Drilling & Completions | Quarterly / Earnings Reports | Third Quarter (3Q) Update | Financial Results | Capital Markets | Capital Expenditure

Cimarex Energy Third Quarter 2020 Results

Cimarex Energy Co. reported its Q3 2020 results

Highlights:

- Generated Net Cash Provided by Operating Activities of $259 million

- Generated $139 million of free cash flow after dividend (Non-GAAP)

- Invested $83 million in the quarter

- Oil production averaged 71,600 barrels per day

Cimarex reported a third quarter 2020 net loss of $292.7 million, or $2.94 per share, compared to net income of $123.8 million, or $1.21 per share, in the same period a year ago. Third quarter results were negatively impacted by non-cash charges related to the impairment of oil and gas properties. Third quarter adjusted net income (non-GAAP) was $52.4 million, or $0.51 per share, compared to third quarter 2019 adjusted net income (non-GAAP) of $96.0 million, or $0.94 per share1. Net cash provided by operating activities was $259.2 million in the third quarter of 2020 compared to $320.1 million in the same period a year ago. Adjusted cash flow from operations (non-GAAP) was $236.7 million in the third quarter of 2020 compared to $360.7 million in the third quarter a year ago1.

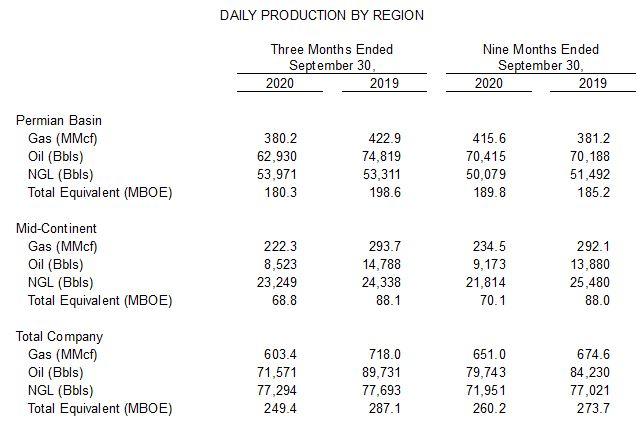

Oil production averaged 71.6 thousand barrels (MBbls) per day. Total company production volumes for the quarter averaged 249.4 thousand barrels of oil equivalent (MBOE) per day.

Realized oil prices averaged $37.94 per barrel, up 94 percent from $19.57 in the previous quarter but down 28 percent from the $52.71 per barrel received in the third quarter of 2019. Realized natural gas prices averaged $1.14 per thousand cubic feet (Mcf), up 25 percent sequentially from $0.91 per Mcf and up 30 percent from the third quarter 2019 average of $0.88 per Mcf. NGL prices averaged $10.89 per barrel, up 45 percent from $7.52 per barrel in the second quarter of 2020 and up one percent from the $10.80 barrel received in the third quarter of 2019.

Cimarex's realized oil price was a negative differential to WTI of $2.99 per barrel in the quarter down from $8.28 per barrel in the previous quarter, with a negative oil price differential in the Permian of $2.71 per barrel in the third quarter, down sequentially from $8.12 per barrel. The company realized a negative differential to Henry Hub on its Permian natural gas production of $1.15 per Mcf in the third quarter of 2020 compared to $1.83 per Mcf in the third quarter of 2019 and $1.09 in the second quarter of 2020. In the Mid-Continent region, the company's average negative differential to Henry Hub was $0.31 per Mcf versus $0.66 per Mcf in the third quarter of 2019 and $0.31 per Mcf in the second quarter of 2020.

Cimarex invested a total of $83 million during the quarter, of which $52 million was attributable to drilling and completion activities and $3 million to saltwater disposal assets. Third quarter investments were funded with cash flow from operating activities. Total debt at September 30, 2020 consisted of $2.0 billion of long-term notes, with no debt maturities until 2024. Cimarex had no borrowings under its revolving credit facility and a cash balance of $273 million at quarter end.

The company has reduced staff by 20 percent year to date through a combination of an Early Retirement Program (ERIP), further staff reductions completed in the third quarter, and attrition. Cimarex has incurred $31 million in severance expenses year to date, of which $15 million was expensed in the third quarter. Cost savings are expected to total $40-50 million annually, beginning in 2021.

Outlook

Improved oil prices in the third quarter allowed Cimarex to resume activity. We are currently running four drilling rigs in the Permian basin and have had two completion crews working since September 1. Cimarex continues to expect capital investment for the year to total approximately $600 million, as stated in guidance given in August.

Fourth quarter 2020 production volumes are expected to average 215 - 235 MBOE per day, with oil volumes estimated to average 62.5 - 68.5 MBbls per day. Total 2020 daily production volumes are expected to average 250 - 255 MBOE per day, with annual oil volumes estimated to average 75.5 - 77.5 MBbls per day.

Operations Update

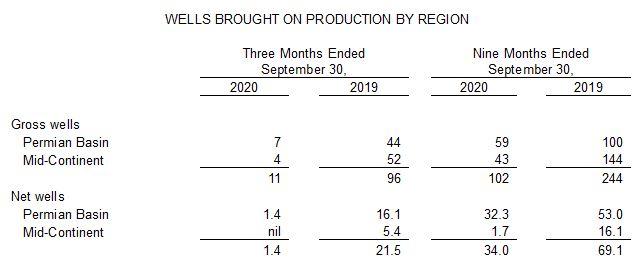

Cimarex invested $83 million during the third quarter, with 95 percent invested in the Permian Basin and 5 percent in the Mid-Continent. Cimarex brought 11 gross (1.4 net) wells on production during the quarter. At September 30, 74 gross (39.0 net) wells were waiting on completion.

Permian Region

Production from the Permian region averaged 180.3 MBOE per day in the third quarter, a nine percent decrease from third quarter 2019. Oil volumes averaged 62.9 MBbls per day, a 16 percent decrease from third quarter 2019 and down nine percent sequentially.

Cimarex brought 7 gross (1.4 net) wells on production in the Permian region during the third quarter. There were 51 gross (38.7 net) wells waiting on completion at September 30. Cimarex currently is operating four drilling rigs and two completion crews in the region.

Mid-Continent Region

Production from the Mid-Continent averaged 68.8 MBOE per day for the third quarter, down 22 percent from third quarter 2019 and in line with the previous quarter.

During the third quarter, 4 gross (nil net) wells were brought on production in the Mid-Continent region. At the end of the quarter, 23 gross (0.3 net) wells were waiting on completion. Cimarex currently is not operating drilling rigs or completion crews in the Mid-Continent.

Cimarex's average daily production and commodity price by region is summarized below:

Related Categories :

Third Quarter (3Q) Update

More Third Quarter (3Q) Update News

-

Evolution Petroleum Corporation Fiscal Third Quarter 2023 Results

-

Civitas Resources Third Quarter 2022 Results

-

Murphy Oil Third Quarter 2022 Results

-

ConocoPhillips Third Quarter 2022 Results

-

California Resources Third Quarter 2022 Results

Mid-Continent News >>>

-

PE Firm Seeds Four New E&P Startups in Strategic Push In 2025 -

-

Schlumberger Shows Steady Resilience Amid Market Volatility -

-

Coterra’s Strategic Pivot: Realigning Rig Activity and Capital Deployment in 2025 -

-

Gulfport Touts Super Long Lateral and Strategic Pivot To Gas Asset

-

Coterra Energy – 2025 Development Summary -

Mid-Continent - Anadarko Basin News >>>

-

Oilfield Service Report : 11 New Leads/Company Formation & Contacts

-

Civitas Provides Update on Current Rigs & Frac Crews -

-

New E&P Company Just Raised $2.0 Billion, Hunting for Assets.

-

New Comapny : New Permian E&P Secures Funds From Large PE-Firm

-

IOG forms Partnership with PE-Firm First Reverse To Fund DrillCo's -