Drilling & Completions | Quarterly / Earnings Reports | Third Quarter (3Q) Update | Financial Results | Capital Markets | Capital Expenditure

Baytex Energy Third Quarter 2020 Results

Baytex Energy Corp. reported its Q3 2020 results (all amounts are in Canadian dollars unless otherwise noted).

Ed LaFehr, President and Chief Executive Officer, said: "We have made tremendous progress to re-set our business in the face of extremely volatile crude oil markets. Our third quarter results demonstrate the success of our actions as we generated free cash flow of $60 million and increased financial liquidity to $344 million. I am also especially pleased with our response to the Covid pandemic with intensified efforts to improve all aspects of our cost structure and capital efficiencies, while protecting the health and safety of our personnel."

Q3 2020 Highlights:

- Generated production of 77,814 boe/d (82% oil and NGL) in Q3/2020 and 82,907 boe/d (82% oil and NGL) for the first nine months of 2020.

- Delivered adjusted funds flow of $79 million ($0.14 per basic share) in Q3/2020 and $229 million ($0.41 per basic share) for the first nine months of 2020.

- Generated free cash flow of $60 million ($0.11 per basic share) in Q3/2020 and $16 million ($0.03 per basic share) for the first nine months of 2020.

- Realized an operating netback of $17.05/boe in Q3/2020, up from $5.96/boe in Q2/2020.

- Reduced net debt by $89 million during the third quarter through a combination of free cash flow and the Canadian dollar strengthening relative to the U.S. dollar.

- Maintained undrawn credit capacity of $426 million and liquidity, net of working capital, of $344 million.

2020 Outlook and Revised Guidance

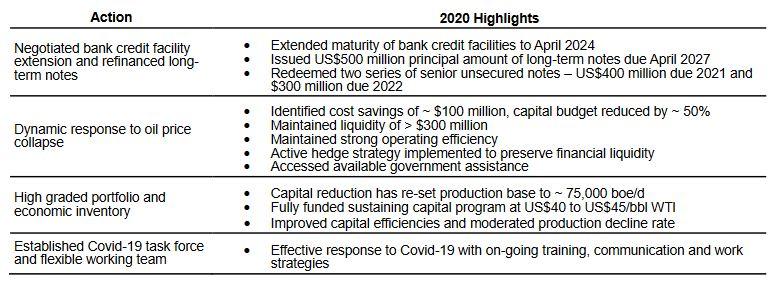

We have responded aggressively to the downturn brought on by Covid-19 as we minimize capital spending, identify cost savings and maintain our liquidity.

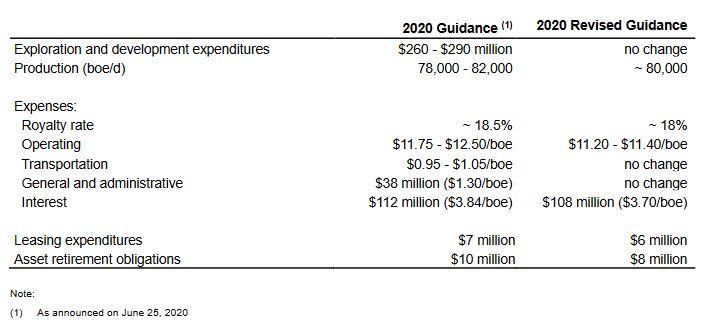

We expect production to average approximately 80,000 boe/d, which represents the mid-point of our guidance range of 78,000 to 82,000 boe/d. Annual capital spending is forecast to be $260 to $290 million, an approximate 50% reduction from our original plan of $500 to $575 million.

We are also reducing our full-year 2020 operating expense guidance by 7% (at the mid-point) to $11.20 to $11.40/boe. We remain intensely focused on driving further efficiencies to capture and sustain cost reductions identified during this downturn, while protecting the health and safety of our personnel.

After two quarters of little to no capital spending in Canada, we have resumed drilling activity during the fourth quarter. We have mobilized two drilling rigs to execute a 30-well drilling program in the Viking and completed two Duvernay wells drilled earlier this year. In addition, with the increase in natural gas prices, we have identified opportunities in west-central Alberta at Pembina O'Chiese to drill natural gas wells with strong economics and capital efficiencies and have two wells planned for this winter.

The following table summarizes our updated 2020 guidance. We are in the process of setting our 2021 capital budget, the details of which are expected to be released in December following approval by our Board of Directors.

During the third quarter we began to benefit from our actions to reduce capital, capture cost savings and maintain liquidity. We generated free cash flow of $60 million during the quarter and $16 million through the first nine months of this year and also increased our financial liquidity to $344 million.

The following table summarizes the important measures we have undertaken to position us for success as markets recover.

Q3/2020 Results

Production during the third quarter averaged 77,814 boe/d (82% oil and NGL), as compared to 72,508 boe/d (81% oil and NGL) in Q2/2020. The higher production reflects the re-start of previously shut-in volumes in Canada, partially offset by lower activity in the Viking and Eagle Ford. Our third quarter production was reduced by approximately 5,000 boe/d due to voluntary shut-ins. Exploration and development spending totaled a modest $16 million during the third quarter.

We delivered adjusted funds flow of $79 million ($0.14 per basic share) in Q3/2020 and generated an operating netback of $17.05/boe ($15.69/boe inclusive of realized financial derivatives loss). The Eagle Ford generated an operating netback of $18.99/boe and our Canadian operations generated an operating netback of $15.90/boe.

We continue to emphasize cost reductions across all facets of our organization. Through the first nine months of 2020 our team has driven operating costs down to $11.08/boe, despite lower production volumes. This compares favorably to our guidance range of $11.75 to $12.50/boe. As a result, we are reducing our full-year 2020 operating expense guidance by 7% (at the mid-point) to $11.20 to $11.40/boe.

Eagle Ford and Viking Light Oil

Production in the Eagle Ford averaged 28,650 boe/d (77% oil and NGL) during Q3/2020, as compared to 34,817 boe/d in Q2/2020. The lower volumes reflect reduced completion activity as we adjusted our development plan in response to volatile commodity prices. We commenced production from six (0.8 net) wells during the third quarter, as compared to 47 (10.7 net) in the first half of 2020. Activity in the Eagle Ford has recently resumed and we have 0.75 net drilling rigs and 0.5 net frac crews running on our lands. We expect to bring approximately 16 net wells on production in the Eagle Ford in 2020.

Production in the Viking averaged 18,774 boe/d (91% oil and NGL) during Q3/2020, as compared to 19,717 boe/d in Q2/2020. We had previously suspended all drilling in the Viking, and as such, there was limited activity during the third quarter. In the first nine months of 2020, we invested $77 million on exploration and development in the Viking and commenced production from 83

(78.5 net) wells. After two quarters of minimal capital spend, we have resumed drilling activity in the Viking with two drillings rigs mobilized to execute a 30-well drilling program during the fourth quarter.

Heavy Oil

Our heavy oil assets at Peace River and Lloydminster produced a combined 24,791 boe/d (89% oil and NGL) during the third quarter, as compared to 13,082 boe/d in Q2/2020. The increased production reflects the re-start of previously shut-in production as operating netbacks improved. The quarterly impact of voluntary shut-ins for heavy oil was approximately 5,000 boe/d, down from 17,000 boe/d in Q2/2020. We currently have approximately 2,000 boe/d of heavy oil production shut-in. We had previously suspended all heavy oil drilling, and as such, there was limited activity during the third quarter. In the first nine month of 2020, we invested $41 million on exploration and development and drilled 33 (33.0 net) wells.

Pembina Area Duvernay Light Oil

Production in the Pembina Duvernay averaged 1,474 boe/d (79% oil and NGL) during Q3/2020, as compared to 717 boe/d in Q2/2020. The increased production during the third quarter reflects the re-start of previously shut-in production as operating netbacks improved.

In Q1/2020, we drilled two wells in the core of our Pembina acreage, bringing total wells drilled to nine in this area. These two wells were fracture stimulated in October using a "plug and perf" system with fracture diversion technology. The wells are scheduled to be placed on production in November. The two wells confirm visibility to a $7.0 million well cost in a full development scenario. The success of our drilling program in the Pembina area has significantly de-risked our approximately 38-kilometre long acreage fairway, where we hold 232 sections (100% working interest) of Duvernay land.

Financial Liquidity

Our credit facilities total approximately $1.07 billion and have a maturity date of April 2, 2024. These are not borrowing base facilities and do not require annual or semi-annual reviews. As of September 30, 2020, we had $426 million of undrawn capacity on our credit facilities, resulting in liquidity, net of working capital, of $344 million. In addition, our first long-term note maturity of US$400 million is not until June 2024.

Our net debt, which includes our credit facilities, long-term notes and working capital, totaled $1.9 billion at September 30, 2020, down from $2.0 billion at June 30, 2020. Based on the forward strip, we expect to maintain our financial liquidity and remain onside with our financial covenants.

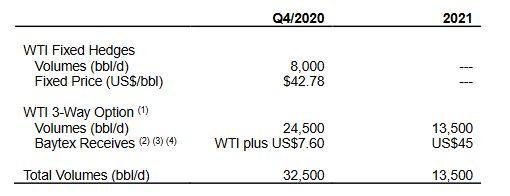

Hedges

For Q4/2020, we also have WTI-MSW basis differential swaps for 5,000 bbl/d of our light oil production in Canada at US$6.15/bbl and WCS differential hedges on 6,500 bbl/d at a WTI-WCS differential of US$16.27/bbl.

We also have WTI-MSW differential hedges on approximately 40% of our expected 2021 Canadian light oil production at US$5.17/bbl and WCS differential hedges on approximately 45% of our expected 2021 heavy oil production at a WTI-WCS differential of approximately US$13.50/bbl.

NYSE Delisting

On March 24, 2020 we received notice from the New York Stock Exchange ("NYSE") that Baytex was no longer in compliance with one of the NYSE's continued listing standards because the average closing price of Baytex's common shares was less than US$1.00 per share over a consecutive 30 trading period. At this time, Baytex has not regained compliance and expects that its common shares will be delisted from the NYSE on December 3, 2020. This will not affect Baytex's business operations and will not affect the continued listing and trading of Baytex's common shares on the Toronto Stock Exchange. Currently, over 80% of the daily trading in Baytex common shares occurs in Canada, ensuring investors will retain significant trading liquidity going forward. In addition, Baytex expects to realize significant cost savings over time as a result of the delisting.

DRIP Termination

Baytex is formally terminating its dividend reinvestment plan ("DRIP"). All participants (as defined in the DRIP) effective as of the termination date, will be issued a certificate for any common shares and a cheque for any cash balance remaining in the participants' account pursuant to the terms of the plan.

Related Categories :

Third Quarter (3Q) Update

More Third Quarter (3Q) Update News

-

Evolution Petroleum Corporation Fiscal Third Quarter 2023 Results

-

Civitas Resources Third Quarter 2022 Results

-

Murphy Oil Third Quarter 2022 Results

-

ConocoPhillips Third Quarter 2022 Results

-

California Resources Third Quarter 2022 Results

Canada News >>>

-

Topaz Energy Expands Montney Royalty Footprint -

-

Why Surface-Only Inventory Predictions Are a Fool’s Errand

-

OPEC+ Nudges Supply Higher: Why This Weekend’s Hike Echoes 2020—But Isn’t 2020

-

SM Energy Hits Record Output; Driven by Uinta

-

Refracs That Compete: Eagle Ford Wells Return to Life

Gulf Coast News >>>

-

Large Cap E&P To Reduce Drilling & Completion Activity in 2026 -

-

Liberty Energy: Navigating the Frac Downturn with Efficiency, Innovation, and Strategic Focus -

-

Baker Hughes Solid Y/Y Performance Amidst US Frac Market Slowdown -

-

Halliburton Warns of Deepening U.S. Frac Slowdown -

-

PE Firm Seeds Four New E&P Startups in Strategic Push In 2025 -