Quarterly / Earnings Reports | Field Development | Third Quarter (3Q) Update | Deals - Acquisition, Mergers, Divestitures | Drilling Activity

Newfield Grows Production +11% In Anadarko

Third Quarter 2018 Highlights

- Newfield's consolidated net production in the third quarter was more than 202,000 BOEPD (38% oil and 62% liquids). This compares favorably to the Company's quarterly guidance range of 187,000 - 198,000 BOEPD.

- Domestic net production was approximately 199,000 BOEPD and bested the mid-point of quarterly guidance by approximately 9,000 BOEPD (~5% higher). Domestic net oil production was approximately 74,300 BOPD. Oil and natural gas liquids comprised 37% and 24% of total domestic production, respectively.

- Stronger than expected production in the third quarter was largely attributable to the Anadarko Basin, which grew 11% over the second quarter of 2018 and averaged over 143,700 BOEPD. Production from the Anadarko Basin exceeded the mid-point of third quarter guidance by more than 8,700 BOEPD. Compared to the same period in 2017, production increased 37%. Anadarko Basin liquids production in the quarter was nearly 87,000 Bbls/d, up approximately 8% over the previous quarter. Net crude oil production from the Anadarko Basin was in-line with expectations and averaged approximately 43,200 BOEPD, with year-to-date volumes growing more than 30% over the comparable period in 2017.

- Newfield lifted approximately 261,000 net barrels of oil during the quarter from its offshore field in China.

- During the third quarter, the Company continued STACK cube development, commencing row drilling operations across multiple drilling units. This effort will allow the Company to optimize operations, test simultaneous cube development of the Meramec, Osage and Woodford, utilize permanent water infrastructure and reduce downtime associated with offset activities.

- In the Williston Basin, net production during the third quarter averaged 21,400 BOEPD, of which 68% was oil. The Company continues to see positive results from increased density spacing in the Bakken.

- In the Uinta Basin, the Company has grown net production 16% year-over-year with a single-rig program. Net production from the Uinta Basin averaged nearly 20,000 BOEPD during the quarter, of which 83% was oil.

The table below provides third quarter 2018 basin-level production, expenses, capital investments and operations results.

|

Anadarko |

Williston |

Uinta |

Arkoma |

||||

|

PRODUCTION |

|||||||

|

Oil (mbopd) |

43.2 |

14.6 |

16.3 |

- |

|||

|

NGL (mbbls/d) |

43.7 |

3.2 |

0.7 |

0.3 |

|||

|

Gas (mmcfpd) |

341.2 |

21.1 |

16.0 |

80.7 |

|||

|

Total (mboepd) |

143.7 |

21.4 |

19.7 |

13.8 |

|||

|

EXPENSES ($/BOE) |

|||||||

|

LOE1 |

$2.04 |

$6.61 |

$9.25 |

$3.19 |

|||

|

Transportation2 |

$4.61 |

$5.97 |

$1.48 |

$4.51 |

|||

|

Production & other taxes |

$1.76 |

$4.47 |

$2.81 |

$0.79 |

|||

|

Total Expenses |

$8.41 |

$17.05 |

$13.54 |

$8.49 |

|||

|

CAPEX ($MM) |

|||||||

|

Drilling & Completion |

$275 |

$39 |

$32 |

- |

|||

|

Other |

$6 |

$1 |

$4 |

$1 |

|||

|

Total CAPEX3 |

$281 |

$40 |

$36 |

$1 |

|||

|

OPERATIONS |

|||||||

|

Operated rigs |

11 |

1 |

1 |

- |

|||

|

Op. wells placed on production (WI%/NRI%) |

39 |

6 |

5 |

NA |

|||

|

Op. wells placed on production (Average GPI) |

8,141' |

10,138' |

9,795' |

NA |

|

1 |

LOE includes other operating expenses. |

|

2 |

Transportation excludes $9 million of firm gas transportation fees in Oklahoma. Third quarter 2018 shortfall fees in the Uinta Basin were $2 million. |

|

3 |

CAPEX excludes $7 million associated with Corporate FF&E. |

Third Quarter 2018 Financial Summary

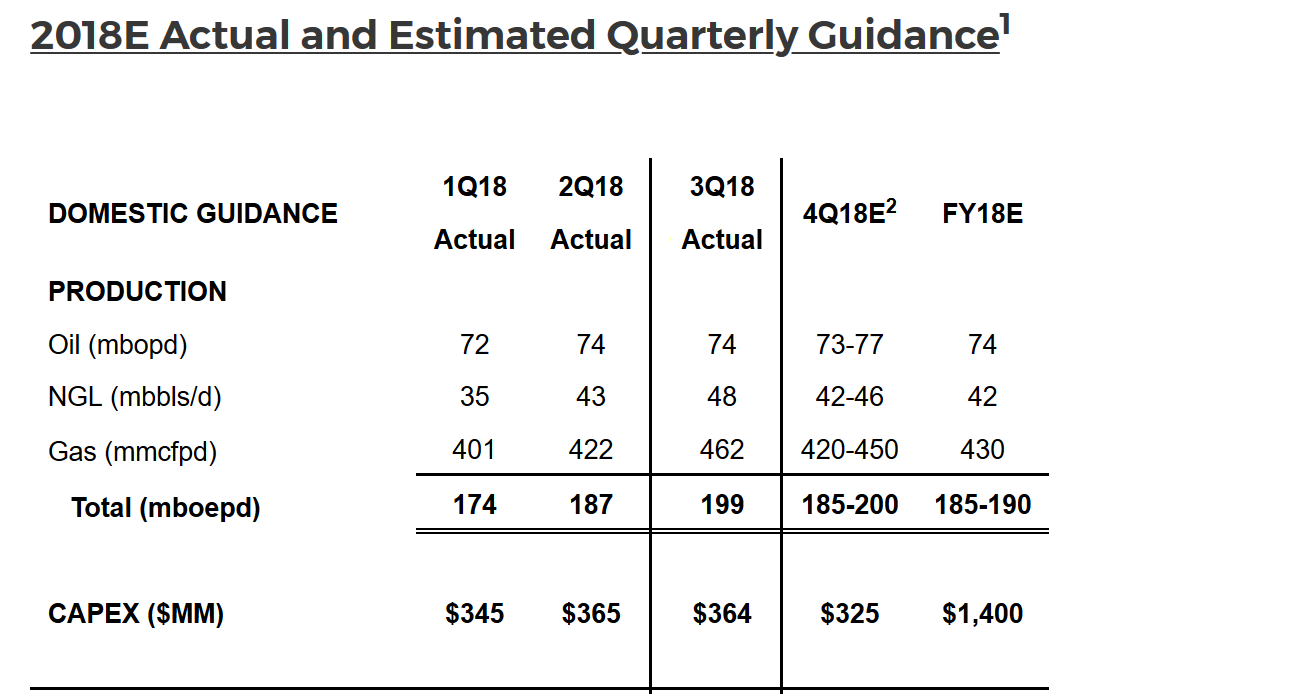

The table below updates 2018 production and capital outlooks for Domestic, and more specifically, the Anadarko Basin.

2018E Actual and Estimated Quarterly Guidance1

Newfield Exploration Company is an independent energy company engaged in the exploration, development and production of crude oil, natural gas and natural gas liquids (NGLs). Our U.S. operations are onshore and focus primarily on large scale, liquids-rich resource plays in the Anadarko Basin of Oklahoma, the Williston Basin of North Dakota and the Uinta Basin of Utah. In addition, we have oil assets offshore China, and gas assets in the Arkoma Basin of Oklahoma.

Related Categories :

Third Quarter (3Q) Update

More Third Quarter (3Q) Update News

-

Evolution Petroleum Corporation Fiscal Third Quarter 2023 Results

-

Civitas Resources Third Quarter 2022 Results

-

Murphy Oil Third Quarter 2022 Results

-

ConocoPhillips Third Quarter 2022 Results

-

California Resources Third Quarter 2022 Results

Mid-Continent News >>>

-

ConocoPhillips to divest Anadarko Basin asset for $1.3B -

-

SM Energy Hits Record Output; Driven by Uinta

-

Large Cap E&P To Reduce Drilling & Completion Activity in 2026 -

-

Liberty Energy: Navigating the Frac Downturn with Efficiency, Innovation, and Strategic Focus -

-

Baker Hughes Solid Y/Y Performance Amidst US Frac Market Slowdown -

Mid-Continent - Anadarko Basin News >>>

-

Halliburton Warns of Deepening U.S. Frac Slowdown -

-

Oilfield Service Report : 13 New Leads/Company Formation & Contacts YTD

-

PE Firm Seeds Four New E&P Startups in Strategic Push In 2025 -

-

Schlumberger Shows Steady Resilience Amid Market Volatility -

-

Gulfport Touts Super Long Lateral and Strategic Pivot To Gas Asset