Quarterly / Earnings Reports | Third Quarter (3Q) Update | Financial Results | Capital Markets | Capital Expenditure

Montage Resources Third Quarter 2020 Results

Montage Resources Corp. announced its third quarter 2020 operational and financial results.

Third Quarter 2020 Highlights:

- Merger with Southwestern Energy Company expected to close following Montage Resources shareholder vote on November 12, 2020

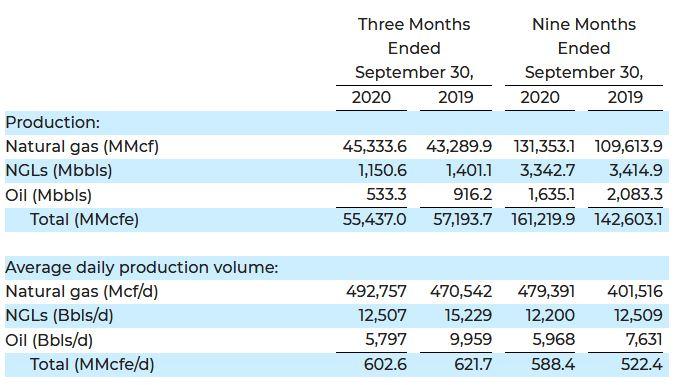

- Average net daily production was 602.6 MMcfe per day, above the high end of the Company’s previously issued guidance range of 580 to 600 MMcfe per day, consisting of 82% natural gas and 18% liquids

- Average natural gas equivalent realized price was $2.30 per Mcfe, including cash settled commodity derivatives and excluding firm transportation expenses

- Per unit cash production costs (including lease operating, transportation, gathering and compression, production, and ad valorem taxes)were $1.21 per Mcfe, below the Company’s previously issued guidance range of $1.25 to $1.35 per Mcfe

- Cash operating margin of $0.93 per Mcfe, or 40%, which was a $0.17 per Mcfe improvement from the second quarter 2020 of $0.76 per Mcfe

- Capital spending for the quarter was $22.3 million, with cumulative spending for the nine months ended September 30, 2020 of $103.8 million

Operational Discussion

The Company’s net production for the three and nine months ended September 30, 2020 and 2019 is set forth in the following table:

Financial Discussion

Revenue for the three months ended September 30, 2020 totaled $115.4 million, compared to $163.3 million for the three months ended September 30, 2019. Adjusted Revenue1, which includes the impact of cash settled commodity derivatives and excludes brokered natural gas and marketing revenue and other revenue, totaled $127.3 million for the three months ended September 30, 2020 compared to $164.8 million for the three months ended September 30, 2019. Net Loss for the three months ended September 30, 2020 was ($92.2) million, or $(2.56) per share, compared to Net Income of $4.3 million, or $0.12 per share, for the three months ended September 30, 2019. Adjusted Net Income (Loss)1 for the three months ended September 30, 2020 was $(17.3) million, or $(0.48) per share, compared to $20.5 million, or $0.57 per share for the three months ended September 30, 2019. Adjusted EBITDAX1 was $51.0 million for the three months ended September 30, 2020 compared to $83.6 million for the three months ended September 30, 2019.

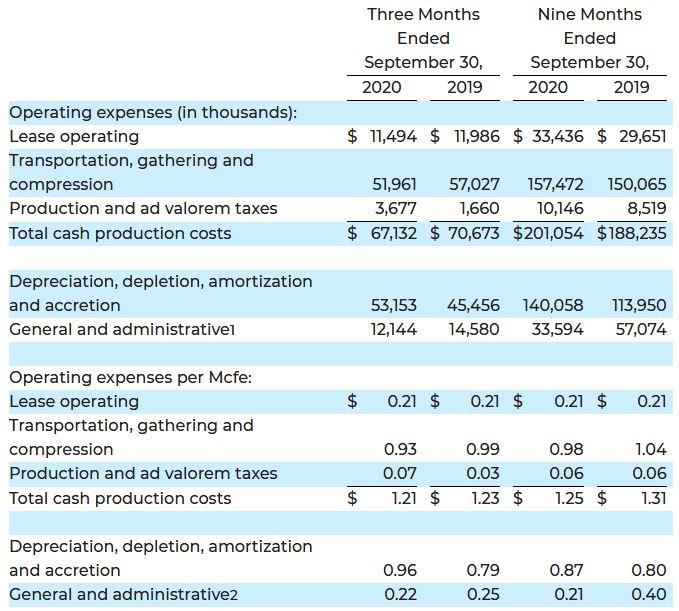

The Company’s cash production costs (which include lease operating, transportation, gathering and compression, production and ad valorem taxes) are shown in the table below. Per unit cash production costs, which include $0.35 per Mcfe of firm transportation expense, were $1.21 per Mcfe for the third quarter of 2020, a decrease of approximately 2% compared to the third quarter of 2019.

General and administrative expense (including one-time merger-related expenses and severance) was $12.1 million and $14.6 million for the three months ended September 30, 2020 and 2019, respectively, and is shown in the table below. Cash general and administrative expense2 (excluding merger-related expenses, severance and stock-based compensation expense) was $8.7 million and $10.2 million for the three months ended September 30, 2020 and 2019, respectively. General and administrative expense per Mcfe (including one-time merger-related expenses and severance) was $0.22 in the three months ended September 30, 2020 compared to $0.25 in the three months ended September 30, 2019. Cash general and administrative expense2 per Mcfe (excluding merger-related expenses, severance and stock-based compensation expense) decreased approximately 11% to $0.16 in the three months ended September 30, 2020 compared to $0.18 in the three months ended September 30, 2019.

Capital Expenditures

Third quarter 2020 capital expenditures were $22.3 million, including $20.2 million for drilling and completions and $2.1 million for land-related expenditures.

During the third quarter of 2020, the Company commenced drilling 2 gross (1.7 net) operated wells and turned to sales 4 gross (2.4 net) operated wells.

Financial Position and Liquidity

As of September 30, 2020, the Company’s liquidity was $279.8 million, consisting of $4.0 million in cash and cash equivalents and $275.8 million in available borrowing capacity under the Company’s revolving credit facility (after giving effect to outstanding letters of credit issued by the Company of $29.2 million and $170.0 million in outstanding borrowings).

Related Categories :

Third Quarter (3Q) Update

More Third Quarter (3Q) Update News

-

Evolution Petroleum Corporation Fiscal Third Quarter 2023 Results

-

Civitas Resources Third Quarter 2022 Results

-

Murphy Oil Third Quarter 2022 Results

-

ConocoPhillips Third Quarter 2022 Results

-

California Resources Third Quarter 2022 Results

Northeast News >>>

-

Why Surface-Only Inventory Predictions Are a Fool’s Errand

-

Silent Surge: Operator Tops Antero in Utica Well Performance

-

Gas Players : A Comparative Analsysis

-

Expand Energy Talks, Wells, Frac Crews, Production For 2H-2025 -

-

A Quarter of Quiet Strength: CNX’s Patient Ascent in Appalachia -

Northeast - Appalachia News >>>

-

Liberty Energy: Navigating the Frac Downturn with Efficiency, Innovation, and Strategic Focus -

-

Baker Hughes Solid Y/Y Performance Amidst US Frac Market Slowdown -

-

Halliburton Warns of Deepening U.S. Frac Slowdown -

-

EQT's Completion Efficiency Drove Outperformance In 2Q

-

Oilfield Service Report : 13 New Leads/Company Formation & Contacts YTD