Exploration & Production | People | Quarterly / Earnings Reports | Second Quarter (2Q) Update | Oil Sands | Forecast - Production | Oil Sands Projects | Job Cuts / Downsize / Layoff | Capital Markets | Capital Expenditure

Cenovus Cutting Further Costs, Employees

Cenovus has announced second quarter 2015 results.

Strategic Update

- On track to achieve approximately $280 million in 2015 cost reductions, 40% greater than initially targeted

- Targeting between 300 and 400 job reductions in Calgary in second half of 2015

- Third quarter dividend reduction of 40%; temporary discount on Dividend Reinvestment Plan (DRIP) discontinued

- Priority focus on expanding existing oil sands projects but at a more moderate pace of growth than in the past

- Investment in deferred oil sands expansions being considered for 2016

Cost Reductions

- Cenovus continues to make solid progress attacking cost structures across the entire company to reduce its spend and create sustainable cost improvements. The company previously announced a target of $200 million in upstream operating, capital and G&A cost savings for 2015, which were largely achieved within the first six months of the year. As a result, the company is increasing its cost-cutting expectation for 2015 to approximately $280 million, 40% higher than its initial target.

- Part of the company's cost-cutting efforts has focused on workforce. In February, Cenovus announced initial plans to reduce its workforce by approximately 800 positions to align with capital budget reductions for the year. The company has since identified 300 to 400 positions at its Calgary offices that are expected to be eliminated before the end of 2015. These positions are no longer required because of a decrease in work due to the continued low oil price environment. Cenovus also intends to review the company's compensation, benefits and time-off practices to ensure they align with current and anticipated market conditions. The cost savings associated with these additional workforce efficiencies are expected to be at least $100 million annually. Because the full impact of these workforce savings is still being finalized and will likely be more evident in 2016, they have not been included in the company's $280 million overall cost-reduction target for this year.

- Cenovus is also planning for additional staff reductions at its field operations in early 2016, as the company continues to identify even greater workforce efficiencies. Details of these additional reductions will be provided at a later date.

Capital Allocation:

- Cenovus anticipates that 2015 capital spending will remain within its previously announced guidance of $1.8 billion to $2.0 billion.

- In its first five years of operations, the company generated a compound annual production growth rate of 24% from its jointly owned Foster Creek and Christina Lake oil sands projects. In response to the company's expectations for a continued low oil-price environment, Cenovus is taking a more moderate and staged approach to expanding these assets. Rather than pursuing multiple major construction projects at the same time, the company will consider expanding existing projects and developing emerging opportunities only when it believes it can do so with the greatest efficiency and cost savings, while generating the greatest potential return for shareholders. The company is no longer targeting to achieve 500,000 barrels per day (bbls/d) of net oil production by 2021.

For the remainder of 2015, Cenovus's capital investment priorities are:

- Sustaining existing oil sands production

- Completing the ongoing Foster Creek phase G expansion

- Completing the ongoing Christina Lake optimization and phase F expansion

- These projects remain on schedule and are expected to add approximately 100,000 bbls/d of incremental gross production capacity (50,000 bbls/d net) by the end of 2016, an increase of about 25% to the company's current total crude oil production volumes once the phases are at full operational capacity.

- For 2016, Cenovus is considering investing capital in additional expansion projects that were deferred earlier this year. With considerable strength on its balance sheet and the sustained reductions already achieved, the company has the financial capability to resume those projects when it feels the timing is right. Those investment decisions would be based on oil price stability, continued balance sheet strength, the company's ongoing cost-cutting success as well as fiscal and regulatory certainty. Cenovus is allocating between $25 million and $30 million for the remainder of 2015 to prepare for the possibility of construction resuming on some of these projects next year.

- Once a decision is made to proceed, Cenovus's priority would be to allocate capital to re-start construction at its deferred Christina Lake phase G and Foster Creek phase H expansions.The next priority would be to resume work at the Narrows Lake oil sands project. These projects have the ability to provide top-tier returns.

- As with its oil sands operations, Cenovus is also taking a more moderate approach to investing in its conventional oil opportunities, with a focus on drilling projects that are considered to be relatively low risk, with short production cycle times and expected returns well in excess of the company's internal hurdle rate of 15%.

- As part of this strategy, Cenovus is currently directing capital to resume drilling at the company's tight oil projects in southeast Alberta, where it has experienced success in recent years, and at its Weyburn enhanced oil recovery project in Saskatchewan, which benefits from strong netbacks and returns at current prices.

- Cenovus has allocated $70 million, activating three rigs, to resume its conventional drilling program in the third quarter. The company has no plans to allocate additional capital to its Pelican Lake or other conventional projects this year.

- Cenovus continues to believe in the long-term potential of its emerging projects, including Telephone Lake and Grand Rapids. At this time though, plans for development of these projects have been deferred, as the company continues to work on new technology and process improvements that are expected to further reduce capital and operating costs for those assets.

- The company expects to provide further clarity around its capital investment plans when it releases its 2016 budget in December.

M&A:

- During the quarter, Cenovus announced an agreement to sell Heritage Royalty Limited Partnership (HRP), a wholly owned subsidiary holding the company's royalty and fee land business. Included in the agreement were associated royalties on third-party interest volumes and on Cenovus's working interest production as well as a Gross Overriding Royalty (GORR) on the company's Pelican Lake and Weyburn production. The sale, which closed on July 29, 2015, generated gross cash proceeds of $3.3 billion, with an expected after-tax gain of approximately $1.9 billion, to be recorded in the third quarter.

- On June 4, 2015, Cenovus announced an agreement to purchase a crude-by-rail trans-loading facility located in Bruderheim, Alberta for approximately $75 million. The purchase supports the company's strategy of increasing transportation options to maximize access to global markets where it expects to capture higher prices for its oil. The transaction is expected to close August 31, 2015, subject to certain conditions.

- Cenovus maintains an active portfolio management program, continuously assessing both acquisition and divestiture opportunities. As part of its strategy to add shareholder value, the company continues to look for opportunities to crystallize additional value from its conventional portfolio, as it did with the HRP sale. Cenovus's conventional oil and natural gas assets have historically provided reliable cash flow, well in excess of their capital investment requirements, to fund the company's oil sands expansions. As production from the oil sands assets grows and they contribute increasing free cash flow, the strategic value of some of its conventional assets has become less important than in previous years.

- While Cenovus continues to believe in the value of its integrated strategy, which includes its refineries, the company has no pending plans to invest in additional downstream assets. It would consider a downstream acquisition only if it offers compelling value and strategic fit, as was identified with the recent Bruderheim rail facility transaction.

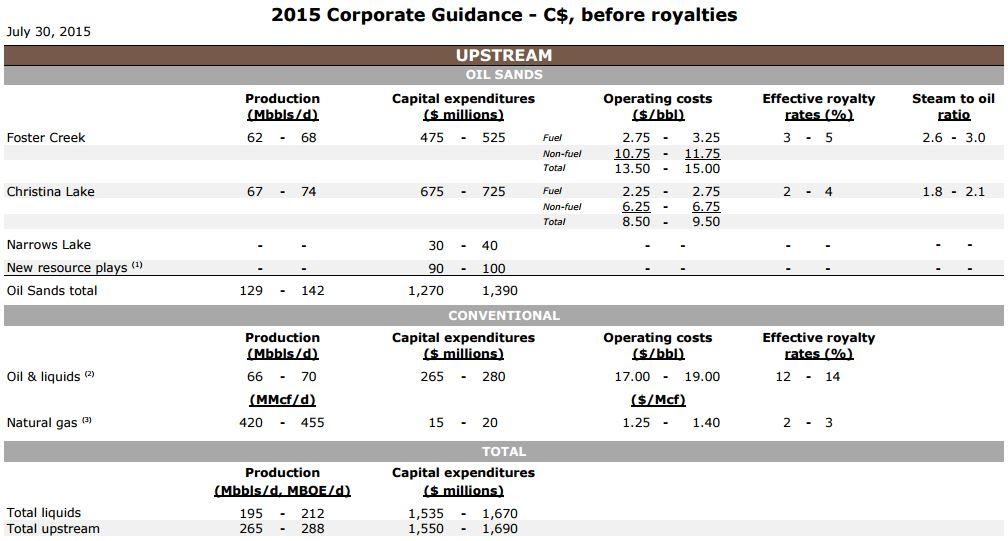

Guidance updated

- Cenovus has updated its 2015 full-year guidance to reflect actual results for the first six months of the year and the company's estimates for the third and fourth quarter. The company's 2015 capital budget remains unchanged at $1.8 billion to $2.0 billion.

Related Categories :

Canada News >>>

-

Topaz Energy Expands Montney Royalty Footprint -

-

Vermillion Closes Saskatchewan Asset Sale -

-

MEG Energy Rejects Strathcona Resources' $6 Billion Takeover Offer

-

Large Permian E&P Cuts Capex;Outlines New D&C Plans, 2024

-

Petrus Resources Ltd. First Quarter 2023 Results

4.jpg&new_width=60&new_height=60&imgsize=false)

6.jpg&new_width=60&new_height=60&imgsize=false)