Government Bids | Hedging | Capital Markets

W&T Offshore High Bidder on GOM Lease; Updates Credit Facility, Hedges

W&T Offshore, Inc. has provided an update regarding several matters including the consolidation of its two Alabama natural gas treatment facilities, the awarding of two blocks from the November 2020 federal Gulf of Mexico lease sale, the semi-annual redetermination of the borrowing base under its revolving credit facility, and new crude oil hedges added.

GOM Lease Sale 256

W&T was the high bidder in the GOM Lease Sale 256 held by the Bureau of Ocean Energy Management ("BOEM") on November 18, 2020 on two shallow water blocks, Eugene Island South Addition block 389 and Ewing Banks block 979. These two blocks cover a total of approximately 8,800 acres. The Company was awarded the two blocks in late 2020 and paid approximately $500,000 for the awarded leases combined, which reflects a 100% working interest in the acreage. The two shallow water blocks have a five-year lease term and 12.5% royalty.

Borrowing Base Redetermination

W&T's bank group recently completed its regularly scheduled semi-annual borrowing base redetermination. The borrowing base was set by the bank group at $190 million. Additional details on the amended credit agreement will be included in a Form 8-K that will be filed tomorrow with the SEC. The next regularly scheduled redetermination is in the spring of 2021. At December 31, 2020, the Company had $80.0 million in borrowings on its revolving credit facility and $4.4 million of letters of credit outstanding, the same positions as of September 30, 2020.

Consolidation of Alabama Natural Gas Treatment Facilities

W&T has substantially completed the consolidation of its two onshore natural gas treatment facilities that service the Mobile Bay area into the Onshore Treating Facility ("OTF") which was acquired in 2019 from ExxonMobil. W&T is in the final stages of closing its Yellowhammer Plant and expects all natural gas produced from its Mobile Bay area assets will be treated in the OTF in late January. The OTF has more than sufficient capacity to meet W&T's current and expected needs as it further develops its Mobile Bay and regional natural gas assets in the future. The consolidation of the facilities is expected to result in savings of approximately $5 million per year beginning in 2021.

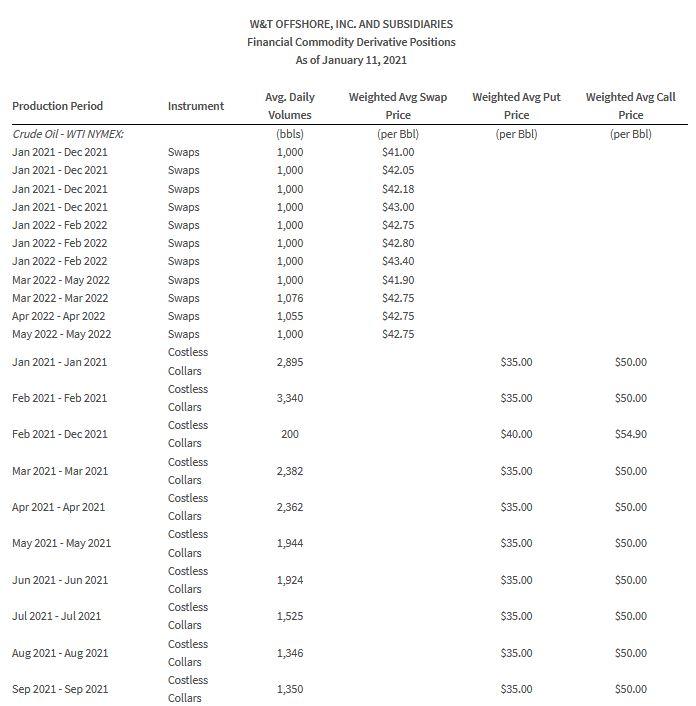

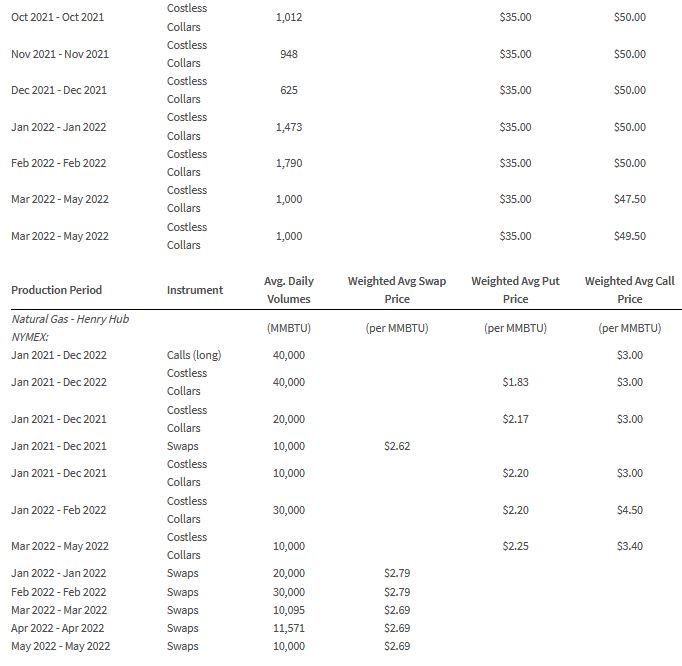

Hedging Update

W&T recently added WTI NYMEX crude oil costless collars on 200 barrels of oil per day of production for the period February 1, 2021 through December 31, 2021 with a floor of $40.00 per barrel and a ceiling of $54.90 per barrel.

Related Categories :

Government Bids

More Government Bids News

-

Iraq Energy Cabinet, Schlumberger Ink $480MM Well Deal

-

W&T Offshore Submits Winning Bid on Two Shallow GOM Blocks

-

Talos Wins GOM Exploration Blocks in Latest Bid Round; 11,520 Gross Acres

-

Australia Opens 2020 Bid Round for New Offshore Permits

-

ExxonMobil Picks Up 1.7MM Acres Offshore Egypt; Exploration Set for 2020

Gulf of Mexico News >>>

-

APA Corporation First Quarter 2023 Results -

-

Evolution Petroleum Corporation Fiscal Third Quarter 2023 Results

-

W&T Offshore, Inc., First Quarter 2023 Results

3.jpg&new_width=60&new_height=60&imgsize=false)

-

Talos Energy Inc. First Quarter 2023 Results -

2.jpg&new_width=60&new_height=60&imgsize=false)

-

Kosmos Energy Ltd. First Quarter 2023 Results