Top Story | Production Rates | Financial Trouble | Capital Markets | Capital Expenditure

Ultra Petroleum Warns of Possible Bankruptcy

Ultra Petroleum warns of possible bankrupcy protection in its 10k filing.

"The audit report we received with respect to our year-end 2015 consolidated financial statements contains an explanatory paragraph expressing uncertainty as to our ability to continue as a “going concern.” Our Credit Agreement requires us to deliver audited, consolidated financial statements without a “going concern” or like qualification or exception. As a result, unless we obtain a waiver of this requirement, subject to a 30-day grace period, we will be in default under our Credit Agreement after we deliver our financial statements to the lenders under the Credit Agreement. Our failure to obtain a waiver of this requirement under the Credit Agreement within the applicable grace period could result in an acceleration of all of our outstanding debt obligations and the potential termination of the Pinedale Lease Agreement."

"We cannot provide any assurances that we will be able to comply with the covenants or to make satisfactory alternative arrangements in the event we cannot do so. If we are unable to cure any such default, or obtain a forbearance, a waiver or replacement financing, and those lenders, or other parties entitled to do so, accelerate the payment of such indebtedness or obligations, we may consider or pursue various forms of negotiated restructurings of our debt obligations and/or asset sales under court supervision pursuant to a voluntary bankruptcy filing under Chapter 11 of the U.S. Bankruptcy Code or the Canadian Bankruptcy and Insolvency Act, which would have a material adverse effect on our business, financial condition, results of operations and cash flows. Under certain circumstances, it is also possible that our creditors may file an involuntary petition for bankruptcy against us."

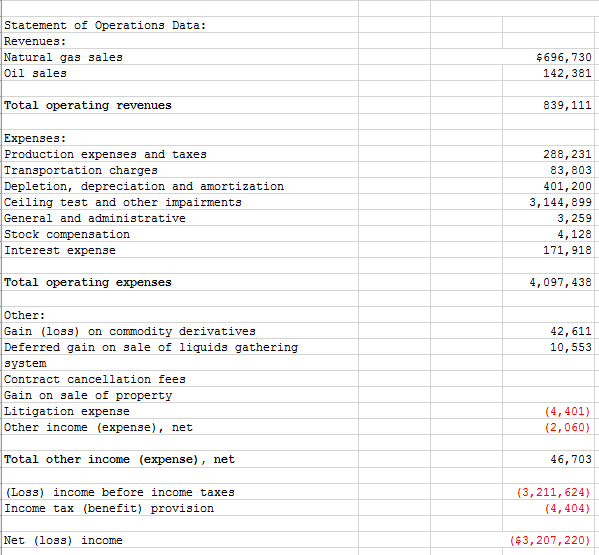

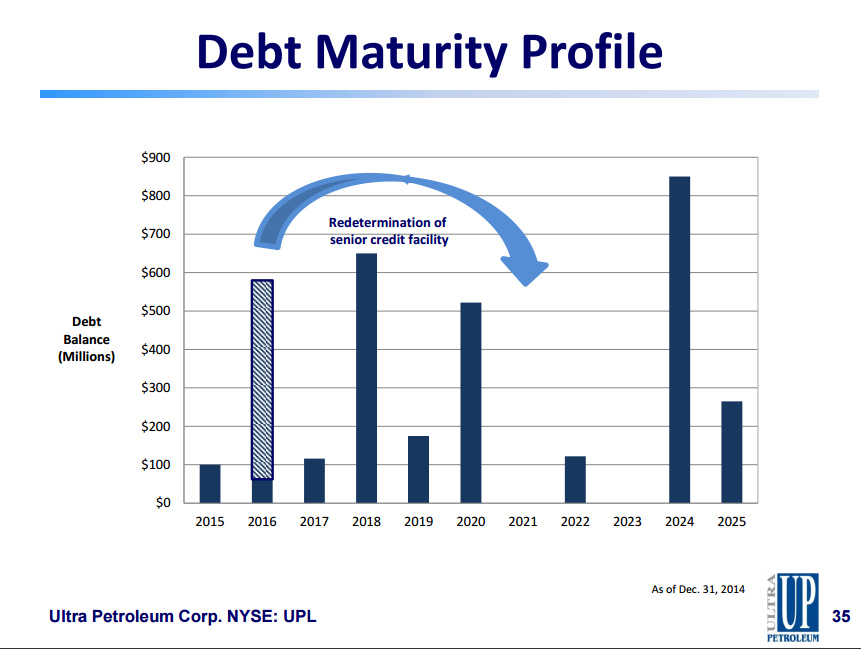

A quick look at the company income statement

- Debt : $3.3 Billion

- Operating Revenues : $839 Million

- Interest Expense : $171 Million

- % of Interest Payment From Operating Revenues : 20%

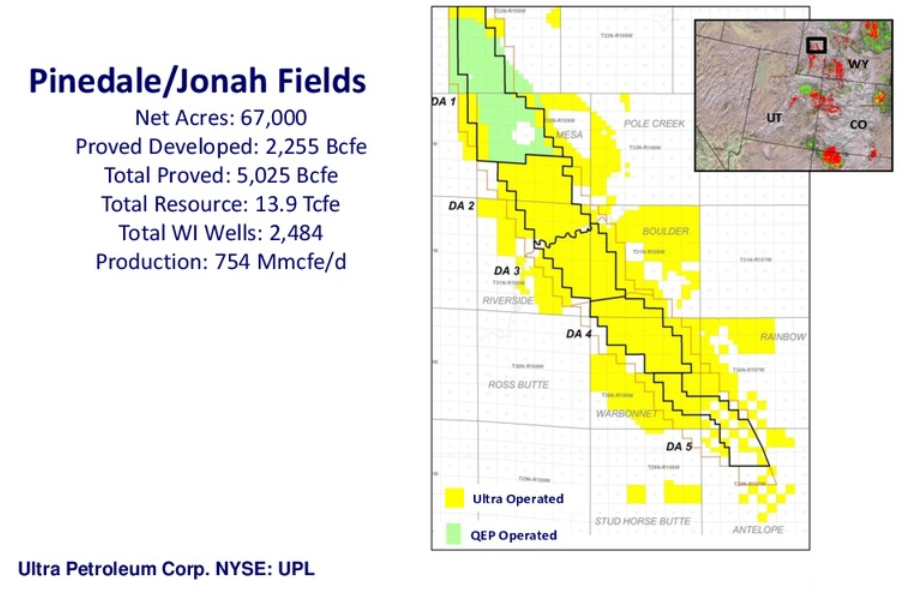

Production

- Natural Gas (Mcf) : 268,954

- Oil & Condensate (bbl) : 3,553

- Total (Mcfe) : 290,149

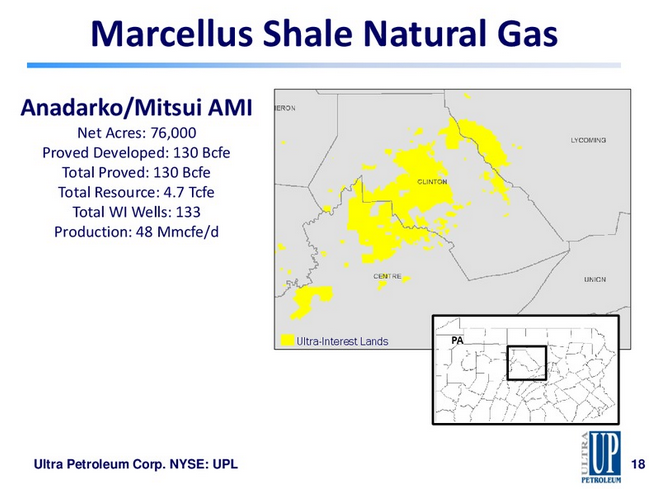

Debt Profile

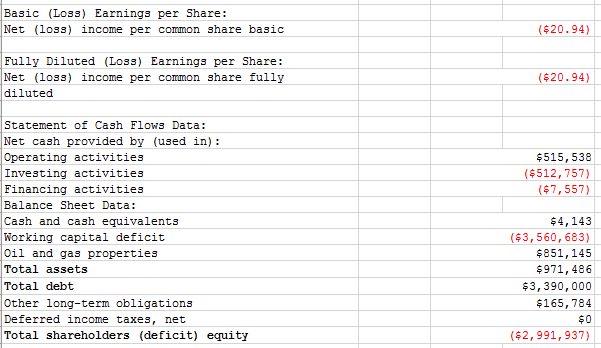

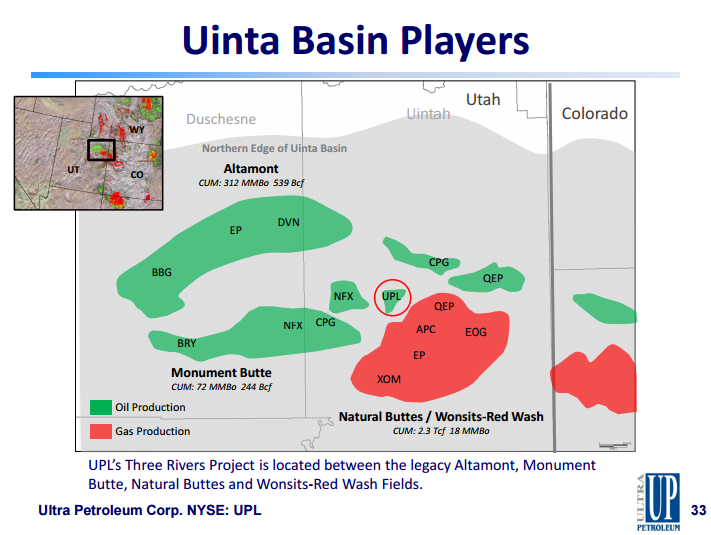

Operations

Source : Ultra Petroleum Via Presentation Manager

Related Categories :

Financial Trouble

More Financial Trouble News

-

Silverbow Resources Board Adopts 'Poison Pill' Strategy

-

Hess Corp. Second Quarter 2022 Results

-

Basic Energy Services Files for Bankruptcy; Inks Stalking Horse Deals

-

Amplify Energy Regains Compliance with NYSE

-

Report: Chesapeake Poised to Emerge from Bankruptcy

Rockies News >>>

-

Why Surface-Only Inventory Predictions Are a Fool’s Errand

-

OPEC+ Nudges Supply Higher: Why This Weekend’s Hike Echoes 2020—But Isn’t 2020

-

SM Energy Hits Record Output; Driven by Uinta

-

Large Cap E&P To Reduce Drilling & Completion Activity in 2026 -

-

Baker Hughes Solid Y/Y Performance Amidst US Frac Market Slowdown -