People | Finance & Investing | Capital Markets | Private Equity Activity

Long Run Raises $200 MM Private Placement

- Entered into an agreement for a private placement to Maple Marathon Investments Limited for gross proceeds of ~$200 mm.

- Maple Marathon will hold approximately 43.9% of the issued and outstanding Common Shares of Long Run

- Maple Marathon will have the right to nominate three directors when its holdings are equal to or more than 40%

- Mr. William E. Andrew will remain as Chairman of the Board.

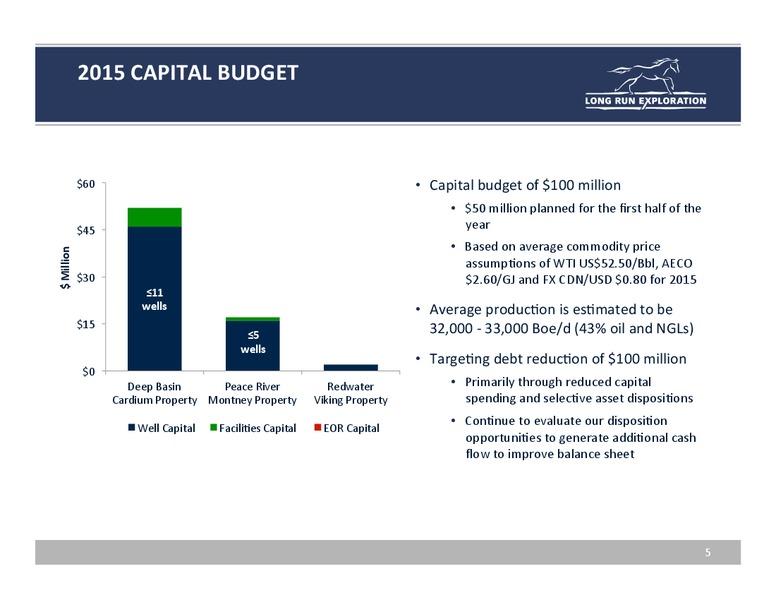

- The company had previously announced a debt reduction goal of only $100 MM for the year

Long Run Exploration Ltd. has announced that it has entered into an agreement for a private placement to Maple Marathon Investments Limited for gross proceeds of approximately $200 million.

The proceeds from the private placement will be used for debt reduction to improve Long Run's capital structure.

Maple Marathon Investments Limited is owned by MIE Holdings Corporation, an independent oil and gas exploration company listed on the Hong Kong Stock Exchange.

Private Placement

Long Run, Maple Marathon and MIE have entered into an investment agreement pursuant to which Long Run will issue, by way of private placement, to Maple Marathon 155,000,000 units at an issue price of $1.30 per Unit.

Each Unit will comprise of: (i) one common share of Long Run; (ii) one-fifth (1/5) of a Common Share purchase warrant and (iii) one-fifth (1/5) of a Common Share purchase warrant. Each whole 18 Month Warrant will entitle the holder to acquire one Common Share at an exercise price of $1.40 for a period of 18 months from closing of the Private Placement. Each whole 24 Month Warrant will entitle the holder to acquire one Common Share at an exercise price of $1.80 for a period of 24 months from closing of the Private Placement.

After giving effect to the Private Placement, Maple Marathon will hold approximately 43.9% of the issued and outstanding Common Shares of Long Run (after giving effect to the issuance of Common Shares pursuant to outstanding restricted awards and prior to giving effect to any exercise of the warrants). The Common Shares and warrants to be issued pursuant to the Private Placement will be subject to statutory resale restrictions for a period of six months and a day following closing of the Private Placement.

The closing of the Private Placement is subject to various conditions including approval by a majority of the shareholders of Long Run, approval of the shareholders of MIE, the receipt of required regulatory approvals (including the Toronto Stock Exchange and approvals required under the Investment Canada Act and the Competition Act (Canada)). The closing of the Private Placement is also conditional on Maple Marathon securing financing to fund its subscription for the Units.

As Maple Marathon will acquire more than 20% of the outstanding Common Shares of Long Run, the TSX rules require that the Private Placement be approved by the shareholders of Long Run at a special meeting to be called for such purpose. In addition, pursuant to the rules of the HKSE, the Private Placement will require approval of the shareholders of MIE.

Pursuant to the Investment Agreement, an information circular is required to be mailed to the holders of Long Run Common Shares prior to October 15, 2015 for the Long Run Special Meeting required to be held prior to November 15, 2015, where Long Run shareholders will vote on the Private Placement. Completion of the Private Placement is expected to occur following the receipt of shareholder and regulatory approvals and is currently expected to occur in late November 2015.

Directors, officers and other shareholders of Long Run, holding in aggregate approximately 11% of the issued and outstanding Common Shares (on a non-diluted basis), have agreed to vote their Common Shares in favour of the Private Placement at the Long Run Special Meeting. The principal shareholder of MIE, holding in the aggregate approximately 54% of the issued and outstanding common shares of MIE (on a non-diluted basis), has agreed to vote in favour of the Private Placement at the MIE meeting of shareholders to be held to consider the Private Placement.

Investment Agreement

Under the terms of the Investment Agreement, Long Run has agreed that it will not solicit or initiate any inquiries or discussions regarding alternate business combinations or acquisition proposals.In certain circumstances, Long Run has agreed to pay a termination fee of $25 million to Maple Marathon, including if Long Run terminates the Investment Agreement to enter into an agreement with respect to a superior proposal or if the board of directors of Long Run withdraws or modifies its recommendation with respect to the Private Placement. Maple Marathon has agreed to pay a termination fee of $25 million to Long Run in the event that the Investment Agreement is terminated as a result of the failure of Maple Marathon to secure the required financing.

The Investment Agreement does not preclude Long Run from pursuing certain asset dispositions.

Governance

Pursuant to a governance agreement to be entered into on closing of the Private Placement, the Board of Long Run will be reconstituted to be comprised of seven directors. Maple Marathon will have the right to nominate: (i) three directors when its holdings are equal to or more than 40% of the outstanding Common Shares; (ii) two directors when its holdings are equal to or more than 20% but less than 40% of the outstanding Common Shares; and (iii) one director when its holdings are more than 10% but less than 20% of the outstanding Common Shares. At closing of the Private Placement, the remaining Board seats will be filled by independent directors. Mr. William E. Andrew will remain as Chairman of the Board.

Advisors

A special committee comprised of independent directors of Long Run was constituted to consider and make recommendations to the Board in connection with, among other things, the Private Placement.

Scotia Waterous Inc. and National Bank Financial Inc. are acting as financial advisors to Long Run. Scotia Waterous Inc. is of the opinion, as of the date hereof, that the consideration to be received by Long Run pursuant to the Private Placement is fair, from a financial point of view, to Long Run (the "Fairness Opinion"). Macquarie Capital Markets Canada Ltd, FirstEnergy Capital Corp. and Cormark Securities Inc. are acting as strategic advisors to Long Run with respect to the Private Placement.

Related Categories :

Canada News >>>

-

Large Permian E&P Cuts Capex;Outlines New D&C Plans, 2024

-

Petrus Resources Ltd. First Quarter 2023 Results

4.jpg&new_width=60&new_height=60&imgsize=false)

-

Cardinal Energy Ltd. First Quarter 2023 Results

-

Headwater Exploration Inc. First Quarter 2023 Results -

6.jpg&new_width=60&new_height=60&imgsize=false)

-

Rubellite Energy Inc. First Quarter 2023 Results

3.jpg&new_width=60&new_height=60&imgsize=false)