Quarterly / Earnings Reports | Second Quarter (2Q) Update | Forecast - Production

Crescent Point Lowers Production Guidance for 2018; Mgmt 'Assessing Future Strategy'

Crescent Point Energy reported its operating and financial results for the quarter ended June 30, 2018.

Interim CEO Assessing Strategy

Currently Craig Bryksa, interim President and CEO, and his new senior leadership team are assessing and optimizing the Company's future strategic direction.

This team includes Ken Lamont, Chief Financial Officer, Ryan Gritzfeldt, Chief Operating Officer, Derek Christie, Senior Vice President, Exploration, and Brad Borggard, Senior Vice President, Corporate Planning and Capital Markets.

Ops Highlights:

Q2 production averaged 181,818 boe/d (90% oil/liquids) - up a slight 2% from 1Q18 and up 5% YOY

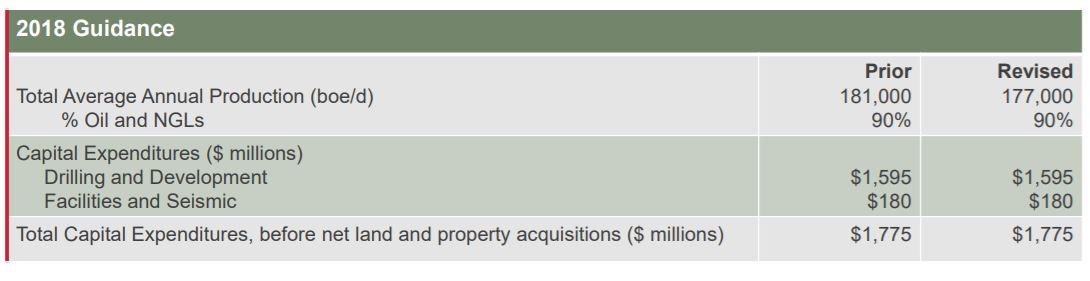

The company has lowered its 2018 production guidance slightly as follows:

- Crescent Point's U.S. operations continued to advance during second quarter. This included horizontal development in the Uinta Basin and North Dakota across multiple zones.

- In the East Shale Duvernay, the Company completed its first half 2018 drilling program with encouraging initial well results. Crescent Point will continue to monitor well performance before increasing the amount of capital allocated to this early-stage resource play.

Financial Highlights:

- Funds flow from operations totaled $500.3 million, or $0.91 per share diluted, based on an operating netback of $40.74 per boe. Funds flow from operations was partially impacted by $13.5 million of incremental severance costs.

- Total capital expenditures during second quarter was $313.6 million. The Company spent $238.6 million on drilling and development activities, drilling 54 (36.0 net) wells, $62.6 million on facilities and seismic and $12.4 million on land.

- Reduced net debt in the quarter by over $390 million, driven by funds flow from operations in excess of capital expenditures and proceeds from recently announced dispositions of approximately $280 million.

- Renewed unsecured, covenant-based credit facilities totaling $3.6 billion, with maturity date extension to 2021.

- Appointed new senior leadership team and streamlined executive structure with fewer members.

- Reviewing strategy with a focus on balance sheet improvement, disciplined capital allocation and cost reductions.

Related Categories :

Second Quarter (2Q) Update

More Second Quarter (2Q) Update News

-

Saturn Oil & Gas Second Quarter 2022 Results

-

Empire Petroleum Second Quarter 2022 Results

-

ProFrac Holding Corp. Second Quarter 2022 Results

-

InPlay Oil Corp. Second Quarter 2022 Results

-

Vermilion Energy Inc. Second Quarter 2022 Results

Canada News >>>

-

Petrus Resources Ltd. First Quarter 2023 Results

4.jpg&new_width=60&new_height=60&imgsize=false)

-

Cardinal Energy Ltd. First Quarter 2023 Results

-

Headwater Exploration Inc. First Quarter 2023 Results -

6.jpg&new_width=60&new_height=60&imgsize=false)

-

Rubellite Energy Inc. First Quarter 2023 Results

-

Bonterra Eneergy Corporation First Quarter 2023 Results

3.jpg&new_width=60&new_height=60&imgsize=false)