Top Story | Deals - Acquisition, Mergers, Divestitures

ConocoPhillips to divest Anadarko Basin asset for $1.3B

ConocoPhillips (“COP”) agreed to sell an Anadarko Basin position for $1.3 billion. The package was part of the Marathon Oil assets COP picked up and is now carving out as it sharpens focus on core returns.

Source : Marathon oil via SlideVault

What’s being sold

-

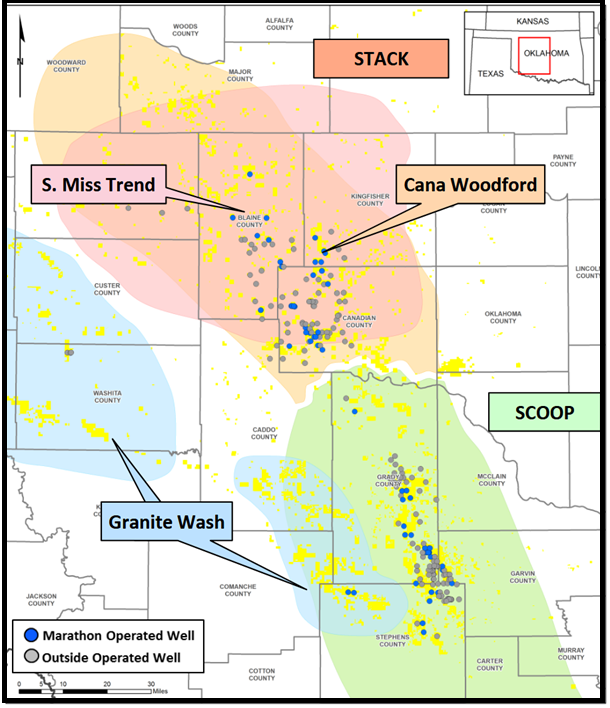

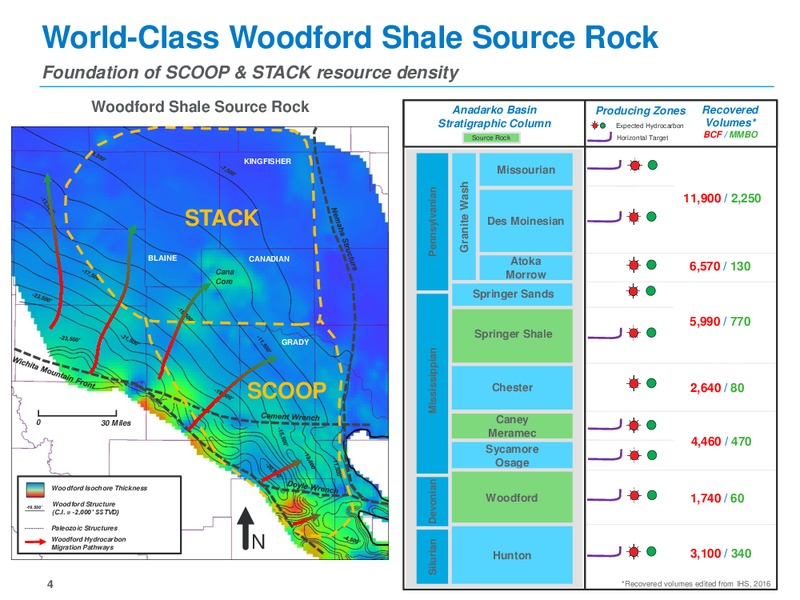

Basin / Play: Anadarko Basin (OK/TX Panhandle)

-

Core counties: Canadian, Caddo, Grady, Stephens, Garvin, Kingfisher, Dewey, Blaine

-

Net acres: ~260,000

-

2P inventory: ~1,670 net locations (~6,300 gross)

Current production & mix (at sale)

-

Total: ~40,000 Boe/d

-

Oil: ~7,200 Bbl/d (calc: 40,000 × 18%)

-

Liquids: ~20,000 Boe/d (50% of total)

-

NGLs: ~12,800 Boe/d (calc: liquids 20,000 − oil 7,200)

-

-

Gas: ~20,000 Boe/d (remainder) → ~120 MMcf/d (calc: 20,000 × 6)

Implied valuation snapshots

-

$ / flowing Boe/d: ~$32,500 (1,300 / 40,000)

-

$ / flowing liquids Boe/d: ~$65,000 (1,300 / 20,000)

-

$ / flowing oil bbl/d (oil-only): ~$180,556 (1,300 / 7,200)

-

$ / net acre: ~$5,000 (1,300 / 260,000)

-

$ / 2P location: ~$778,000 per net (1,300 / 1,670) • ~$206,000 per gross (1,300 / 6,300)

All dollar figures in billions/millions where appropriate; production conversions use 6 Mcf/Boe. Calculations rounded.

Why it makes sense (deal lens)

-

Portfolio focus: Monetizes a sizeable, multi-county position outside COP’s highest-return core while preserving balance sheet capacity for core basin capital (and/or shareholder returns).

-

Buyer’s angle: Large, contiguous footprint with scale (260k net acres), meaningful running room (1,670 net 2P), and established multi-bench exposure across the Anadarko—plus existing midstream and service depth in those counties.

Recent Deals/Transactions

| Date Annouced | Category | Headline | Buyer(s) | Seller(s) | Value ($mm) |

|---|---|---|---|---|---|

| 09/02/2025 | E&P | Crescent Energy Acquires Vital |

|

|

|

| 07/10/2025 | E&P | Mach Resources Buys San Juan Gas Asset for $787 Million |

|

|

|

| 07/10/2025 | E&P | Mach Enters Permian Basin, Buys PE_backed Sabinal Assets for $500 Million |

|

|

|

| 06/05/2025 | E&P | Vermillion Energy Exits US, Sells Power River Basin Asset |

|

|

|

| 05/30/2025 | E&P | EOG Acquires Utica Liquids Focus Encino For $5.6 Billion |

|

|

|

| 05/13/2025 | E&P | TXO Partners Acquires White Rock Assets in the Elm Coulee Field |

|

|

|

| 05/07/2025 | E&P | Permian Resources Bolt-On Assets From APA Corp |

|

|

|

| 05/03/2025 | E&P | Riley Permian Acquires PE-Backed Silverback II For $142million |

|

|

|

| 04/22/2025 | E&P | EQT Acquires Olympus Energy Assets For $1.8 Billion |

|

|

|

| 04/01/2025 | E&P | TG Natural Resources Acquires Interest in Chevron’s Haynesville Asset |

|

|

|

| Total |

|