Finance & Investing | Top Story | Private Equity | Financial Trouble | Capital Markets | Private Equity Activity

Gulfport Headed for Proxy Battle; Cuts 2020 Completion Activity in Half

Gulfport Energy Corp. is headed for proxy fight with investor Firefly Value Partners, which own 13% and wants to replace two members of the board.

Firefly's letter to Gulfport is available here.

Gulfport recently reported a net loss of over $2 billion, which was a result of an impairment charge. Production was up +1% from 2018 with $602 million in capex.

Stock Plummets

Gulfport's stock value has dropped sizably in recent weeks, likely spurred by several things including Firefly's nominations, cuts to spending, D&C activity and production expectations for 2020 and the impairment charge.

2020 Plans - Completion Activity Cut 50%

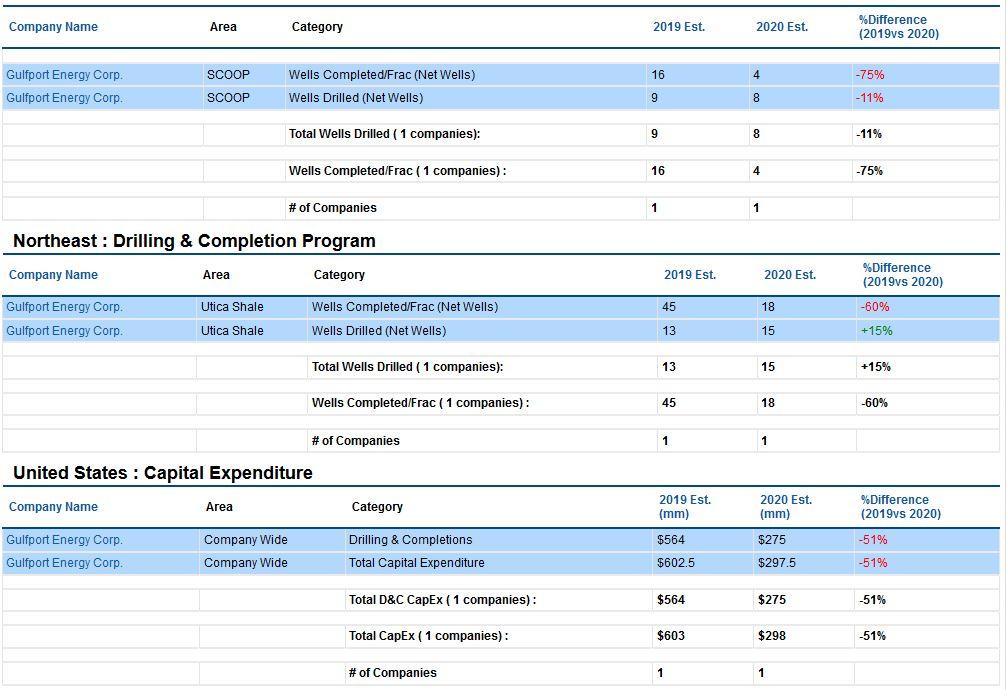

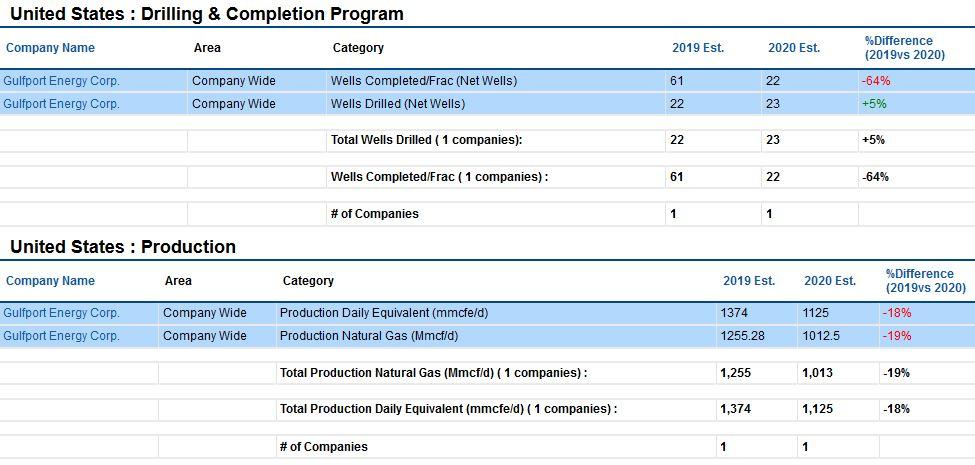

For 2020, the company is guiding that production will be down -19% with $300 million in capex, a -50% cut YOY.

Wells completed / frac'd will be down 50% in 2020 vs 2019.

Related Categories :

Activist Activity

More Activist Activity News

-

Silverbow Resources Board Adopts 'Poison Pill' Strategy

-

Activist Investment Firm Kimmeridge Takes Aim at Chesapeake; Proposes Changes

-

Callon Remains 'Confident' in Carrizo Deal Despite Shareholder Pushback

-

Callon Pressured to Ditch Carrizo Deal by Major Shareholder

-

Icahn Launches Proxy Battle with Oxy

Mid-Continent News >>>

-

Why Surface-Only Inventory Predictions Are a Fool’s Errand

-

From Hedge Funds to Supermajors: Everyone Wants Hub-Linked Gas

-

ConocoPhillips to divest Anadarko Basin asset for $1.3B -

-

Silent Surge: Operator Tops Antero in Utica Well Performance

-

Gas Players : A Comparative Analsysis

Mid-Continent - Anadarko Basin News >>>

-

Expand Energy Talks, Wells, Frac Crews, Production For 2H-2025 -

-

A Quarter of Quiet Strength: CNX’s Patient Ascent in Appalachia -

-

Liberty Energy: Navigating the Frac Downturn with Efficiency, Innovation, and Strategic Focus -

-

Baker Hughes Solid Y/Y Performance Amidst US Frac Market Slowdown -

-

Halliburton Warns of Deepening U.S. Frac Slowdown -