Drilling & Completions | Quarterly / Earnings Reports | First Quarter (1Q) Update | Forecast - Production | Capital Markets | Capital Expenditure | Drilling Activity

Jagged Peak Shifts Bulk of Activity to 2H; Q1 Output Up 33% as Spending Drops 34%

Jagged Peak Energy reported its Q1 2019 results. Here are the highlights from its report and presentation.

Shifting Ops to 2H19

The company noted it is shifting the majority of its activity for 2019 to 2H19 with two large pad-drilling projects:

- Coriander Pad: The Company's Coriander pad will target the 3rd Bone Spring, Wolfcamp A, and Wolfcamp B zones. This six-well pad will utilize three rigs, each drilling two-well pads, shortening the cycle time of the project from spud to sales. This pad is expected to be turned online in the third quarter of 2019.

- Venom Pad: After the Coriander pad, the Company intends to begin work on its eight-well Venom pad, which is expected to be spud by the end of the second quarter and be turned online in the fourth quarter of 2019.

By shifting the 2019 program to include these two larger scale projects, the resulting growth profile is weighted to the second-half of the year, but maintains full-year capital, turned online count, and production volume guidance.

Jim Kleckner, President and Chief Executive Officer, commented, "From an inventory development standpoint, we have recently reworked our drilling and completions program for 2019 to utilize larger scale pads and have replaced several two-well pads with the six-well Coriander and eight-well Venom projects in our Whiskey River area. With this new drill schedule, we begin to transition into multi-horizon co-development projects, where we can realize increased capital and operating efficiencies. While these larger projects optimize the development of our acreage, we estimate that they are net neutral for capital and production in 2019 and thus we confirm our full-year guidance and our commitment to our previously announced 2019 capital budget."

Q1 Summary: Production Lower Than Expected

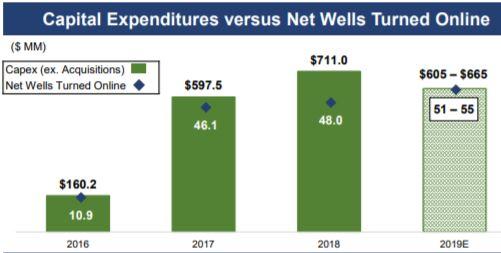

- Q1 D&C Spending: $136.7 million - down a sizable 34% from Q1 2018

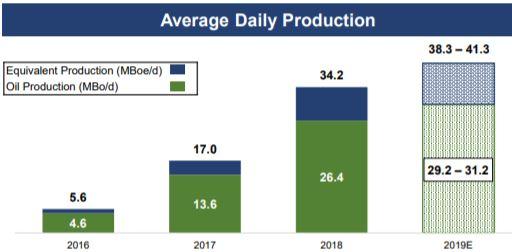

- Q1 Production: Total equivalent production averaged 36.7 MBOEPD - up +33% YOY

- This is at the lower end of the Company's previously announced guidance range of 36.5 - 37.9 MBOEPD

- Well Activity (gross): Drilled13 and completed 12 gross (11.8 net) wells (100% operated)

- Additionally, a portion of the capital spent during the first quarter relates to 16 gross (14.7 net) operated wells that were in various stages of being drilled or completed at March 31, 2019

- Guidance Reaffirmed: The Company has confirmed all of its fourth quarter and full-year guidance ranges.

Related Categories :

First Quarter (1Q) Update

More First Quarter (1Q) Update News

-

Gulfport Touts Super Long Lateral and Strategic Pivot To Gas Asset

-

Civitas Provides Update on Current Rigs & Frac Crews -

-

Large Permian E&P Talks 1Q'24; 282 Wells Planned for 2024 -

-

CNX Resources Cut Frac Activity 50%, Talks 1st Quarter Activity -

-

Large E&P To Defer Completion Activity, Build DUCs -

Permian News >>>

-

Why Surface-Only Inventory Predictions Are a Fool’s Errand

-

Occidental Eyes $10 Billion OxyChem Sale Amid Debt and Capital Discipline Push -

-

Permian Gas Gets New Highway: Transwestern’s 1.5 Bcf/d Desert Southwest Expansion -

-

WaterBridge Infrastructure Brings Delaware Basin Water Model to Wall Street -

-

OPEC+ Nudges Supply Higher: Why This Weekend’s Hike Echoes 2020—But Isn’t 2020

Permian - Delaware Basin News >>>

-

SM Energy Hits Record Output; Driven by Uinta

-

The Permian Play: How ExxonMobil Is Rewriting the Shale Narrative -

-

Large Cap E&P To Reduce Drilling & Completion Activity in 2026 -

-

$2.4B Deal Gives MPLX Sour Gas Edge in Permian -

-

Liberty Energy: Navigating the Frac Downturn with Efficiency, Innovation, and Strategic Focus -