General News | Deals - Acquisition, Mergers, Divestitures

Amplify Energy, Midstates Finalize Merger Deal; Talk 2019 Spending Outlook

Amplify Energy and Midstates Petroleum have finalized their all-stock merger deal. The agreement was initially announced back in early May 2019.

Terms of the deal were not disclosed.

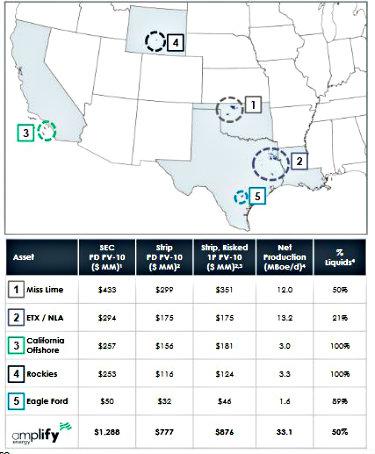

Pro Forma Assets:

- MissLime: 100,000 net acres

- Ark-La-Tex: 93,300 net acres

- Eagle Ford: 750 net acres

- Rockies CO2: 7,000 net acres

- California Offshore: 17,000 net acres

Total production of ~40.1 MBOEPD

- MissLime: 16.4 MBOEPD

- Ark-La-Tex: 15.5 MBOEPD

- Eagle Ford: 16.4 MBOEPD

- Rockies CO2: 4.1 MBOEPD

- California Offshore: 3.1 MBOEPD

Operations and Capital Spending Outlook

In 2H 2019, we anticipate capital spending of approximately $38 million across our operating areas. Approximately 53% (or $20 million) of this capital will be invested in Bairoil, primarily to fund the plant expansion project, which is expected to come online in the fourth quarter of 2019. The expansion will provide additional CO2 recycling capacity and allow currently shut-in wells to be turned back online, increasing oil production by approximately 900 Boe/d.

Recent Deals/Transactions

| Date Annouced | Category | Headline | Buyer(s) | Seller(s) | Value ($mm) |

|---|---|---|---|---|---|

| 09/02/2025 | E&P | Crescent Energy Acquires Vital |

|

|

|

| 07/10/2025 | E&P | Mach Resources Buys San Juan Gas Asset for $787 Million |

|

|

|

| 07/10/2025 | E&P | Mach Enters Permian Basin, Buys PE_backed Sabinal Assets for $500 Million |

|

|

|

| 06/05/2025 | E&P | Vermillion Energy Exits US, Sells Power River Basin Asset |

|

|

|

| 05/30/2025 | E&P | EOG Acquires Utica Liquids Focus Encino For $5.6 Billion |

|

|

|

| 05/13/2025 | E&P | TXO Partners Acquires White Rock Assets in the Elm Coulee Field |

|

|

|

| 05/07/2025 | E&P | Permian Resources Bolt-On Assets From APA Corp |

|

|

|

| 05/03/2025 | E&P | Riley Permian Acquires PE-Backed Silverback II For $142million |

|

|

|

| 04/22/2025 | E&P | EQT Acquires Olympus Energy Assets For $1.8 Billion |

|

|

|

| 04/01/2025 | E&P | TG Natural Resources Acquires Interest in Chevron’s Haynesville Asset |

|

|

|

| Total |

|