Quarterly / Earnings Reports | Debt | Second Quarter (2Q) Update | Deals - Acquisition, Mergers, Divestitures | Financial Results | Capital Markets | Drilling Activity | Suspend or Reduced Operations

Freeport-McMoRan Makes Two Quiet Asset Sales in 2Q; Focuses on GOM

Freeport-McMoRan Inc. has reported its second quarter 2016 results.

Oil and Gas Operations

Through its wholly owned oil and gas subsidiary, FM O&G, FCX's principal oil and gas assets include significant oil production facilities and growth potential in the Deepwater GOM and established oil production facilities in California. For the first six months of 2016, approximately 90 percent of FCX's oil and gas revenues were from oil and NGLs.

During second-quarter 2016, FM O&G completed the sale of certain oil and gas royalty interests for cash consideration of $102 million (before closing adjustments), and in July 2016, completed the sale of its Haynesville shale assets in North Louisiana for cash consideration of $87 million (before closing adjustments). Under full cost accounting rules, the proceeds from these transactions are recorded as a reduction of capitalized oil and gas properties, with no gain or loss recognition.

Oil and Gas Exploration, Operating and Development Activities

In second-quarter 2016, FM O&G remained focused on managing costs and enhancing asset values in response to the current market environment. FM O&G achieved a number of important operational milestones during the quarter, including the commencement of production from five 100-percent-owned Deepwater GOM tieback wells, including three at Holstein Deep and two in the Horn Mountain area. At Lucius and Heidelberg, the operator drilled development wells with favorable results that we believe will further benefit future oil production.

During second-quarter 2016, FCX negotiated the termination and settlement of FM O&G's drilling rig contracts with Noble Drilling (U.S.) LLC (Noble) and Rowan Companies plc (Rowan). As a result of the settlements, FM O&G was released from a total of $1.1 billion in payment obligations under its three drilling rig contracts. In aggregate, reductions in previously contracted commitments for deepwater drillships approximate $350 million. During second-quarter 2016, FCX issued 48 million shares of its common stock (representing a value of $540 million) and paid $85 million cash in connection with the settlements. FCX will fund the remaining $130 million in cash during third-quarter 2016. FCX also agreed to provide contingent payments of up to $105 million, depending on the average price of crude oil over the 12-month period ending June 30, 2017. A net charge of $0.6 billion was recorded in second-quarter 2016 associated with the termination of these contracts.

Assuming an average oil price of $49 per barrel, combined with these actions, operating cash flows from the oil and gas business are expected to exceed its capital expenditures in the second half of 2016 and 2017.

Since commencing development activities in 2014 at its three 100-percent-owned production platforms in the Deepwater GOM, FM O&G has drilled 14 wells in producing fields with positive results; 10 of these wells have been brought on production, including five wells during second-quarter 2016.

Oil and Gas Capital Expenditures. Capital expenditures for oil and gas operations in second-quarter 2016 totaled $388 million in the U.S. (including $205 million incurred for GOM and approximately $150 million associated with the change in capital expenditure accruals) and $4 million associated with international oil and gas properties.

Capital expenditures for oil and gas operations for the year 2016 are estimated to total $1.4 billion, with approximately 90 percent of the capital budget expected to be directed to the GOM.

Deepwater GOM. FM O&G operates and owns 100-percent working interests in the Holstein, Marlin and Horn Mountain deepwater production platforms, which in total have processing capacity of 250 MBbls of oil per day. In addition, FM O&G has interests in the Lucius, Heidelberg, Ram Powell and Hoover producing oil fields and the Atwater Valley undeveloped area.

During second-quarter 2016, production from six wells in the Lucius field in the Keathley Canyon area averaged 20 MBOE per day, net to FM O&G’s 25-percent working interest. The field has performed well since initial production commenced in first-quarter 2015. In second-quarter 2016, the operator completed the seventh well in the field. Approximately 80 percent of FM O&G’s working interest is held through its consolidated subsidiary Plains Offshore Operations Inc. (POI). Third parties hold a preferred interest in POI and are entitled to a liquidation preference and to receive preferred distributions.

In January 2016, first oil production commenced from three initial subsea wells in the Heidelberg oil field in the Green Canyon area. Heidelberg is a subsea oil development consisting of five subsea wells tied back to a truss spar hull located in 5,300 feet of water. In second-quarter 2016, the operator commenced drilling a fourth well in the field, and in July 2016, logging results confirmed oil pay with similar characteristics to a good offset producing well. The fifth and final well of the initial development phase commenced drilling in third-quarter 2016. Heidelberg field was discovered in February 2009, and the subsequent development project was sanctioned in early 2013. FM O&G has a 12.5 percent working interest in Heidelberg.

At the 100-percent-owned Holstein Deep, three wells commenced production in second-quarter 2016 and are currently producing at a gross rate of approximately 9 MBOE per day. The rates are below previous estimates, reflecting lower than expected crude oil quality and lower permeability. The Holstein Deep development is located in Green Canyon Block 643, west of the 100-percent-owned Holstein platform in 3,890 feet of water, with production facilities capable of processing 113 MBbls of oil per day.

FM O&G’s 100-percent-owned Horn Mountain field is located in the Mississippi Canyon area and has production facilities capable of processing 75 MBbls of oil per day. The Quebec/Victory and Kilo/Oscar wells commenced production in second-quarter 2016. To enhance recovery of remaining oil in place, future development plans will target subsea tieback from multiple stacked sands in the area.

FM O&G’s well inventory also includes the Horn Mountain Deep discovery well, where successful drilling results in 2015 indicated the presence of sand sections deeper than known pay sections in the field. These positive results and geophysical data support the existence of Middle Miocene reservoir potential for additional development opportunities in the Horn Mountain Deep area, including five 100-percent-owned exploration prospects with significant future potential. FM O&G controls rights to over 55,000 acres associated with these prospects.

FM O&G’s 100-percent-owned Marlin Hub is located in the Mississippi Canyon area and has production facilities capable of processing 60 MBbls of oil per day. FM O&G has drilled five successful tieback opportunities in the area since 2014. The King D-12 and Dorado wells commenced production in 2015, and the King D-13 well commenced production in first-quarter 2016.

Debt Reduction Initiatives

FCX previously announced plans to reduce debt and restore its balance sheet strength through a combination of asset sale transactions, cash flow from operations and potential capital market transactions. To date, FCX has announced over $4 billion in transactions and has received aggregate cash consideration of $1.4 billion, including $87 million in July 2016. The $2.65 billion Tenke Fungurume (Tenke) transaction is expected to close in fourth-quarter 2016. In addition, FCX continues to aggressively manage production, exploration and administrative costs and capital spending.

During second-quarter 2016, FCX restructured its oil and gas business to reduce costs and align capital allocation for the business with FCX’s corporate debt reduction initiatives. During the quarter, FCX terminated contracts for Freeport-McMoRan Oil & Gas LLC’s (FM O&G) deepwater drillships, and settled aggregate commitments totaling $1.1 billion for $755 million, of which $540 million was funded with shares of FCX common stock. In addition to the drillship contract savings of approximately $350 million, FCX has identified annual operating and administrative cost savings in excess of $150 million in connection with restructuring efforts.

During 2016, FCX has retired $369 million of its senior notes through a series of privately negotiated exchanges for 28 million shares of its common stock (including $268 million during second-quarter 2016, which resulted in a $39 million gain on early extinguishment of debt). These transactions will reduce annual interest expense by $17 million. FCX will continue to evaluate opportunities for transactions, which may include open-market purchases of its debt, debt for debt exchanges, and privately negotiated exchanges of its debt for equity or equity-linked securities. FCX may also issue additional debt or convertible securities to repay or refinance existing debt. The completion and amount of these transactions, if any, are subject to a number of factors, including market conditions, FCX's financial position and its ability to complete such transactions on economically attractive terms.

With the successful completion of the Cerro Verde expansion and access to higher grade ore from the Grasberg mine in future quarters, FCX expects to generate substantial cash flows over the next 18 months for debt reduction.

As part of its plan to reduce outstanding indebtedness, FCX intends to commence, subject to market conditions, a registered at-the-market offering of up to $1.5 billion of common stock and use the proceeds to retire outstanding indebtedness. FCX believes the proceeds of this offering, together with previously announced asset sale transactions and anticipated cash flow from operations, will enable it to achieve its near-term debt reduction objectives.

While additional asset sales may be considered, FCX remains focused on retaining a high-quality portfolio of long-lived copper assets positioned to generate value as market conditions improve. In addition to debt reduction plans, FCX is pursuing opportunities to create additional value through mine designs that would increase copper reserves, reduce costs and provide opportunities to enhance net present values, and continues to advance studies for future development of its copper resources, the timing of which will be dependent on market conditions.

Sales

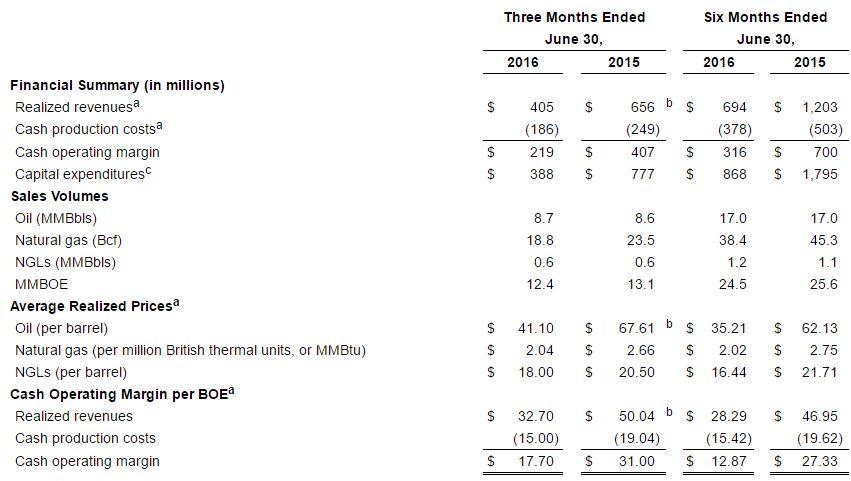

Second-quarter 2016 sales from oil and gas operations of 12.4 MMBOE, including 8.65 million barrels (MMBbls) of crude oil, 18.8 billion cubic feet (Bcf) of natural gas and 0.6 MMBbls of natural gas liquids (NGLs), were lower than the April 2016 estimate of 13.5 MMBOE, primarily reflecting lower than anticipated well performance and start-up delays at new wells, and were lower than second-quarter 2015 sales of 13.1 MMBOE, primarily reflecting lower natural gas volumes from Haynesville.

Oil and Gas Cash Production Costs per BOE. Cash production costs for oil and gas operations of $15.00 per BOE in second-quarter 2016 were lower than cash production costs of $19.04 per BOE in second-quarter 2015, primarily reflecting higher production from Gulf of Mexico (GOM) wells and ongoing cost reduction efforts.

Based on current sales volume and cost estimates, cash production costs are expected to approximate $15.50 per BOE for the year 2016.

Other

Impairment of Oil and Gas Properties. FM O&G follows the full cost method of accounting, whereby all costs associated with oil and gas property acquisition, exploration and development activities are capitalized and amortized to expense under the unit-of-production method on a country-by-country basis using estimates of proved oil and gas reserves relating to each country where such activities are conducted. The costs of unproved oil and gas properties are excluded from amortization until the properties are evaluated.

Financial and Operating Data. Following is a summary of financial and operating data for the U.S. oil and gas operations for the second quarters and first six months of 2016 and 2015:

FM O&G's average realized price for crude oil was $41.10 per barrel in second-quarter 2016 (87 percent of the average Brent crude oil price of $47.03 per barrel). FM O&G's average realized price for natural gas was $2.04 per MMBtu in second-quarter 2016, compared to the New York Mercantile Exchange natural gas price average of $1.95 per MMBtu for the April through June 2016 contracts.

Lower realized revenues for oil and gas operations of $32.70 per BOE in second-quarter 2016, compared to $50.04 per BOE in second-quarter 2015, primarily reflects lower oil prices and the impact of realized cash gains on derivative contracts of $7.73 per BOE in second-quarter 2015.

Cash production costs for oil and gas operations of $15.00 per BOE in second-quarter 2016 were lower than cash production costs of $19.04 per BOE in second-quarter 2015, primarily reflecting higher production from GOM wells and ongoing cost reduction efforts.

Daily sales volumes averaged 136 MBOE for second-quarter 2016, including 95 thousand barrels (MBbls) of crude oil, 207 million cubic feet (MMcf) of natural gas and 6 MBbls of NGLs. Since year-end 2015, FM O&G has commenced production from six 100-percent-owned Deepwater GOM wells. Oil and gas sales volumes are expected to average 130 MBOE per day for the year 2016, comprised of 73 percent oil, 5 percent natural gas and 22 percent NGLs. These estimates are below the April 2016 estimates of 149 MBOE per day, reflecting revised estimates for three Holstein Deep wells that commenced production in second-quarter 2016, the sale of the Haynesville shale assets and production constraints following a fire at a third-party natural gas processing plant.

In late June 2016, a fire at a third-party natural gas processing plant in Pascagoula, Mississippi resulted in the shutdown of the plant and the pipeline that transports gas supply from several offshore platforms, including FM O&G’s Horn Mountain and Marlin facilities (representing approximately 45 percent of FM O&G's GOM BOE production). As a result, production has been temporarily constrained and FM O&G is currently accessing an alternative pipeline as an interim solution. FM O&G is working with third parties on alternative routes to resume normal production and does not expect long-term impacts from this event.

Based on current sales volume and cost estimates, cash production costs are expected to approximate $15.50 per BOE for the year 2016.

Cash Flows, Cash and Debt Transactions

Operating Cash Flows. FCX generated operating cash flows of $874 million (including $278 million in working capital sources and changes in other tax payments) for second-quarter 2016 and $1.6 billion (including $466 million in working capital sources and changes in other tax payments) for the first six months of 2016.

Based on current sales volume and cost estimates and assuming average prices of $2.25 per pound of copper, $1,300 per ounce of gold, $6 per pound of molybdenum and $48 per barrel of Brent crude oil for the second half of 2016, FCX's consolidated operating cash flows are estimated to approximate $4.5 billion for the year 2016 (including $0.7 billion in working capital sources and other tax payments). The impact of price changes for the second half of 2016 on operating cash flows would approximate $260 million for each $0.10 per pound change in the average price of copper, $40 million for each $50 per ounce change in the average price of gold, $35 million for each $2 per pound change in the average price of molybdenum and $55 million for each $5 per barrel change in the average Brent crude oil price.

Capital Expenditures. Capital expenditures totaled $833 million for second-quarter 2016, consisting of $441 million for mining operations (including $350 million for major projects) and $392 million for oil and gas operations. Capital expenditures for the first six months of 2016 totaled $1.8 billion, consisting of $900 million for mining operations (including $0.7 billion for major projects) and $915 million for oil and gas operations.

Capital expenditures are expected to approximate $3.1 billion for the year 2016, consisting of $1.7 billion for mining operations (including $1.3 billion for major projects, primarily for underground development activities at Grasberg and remaining costs for the Cerro Verde expansion) and $1.4 billion for oil and gas operations.

Financial Results

Net loss attributable to common stock totaled $479 million, $0.38 per share, for second-quarter 2016. After adjusting for net charges totaling $452 million, $0.36 per share, second-quarter 2016 adjusted net loss attributable to common stock totaled $27 million, $0.02 per share.

Consolidated sales totaled 12.4 million barrels of oil equivalents (MMBOE) for second-quarter 2016, compared with 13.1 MMBOE for second-quarter 2015.

Consolidated sales for the year 2016 are expected to approximate 47.4 MMBOE, including 11.4 MMBOE for third-quarter 2016.

Average realized prices were $41.10 per barrel for oil for second-quarter 2016.

Average unit net cash costs were $15.50 per BOE for oil and gas operations.

Capital expenditures totaled $833 million for second-quarter 2016, consisting of $392 million for oil and gas operations. Capital expenditures are expected to approximate $3.1 billion for the year 2016, consisting of $1.4 billion for oil and gas operations.

During second-quarter 2016, FCX entered into agreements to terminate FM O&G's three drilling rig contracts for a total of $755 million and potential contingent consideration depending on future oil prices. The settlements result in aggregate savings of approximately $350 million, compared to the previously contracted commitments.

Through July 25, 2016, FCX exchanged $369 million in senior notes for approximately 28 million shares of its common stock in a series of privately negotiated transactions, including $268 million exchanged during second-quarter 2016.

At June 30, 2016, consolidated debt totaled $19.3 billion and consolidated cash totaled $352 million. At June 30, 2016, FCX had no borrowings and $3.5 billion available under its $3.5 billion revolving credit facility.

Freeport-McMoRan Inc. reported net losses attributable to common stock of $479 million, $0.38 per share, for second-quarter 2016 and $4.7 billion, $3.70 per share, for the first six months of 2016, compared with $1.85 billion, $1.78 per share, for second-quarter 2015 and $4.3 billion, $4.16 per share, for the first six months of 2015.

Richard C. Adkerson, President and Chief Executive Officer, said, "We are pleased to report significant progress toward our immediate objective of strengthening FCX’s balance sheet and enhancing shareholder value in a challenging market environment. Our global team continues to execute on our strategy to constrain costs and capital spending in a manner that protects the long-term values of our large resources. Our announced asset sale transactions totaling over $4 billion year-to-date demonstrate the attractiveness of our high-quality asset base. We are focused on executing our operating plans, which position us for significant free cash flow generation in the balance of 2016 and 2017, and on building long-term values from our portfolio of low-cost, long-lived reserves and resources for the benefit of our shareholders."

Related Categories :

Second Quarter (2Q) Update

More Second Quarter (2Q) Update News

-

SM Energy Hits Record Output; Driven by Uinta

-

Expand Energy Talks, Wells, Frac Crews, Production For 2H-2025 -

-

Comstock Rides Higher Gas Prices, Operational Momentum in Q2 2025

-

A Quarter of Quiet Strength: CNX’s Patient Ascent in Appalachia -

-

Liberty Energy: Navigating the Frac Downturn with Efficiency, Innovation, and Strategic Focus -

Ark-La-Tex - North Louisiana News >>>

-

APA Corporation First Quarter 2023 Results -

-

Evolution Petroleum Corporation Fiscal Third Quarter 2023 Results

-

W&T Offshore, Inc., First Quarter 2023 Results

3.jpg&new_width=60&new_height=60&imgsize=false)

-

Talos Energy Inc. First Quarter 2023 Results -

2.jpg&new_width=60&new_height=60&imgsize=false)

-

Kosmos Energy Ltd. First Quarter 2023 Results