Exploration & Production | Production Rates | Forecast - Production | Hedging | Capital Markets | Drilling Program

Crescent Point Completes First Viewfield Bakken Waterflood

Crescent Point Energy Corp. has announced its operating and financial results for the quarter ended March 31, 2015.

First Quarter 2015 Highlights

- Crescent Point achieved average production of 153,854 boe/d in the quarter, which was weighted 91 percent to light and medium crude oil and liquids. This represents an increase of 18 percent, or more than 23,000 boe/d, over first quarter 2014.

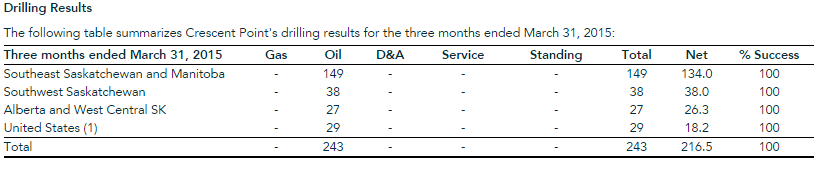

- During the quarter, the Company spent $496.2 million on drilling and development activities, drilling 243 (216.5 net) wells with a 100 percent success rate. Crescent Point also spent $60.6 million on land, seismic and facilities, for total development capital expenditures of $556.8 million.

- First quarter netbacks of $35.01 per boe were strong relative to average selling prices of $44.32 per boe, partly due to the Company's conservative hedging program.

- Crescent Point continued to hedge its oil production to protect its cash flow and balance sheet. As at April 30, 2015, the Company had hedged 58 percent of its oil production, net of royalty interest, for the remainder of 2015 at a weighted average price of greater than CDN$88.00/bbl and 34 percent for 2016 at a weighted average price of greater than CDN$83.00/bbl.

- Crescent Point has announced that it has finalized negotiations and successfully completed the unitization of its first waterflood unit in the Viewfield Bakken resource play. Completion of Viewfield Bakken Voluntary Unit #1 (the "Stoughton Unit") is expected to allow Crescent Point to accelerate its waterflood program over the coming years and to expand the Stoughton Unit waterflood project. Unitization also increases the amount of reservoir and production that can be positively impacted by waterflood. Crescent Point has a 100 percent working interest in the Stoughton Unit and continues to move forward with the unitization of three more units in the Viewfield Bakken.

- Crescent Point continues to advance its emerging growth plays in both the Uinta Basin and Flat Lake. Due to recent encouraging results from its operated horizontal wells in the Douglas Creek and Wasatch zones in the Uinta Basin, the Company is planning to drill additional horizontal wells in the Uinta Basin to follow up on this success. In addition, the Company is planning additional step-out wells in Flat Lake during 2015 due to strong results from recent wells.

- As previously announced, Crescent Point increased its syndicated credit facility in the quarter by 40 percent from $2.5 billion to $3.5 billion. Including the Company's $100 million revolving term operating facility, Crescent Point's total bank line increased to $3.6 billion. At March 31, 2015, approximately $1.9 billion, or 53 percent of current capacity, was drawn on these facilities. This increase in credit capacity provides a significant unutilized source of capital and financial flexibility to the Company, which is increasingly valuable in the current oil price environment. Crescent Point remains committed to maintaining a financially strong organization with a conservative balance sheet.

- Subsequent to the quarter, the Company closed a private placement of long-term debt in the form of senior guaranteed notes to a group of institutional investors in order to continue to add to its near-term liquidity. The notes issued pursuant to the placement are unsecured and rank equally with Crescent Point's obligations under its bank facilities. In total, US$250.0 million and CDN$65.0 million was raised through three separate series of notes at fixed coupon rates ranging from 3.94 percent to 4.18 percent and maturities of 10 to 12 years. Proceeds from the placement were used to reduce the Company's outstanding bank line following the end of the quarter.

Operations Review

First Quarter Operations Summary

- Crescent Point achieved record daily average production of 153,854 boe/d, which represents an increase of 18 percent, or more than 23,000 boe/d, over first quarter 2014. The Company's production performance during the quarter was driven by its successful development program, the Company's ongoing waterflood success and continued strong results from its cemented liner completion techniques.

- In first quarter, Crescent Point finalized negotiations with freehold royalty interest owners and successfully completed the unitization of its first waterflood unit in the Viewfield Bakken resource play. The Stoughton Unit received technical approval from the Government of Saskatchewan in first quarter 2014 and Crescent Point completed unitization as of April 1, 2015. Completion of the unit is expected to allow Crescent Point to accelerate its waterflood program over the coming years and to expand the Stoughton Unit waterflood project beyond Crown lands onto freehold lands. Unitization also increases the amount of reservoir and production within the Stoughton Unit that can be positively impacted by waterflood. Crescent Point has a 100 percent working interest in the Stoughton Unit, which encompasses 27 net sections in the heart of the Viewfield Bakken resource play. This unit has the potential for approximately 105 water injection wells, of which 50 percent are expected to be converted by year-end. Crescent Point continues to move forward with the unitization of three more Viewfield Bakken units, spanning approximately an additional 170 net sections of land.

- Waterflood application to the Viewfield Bakken resource play is expected to continue to lower decline rates in the play and to increase expected recovery factors. Based on results to date, the Company estimates it has reduced decline rates by up to 10 percent in waterflood-affected areas in the Viewfield Bakken resource play, compared to areas not under waterflood. Unitization, coupled with the recent utilization of the new closeable sliding sleeve technology, allows for the potential to increase the efficiency and productivity of the Company's waterflood programs.

Southeast Saskatchewan and Manitoba

- In first quarter, Crescent Point continued to successfully execute its capital program in southeast Saskatchewan and Manitoba. Successful results in the Company's core Viewfield Bakken and Flat Lake Torquay resource plays continue to be strong drivers of Crescent Point's production growth.

- During first quarter, Crescent Point drilled 87 (86.0 net) oil wells in the Viewfield Bakken resource play. The Company continues to refine its completion techniques while also expanding its waterflood program, supporting its strategy of optimizing returns and free cash flow in the Viewfield Bakken play. The new closable sliding sleeve technology was successfully deployed during the drilling and completion of 29 wells. Going forward, the Company expects to fully deploy this technology in all cemented liner completions in the Viewfield Bakken play.

- The Company is pleased with drilling results to date in the Torquay play at Flat Lake, having drilled 20 (20.0 net) oil wells during the quarter. The Company's 2015 drilling program in Flat Lake continues to be focused on low-risk development opportunities coupled with step-out drilling to further delineate the area. Based on encouraging results that came on production early in first quarter, the Company is planning additional step-out wells during 2015 to build on this success.

- The Company drilled 42 (28.0 net) oil wells in other areas of southeast Saskatchewan and Manitoba during the quarter. Crescent Point's conventional and unconventional inventory in southeast Saskatchewan and Manitoba continues to provide the Company with a source of low-risk, high-netback drilling inventory to generate strong future cash flows.

Southwest Saskatchewan

- Crescent Point continued to expand its waterflood program in the Shaunavon resource play during first quarter. The Company currently has 45 water injection wells operating in the Shaunavon play and is targeting a total of 76 by year-end 2015. Based on results to date, the Company estimates it has reduced decline rates by more than 10 percent in waterflood-affected areas in the play, compared to areas not under waterflood.

- During first quarter, the Company drilled 38 (38.0 net) oil wells in the Shaunavon resource play. The new closeable sliding sleeve technology was successfully deployed during the drilling and completion of 31 wells. Going forward, the Company expects to use this new technology in all future cemented liner completions in the Shaunavon resource play. The Company continues to refine its completion technology in the Shaunavon, with positive production response.

Alberta and West Central Saskatchewan

- During the quarter, the Company continued its drilling program in the Dodsland area in the Saskatchewan Viking play, drilling 24 (23.5 net) oil wells and achieving a 100 percent success rate. Crescent Point is pleased with production results to date, as wells have been coming on production at, or better than, forecasted rates. For 2015, the Company plans to drill 137 net oil wells in the Saskatchewan Viking, which compares to 30.8 net oil wells drilled in 2014. This increased activity reflects the acquisition of assets from Polar Star Oil and Gas Inc. during mid-2014, as well as higher allocation in the 2015 budget due to the low-cost, high-return nature of the play.

- Crescent Point and its partner expanded their first waterflood pilot in the Beaverhill Lake play in first quarter 2015. The Company has also received regulatory approval for its first operated waterflood pilot in the play. Water injection is expected to begin in second quarter 2015.

United States

- During first quarter, the Company participated in the drilling of 25 (16.1 net) oil wells in the Uinta Basin, achieving a 100 percent success rate.

- Crescent Point continues to be pleased with results to date in the Uinta Basin, in which it has accumulated a land position of more than 189,000 net acres. Since entering the play in late 2012, the Company has grown proved plus probable reserves by 58 percent as of year-end 2014, and production from approximately 7,800 boe/d to over 15,000 boe/d, as of first quarter 2015. The Company remains very excited about the future opportunity in the Uinta Basin, which is a multi-zone, stacked play that is in the early stages of horizontal development. The Company is pleased to announce that its operated Douglas Creek and Wasatch horizontal wells were successful and is very encouraged with results to date. Industry peers have also successfully completed horizontal wells with encouraging initial production results in various zones, including the Wasatch, Uteland Butte and Castle Peak zones. Based on the success and learnings from horizontal wells in these four zones, the Company plans to drill additional horizontal wells during 2015.

- The Company is in the final stages of processing data from its operated 3-D seismic program, covering approximately 140 square miles, primarily in the Randlett area. Crescent Point expects to receive final data during early second quarter. The interpretation of this data will be used to help Crescent Point optimize the development of its operated lands.

- During 2014, Crescent Point also received state regulatory approval for a second waterflood injection pilot in the Randlett area of the Uinta Basin. Water injection in both pilots is expected to begin in 2016.

- During first quarter, the Company also participated in the drilling of 4 (2.2 net) oil wells in North Dakota, targeting both the Bakken and Three Forks formations. The Company is encouraged with results to date in both formations.

- Since the start of first quarter 2015, Crescent Point has seen significant capital and drilling cost reductions in both the Uinta Basin and North Dakota resource plays. Increased market access for Uinta Basin crude has also improved realized pricing, further enhancing economics in the area.

Outlook

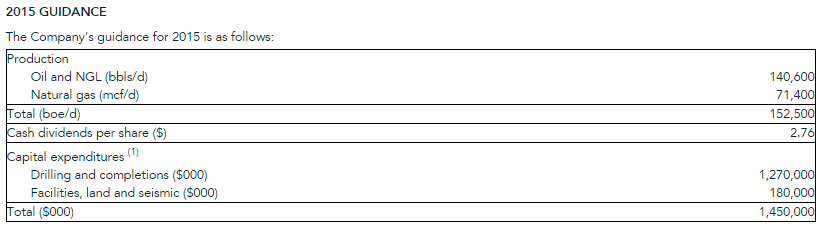

- Crescent Point has had an excellent start to 2015 and is well positioned to achieve its annual production target of 152,500 boe/d. The Company continues to maintain various levers to manage potential fluctuations in commodity prices and expects to revisit its current $1.45 billion budget in third quarter.

- Crescent Point continues to pursue a concentrated effort to improve its overall capital efficiencies through a combination of operating efficiencies and cost reductions with its vendor partners. Significant progress has been realized to date, with a continued goal of realizing 30 percent improvements relative to 2014. Cost reductions in various areas such as hydraulic fracturing, hauling, chemicals and service rigs are a few examples where the Company has realized savings. These savings provide the Company with additional financial and operational flexibility.

- As part of its overall risk management strategy, Crescent Point continues to actively hedge its oil production. As at April 30, 2015, the Company had hedged 58 percent of its oil production, net of royalty interest, for the remainder of 2015 at a weighted average price of greater than CDN$88.00/bbl and 34 percent for 2016 at a weighted average price of greater than CDN$83.00/bbl. The Company's oil and gas hedge books extend into 2018 at attractive prices. Realized prices during second quarter 2015 are expected to be higher than those realized during first quarter 2015 due to a combination of stronger benchmark commodity prices and narrower corporate differentials.

- The Company increased its syndicated credit facility by 40 percent, or $1.0 billion, for total bank credit capacity of $3.6 billion. This substantial increase in financial flexibility is increasingly important given the current low oil price environment. The Company also closed a private placement of senior guaranteed notes subsequent to quarter end for a total of US$250.0 million and CDN$65.0 million. The senior notes have maturities in 2025 and 2027 and carry fixed coupon rates ranging from 3.94 percent to 4.18 percent. Proceeds from this note offering were used to reduce outstanding bank indebtedness following the end of the quarter.

- "Our commitment to a strong balance sheet, our active hedging program and our high-quality asset base continue to position us well to grow our business and protect our dividend over the long term. We expect our payout ratio, which temporarily increased during the quarter due to weak oil prices, to improve throughout the year and is something that we've managed through before. We will continue to look for ways to improve our financial position and our asset base," said Scott Saxberg, president and CEO of Crescent Point.

- The Company continues to advance the development of its waterflood program. Crescent Point's recent unitization of its Stoughton Unit in the Viewfield Bakken resource play provides significant benefits.

- "We are very excited about our first unit, as we now have the ability to accelerate our waterflood program in the Viewfield Bakken play. Unitization should increase the pressure in a larger portion of the reservoir, creating a more optimal sweep between our water injection and producing wells," said Saxberg. "Our waterflood program, in combination with the new closable sliding sleeve, is expected to help lower our corporate decline and optimize our free cash flow."

- The Company's current budget remains focused on low-risk, high-return development opportunities and the continued expansion of its earlier-stage growth plays. The Company also continues to test and implement new technologies, which add to its knowledge base and allow for future cost reductions and the potential for increased recoveries.

- "We are very pleased with the progress to date in each of our plays, including our growth areas. The economic boundaries in our high-return Torquay play continue to expand, while horizontal development is successfully advancing in our large oil-in -place Uinta play," said Saxberg.

- Crescent Point remains well positioned to execute on its total return strategy for shareholders due to its conservative business approach, its high-quality inventory base and its commitment to advancing technology and its waterflood program. The Company plans to revisit its current $1.45 billion budget in third quarter, and will take into account the Company's continued efforts to improve overall capital efficiencies, as well as the outlook for commodity prices. Crescent Point remains committed to maintaining a strong financial position, its dividend and its long-term growth profile.

Related Categories :

Forecast - Production

More Forecast - Production News

-

Coterra Energy Q4, Full Year 2022 Results; 2023 Plans

-

Southwestern Energy 4Q, Full Year 2022 Results; Talks 2023 Plans

-

Operators Cite Investor Pressure for Production Growth Restraint

-

Murphy Oil to Keep 2021 Spending, Production Near 2020 Levels

-

Ecopetrol IDs 2021 Capex; Bets Bulk on Colombian Ops

Canada News >>>

-

Vermillion Closes Saskatchewan Asset Sale -

-

MEG Energy Rejects Strathcona Resources' $6 Billion Takeover Offer

-

Petrus Resources Ltd. First Quarter 2023 Results

4.jpg&new_width=60&new_height=60&imgsize=false)

-

Cardinal Energy Ltd. First Quarter 2023 Results

-

Headwater Exploration Inc. First Quarter 2023 Results -

6.jpg&new_width=60&new_height=60&imgsize=false)