Drilling & Completions | Quarterly / Earnings Reports | Third Quarter (3Q) Update | Financial Results | Capital Markets | Capital Expenditure | Capital Expenditure - 2020 | Capital Expenditure - 2021

Kelt Exploration Third Quarter 2020 Results; Unveils 2021 Budget

Kelt Exploration Ltd. reported its Q3 2020 results.

2021 Budget

The Company’s Board of Directors has approved a capital expenditure budget of $90.0 million for 2021.

Kelt expects to drill 10 gross (10.0 net) wells in 2021 and expects to complete 12 gross (12.0 net) wells in 2021. The Company expects to have 5 gross (5.0 net) wells drilled but un-completed (“DUC”) by the end of 2021. The 2021 capital expenditures are expected to be allocated as follows: $58.5 million for drilling and completing wells, $28.0 million for facilities, pipeline and equipment and $3.5 million for land and seismic.

At Wembley/Pipestone, the Company plans to drill four wells and also complete four wells. At Pouce Coupe, Kelt plans to complete the two high deliverability gas wells that are expected to be drilled in November/December 2020. At Oak/Flatrock, Kelt expects to drill five wells and complete six wells, leaving the year with three DUCs. The Company also expects to drill a vertical stratigraphic well at Oak, which after evaluation will be converted to a water disposal well. At Oak/Flatrock, Kelt expects to construct an oil battery, a gas compression facility and related pipeline infrastructure during the summer of 2021.

Q3 Summary

Kelt continues to monitor current market conditions resulting from the on-going COVID-19 pandemic. The Company’s highest priority remains the health and safety of its employees, partners and the communities where it operates. Kelt continues to maintain measures that have been put in place to protect the well-being of these stakeholders and is proud of the dedication of its workforce to maintain safe operations and business continuity during the on-going pandemic.

On August 21, 2020, Kelt completed the sale of its Inga/Fireweed Division. Cash proceeds were $510.0 million, prior to closing adjustments. In addition, the purchaser assumed certain specific financial obligations related to the assets in the amount of approximately $41.0 million. Kelt’s third quarter results reflect the sale and the associated closing adjustments to account for the July 1, 2020 effective date of the transaction.

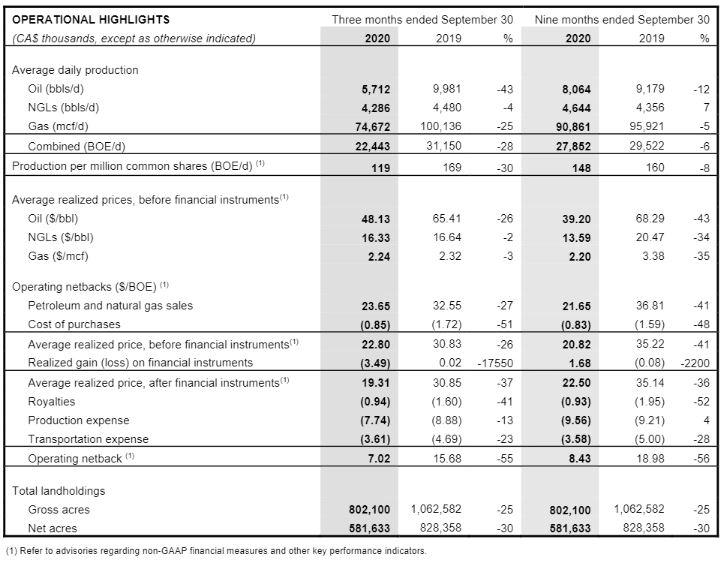

Average production for the three months ended September 30, 2020 was 22,443 BOE per day, down 28%, compared to average production of 31,150 BOE per day during the third quarter of 2019. Production for the three months ended September 30, 2020 was weighted 45% oil and NGLs and 55% gas.

Kelt’s realized average oil price during the third quarter of 2020 was $48.13 per barrel, down 26% from $65.41 per barrel in the third quarter of 2019. The decrease in realized oil prices was primarily related to the decline in global oil demand resulting from the COVID-19 pandemic, despite the efforts of global oil producers to reduce supply by curtailing portions of their oil production. The realized average NGLs price during the third quarter of 2020 was $16.33 per barrel, relatively unchanged from $16.64 per barrel in the same quarter of 2019.

Kelt’s realized average gas price for the third quarter of 2020 was $2.24 per Mcf, down 3% from $2.32 per Mcf in the corresponding quarter of the previous year. As producers in Canada and the United States curtailed capital expenditures, resulting from the financial stresses caused by the COVID-19 pandemic, North American gas supply has been reduced considerably. Initially, the pandemic also resulted in global gas demand destruction which in turn negatively impacted North American LNG exports. As global gas demand begins to recover with the onset of colder winter weather, North American LNG exports are expected to increase creating a tighter supply-demand differential which is currently being reflected in the pricing of the gas futures market for 2021.

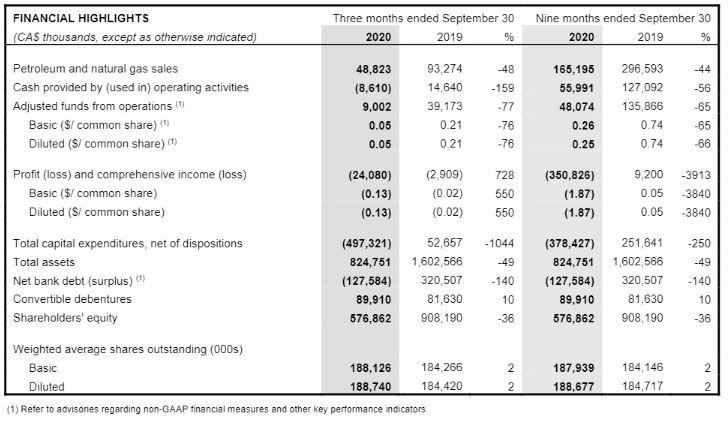

For the three months ended September 30, 2020, revenue was $48.8 million and adjusted funds from operations was $9.0 million ($0.05 per share, diluted), compared to $93.3 million and $39.2 million ($0.21 per share, diluted) respectively, in the third quarter of 2019.

During the third quarter of 2020, Kelt unwound 50% (1,500 bbls/d) of its crude oil fixed MSW price financial contracts for the remainder of the year. These contracts were put in place prior to the disposition of the Inga/Fireweed assets. The Company has taken advantage of the recent run up in future natural gas prices by entering into the following financial contracts:

- Kelt has fixed the NYMEX Henry Hub price on gas sales of 5,000 MMBtu/d at a price of CAD $3.95/MMBtu for the period from December 1, 2020 to October 31, 2021;

- Kelt has fixed the NYMEX Henry Hub price on gas sales of 5,000 MMBtu/d at a price of CAD $4.05/MMBtu for the period from January 1, 2021 to October 31, 2021; and,

- Kelt has fixed the AECO Hub price on gas sales of 5,000 GJ/d (approximately 4,750 MMBtu/d) at a price of CAD $2.70/GJ (CAD $2.84/MMBtu) for the period from December 1, 2020 to October 31, 2021.

Capital expenditures incurred during the three months ended September 30, 2020 were $8.8 million, down 84% from $54.2 million of capital expenditures during the third quarter of 2019. Proceeds from the sale of assets during the third quarter of 2020 were $506.2 million, up from only $1.5 million in the same period of 2019. The majority of the asset sale proceeds during the third quarter of 2020 was from the sale of the Company’s Inga/Fireweed Division.

At September 30, 2020, the Company had no bank debt outstanding. Cash and cash equivalents at September 30, 2020 were $135.5 million. On October 3, 2020, Kelt redeemed the $89.9 million of outstanding principal amount of its 5.00% convertible unsecured subordinated debentures.

Re-instating 2020 Guidance

Kelt expects its average 2020 production to be approximately 24,400 BOE per day, weighted approximately 44% oil and NGLs and 56% gas. Kelt is forecasting 2020 average commodity prices as follows: US$38.00 per barrel for WTI oil and US$2.10 per MMBtu for NYMEX Henry Hub natural gas.

Kelt expects adjusted funds from operations in 2020 to be approximately $57.0 million or $0.30 per diluted share. Kelt does not expect to have any bank debt outstanding at December 31, 2020 and the Company is forecasting a working capital surplus amount of $30.0 million at year-end.

Kelt continues to reduce production expenses by minimizing trucking of water and oil through infrastructure optimization and through the use of Company owned water injection facilities. Kelt has reduced its exposure to higher transportation cost gas hubs in the United States and is directing larger gas volumes to the western Canadian AECO gas market where the Company believes the market will remain under supplied over the next year.

At Wembley/Pipestone, Kelt has completed construction of its infrastructure giving the Company access to flow gas to three significant sized gas processing plants in the area. Kelt has significant behind pipe volumes at Wembley/Pipestone from five wells that have been drilled and completed. The Company expects to have two additional wells drilled (DUCs) at Wembley/Pipestone by year-end. Kelt expects to tie-in certain wells at Wembley/Pipestone in 2021 and will monitor future crude oil prices to determine the timing of pipeline construction required to tie-in the remaining wells that currently have production behind pipe.

Kelt expects the supply-demand differential in the gas market to tighten with the onset of winter, given the recent declines in Canadian and United States gas production. The Company plans to take advantage of these anticipated strong gas markets by drilling two high deliverability gas wells at its Pouce Coupe property in the fourth quarter of 2020.

Related Categories :

Third Quarter (3Q) Update

More Third Quarter (3Q) Update News

-

Evolution Petroleum Corporation Fiscal Third Quarter 2023 Results

-

Civitas Resources Third Quarter 2022 Results

-

Murphy Oil Third Quarter 2022 Results

-

ConocoPhillips Third Quarter 2022 Results

-

California Resources Third Quarter 2022 Results

Canada News >>>

-

Topaz Energy Expands Montney Royalty Footprint -

-

Vermillion Closes Saskatchewan Asset Sale -

-

MEG Energy Rejects Strathcona Resources' $6 Billion Takeover Offer

-

Large Permian E&P Cuts Capex;Outlines New D&C Plans, 2024

-

Petrus Resources Ltd. First Quarter 2023 Results

4.jpg&new_width=60&new_height=60&imgsize=false)

6.jpg&new_width=60&new_height=60&imgsize=false)