Grew More Than 100% In 2013

Three companies have stood out in the last year and driven their stock to double in price in 2013.

Diamondback Energy, Matador Resources, and Penn Virginia have all inspired confidence from wall street with their performance. We will take a closer look and examine why.

Diamondback Energy

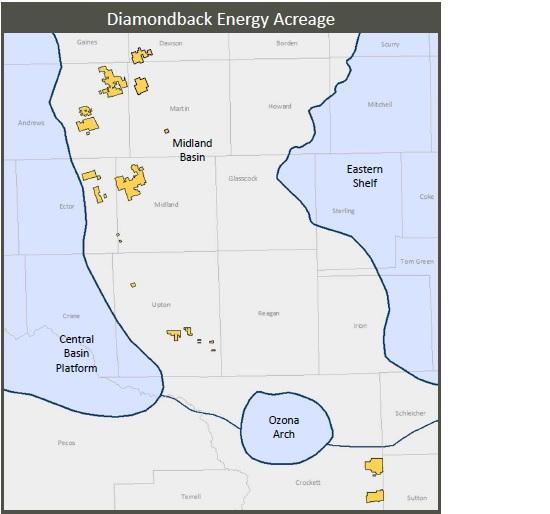

Diamondback Energy has grown its stock price by 140% in 2013, with an IPO that only started in October of 2012. Focused on the Permian Basin, Diamondback has doubled their proved reserves since 2012 through 2013 in their acquisition of 23,650 combined net acres in the Permian in September.

Diamondback's assets in the Permian include 66,000 net acres. They are focused on the Wolfcamp B horizon, joining notable operators Concho Resources, EOG Resources, EP Energy, Devon Energy, and SM Energy.

They have 1251 gross drilling locations, with 309 of those in Wolfcamp B. 24 wells are in production in Wolfcamp B with 7 in development. These wells have seen good economics for Diamondback, with a 47% IRR based on $7 MM wells with $90 WTI crude. The type curves for Midland and Andrews counties suggest performance above the Wolfcamp B average.

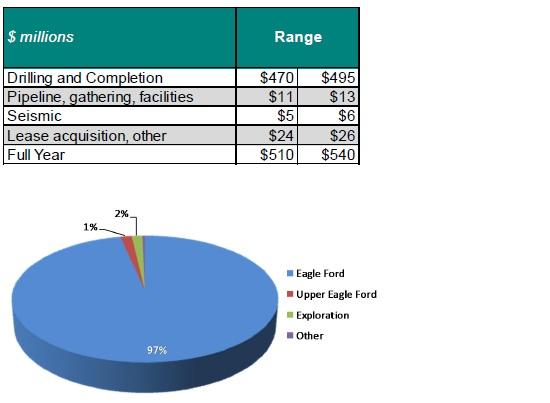

Diamondback's plans for 2014 have the majority of the budget spent on drilling and completions. They plan to add another horizontal rig, increasing their count from five to six total rigs, five horizontal and one vertical. Their budget is a 48% increase from last year's of $320 MM. The budget will allocate 85% to horizontal development of 60-75 gross wells. Only eight percent will go toward drilling 20-25 gross vertical wells in 2014.

Penn Virginia

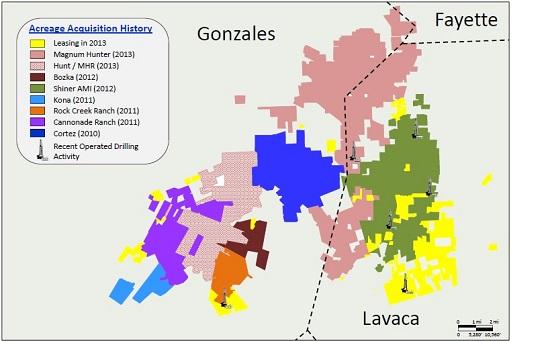

Penn Virginia stands out in 2013 and 2014 as an almost pure play Eagle Ford producer. Their growth in 2013 was helped largely by a deal in April where it acquired around 19,000 net acres in Gonzales and Lavaca counties from Magnum Hunter Resources. This Acquisition increased Penn Virginia's proved reserves by 12.0 MMBOE from 26.2 MMBOE before the acquisition, a 50 percent increase.

They have 72,200 net acres in Gonzales and Lavaca counties, with 890 gross drilling locations at present.

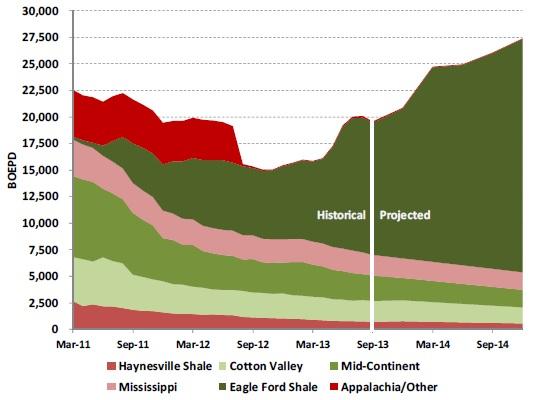

Penn Virginia's enthusiasm for the Eagle Ford will continue into the future, as is evident from their latest presentation:

This projection is backed up by Penn Virginia's capital budget for 2014, which allocates 97% to the Eagle Ford, with the majority of that spent on drilling and completion. They plan to run six rigs in the Eagle Ford, with five operated. They will drill an estimated 60-70 wells based on a $7.5 MM well cost.

Matador Resources

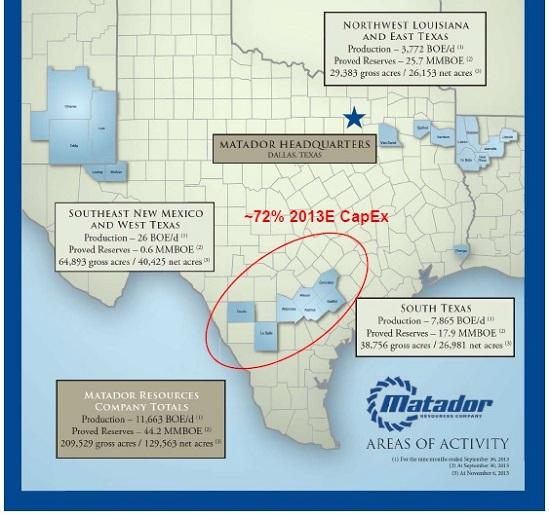

Matador Resources IPO came in February of 2012, and they too have seen quick growth in stock price. They have more than doubled oil production and oil based reserves throughout 2013. Matador's production comes primarily from two plays, the Eagle Ford and Haynesville/Cotton Valley. Matador has 949 gross drilling locations, with 129,563 net acres.

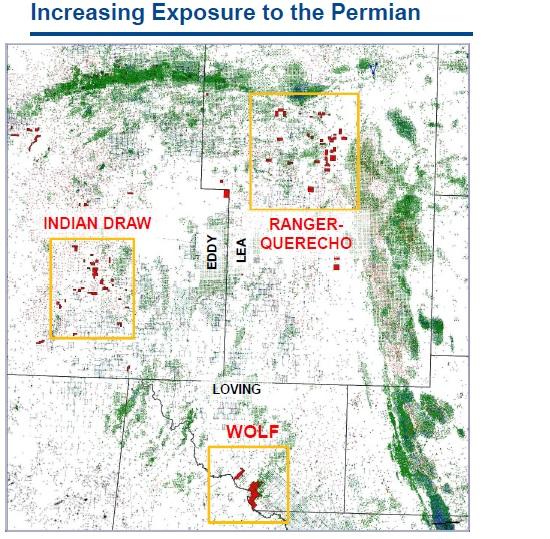

They have increased their reserves and planned drilling locations with substantial acreage acquisitions in the Permian Basin in 2014 in New Mexico.

The drivers for capital spending for Matador in 2014 will be both the Permian and Eagle Ford. Like Penn Virginia and Diamondback, the majority of the budget will now be spent on exploiting acquired acreage through drilling and completions. They plan to continue with two rigs in the Eagle Ford, and one in the Permian Basin. Their capital budget represents a 19% increase over 2013, from $370 MM to $440 MM.

All three companies have driven stock prices higher through a combination of aggressively increasing proven reserves and planned exploitation of high-yield acreage in the Permian and Eagle Ford. This will undoubtedly bring greater pressure for fraccing and completions services in Texas and New Mexico as this trend plays out.

Gulf Coast - South Texas News >>>

-

Why Surface-Only Inventory Predictions Are a Fool’s Errand

-

Occidental Eyes $10 Billion OxyChem Sale Amid Debt and Capital Discipline Push -

-

Permian Gas Gets New Highway: Transwestern’s 1.5 Bcf/d Desert Southwest Expansion -

-

WaterBridge Infrastructure Brings Delaware Basin Water Model to Wall Street -

-

OPEC+ Nudges Supply Higher: Why This Weekend’s Hike Echoes 2020—But Isn’t 2020

Permian News >>>

-

SM Energy Hits Record Output; Driven by Uinta

-

The Permian Play: How ExxonMobil Is Rewriting the Shale Narrative -

-

Large Cap E&P To Reduce Drilling & Completion Activity in 2026 -

-

$2.4B Deal Gives MPLX Sour Gas Edge in Permian -

-

Liberty Energy: Navigating the Frac Downturn with Efficiency, Innovation, and Strategic Focus -