Government & Regulatory | Drilling & Completions | Quarterly / Earnings Reports | Third Quarter (3Q) Update | Financial Results | Hedging | Capital Markets | Capital Expenditure | Capital Expenditure - 2021

PDC Energy Third Quarter 2020 Results; IDs Preliminary 2021 Capex

PDC Energy, Inc. announced its 2020 third quarter operating and financial results.

2021 Preliminary Outlook

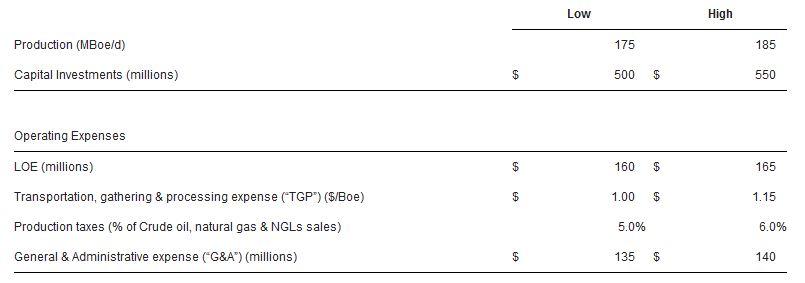

The Company's preliminary 2021 Outlook remains unchanged from an operational standpoint as it contemplates total capital investment between $500 million and $600 million.

PDC projects drilling, completion and facility costs in each basin to decrease five to ten percent compared to its previously stated cost estimates of approximately $400 per foot in Wattenberg and approximately $850 per foot in the Delaware Basin. These potential savings are subject to market conditions and will likely be partially offset by the aforementioned Wattenberg operating efficiencies resulting in additional spuds and TILs late in 2021. Assuming $40 per Bbl WTI oil, $2.75 per Mcf NYMEX natural gas and NGL realizations of approximately $10 per barrel, the Company projects to generate approximately $300 million of adjusted free cash flow in 2021.

The previously disclosed 2021 expectations of 175,000 to 185,000 Boe per day and 64,000 to 68,000 barrels per day for both total production and oil production, respectively, remain unchanged and are consistent with the current 2020 guidance ranges.

2020 Third Quarter Highlights:

- Net cash from operating activities of approximately $280 million and adjusted cash flows from operations, a non-U.S. GAAP metric defined below, of approximately $260 million.

- Oil and gas capital investments of approximately $35 million.

- Approximately $225 million of adjusted free cash flow, a non-U.S. GAAP metric reconciled below and defined as net cash flows from operating activities, before changes in working capital, less oil and gas capital investments.

- Paid down approximately $215 million of debt from the Company's revolving credit facility. The Company paid down an incremental $70 million of debt in October, resulting in total debt of less than $1.7 billion as of October 31, 2020.

- Lease operating expense ("LOE") of $37 million or $2.11 per barrel of oil equivalent ("Boe").

- Total production of 17.7 million Boe or approximately 192,000 Boe per day and oil production of 6.0 million barrels ("Bbls") or approximately 65,000 Bbls per day.

- In September and October 2020, the Company received approval from the Colorado Oil and Gas Conservation Commission ("COGCC") for an additional 32 future drilling locations. The Company now estimates it will have approximately 475 combined approved permits and drilled but uncompleted wells ("DUC") at year-end 2020.

President and Chief Executive Officer Bart Brookman commented "I'm extremely proud of our team's ability to remain focused and execute through all the uncertainty we experienced in the third quarter. I believe the company's considerable free cash flow generation and subsequent debt pay down truly differentiates PDC. Furthermore, our ongoing track record of safe and responsible operations remains our highest priority. This reputation, when combined with our community and county relationships, give us the utmost confidence in our long-term development plan on PDC's 100% Weld County acreage position."

Colorado Regulatory Update

In September and October, PDC received COGCC approval related to 32 future wells. This inventory is located on four surface locations (Form 2A's) averaging approximately ten building units within 2,000 feet and 750 feet to the nearest building unit. The Company expects to exit 2020 with approximately 23 approved surface permits comprising approximately 275 future locations as well as an additional 200 DUCs. The approximately 475 combined locations equate to nearly four years of future completion activity at the Company's current pace.

Ops, 2020 Capital Spend and Financials

Year-to-date, PDC has generated approximately $240 million of adjusted free cash flow, including $225 million in the third quarter. Additionally, the Company paid down approximately $215 million of debt in the third quarter and an incremental $70 million in October, resulting in total debt of less than $1.7 billion, as of October 31. Assuming fourth quarter pricing of $35 per Bbl WTI, $2.50 per Mcf NYMEX natural gas and NGL realizations of approximately $10 per barrel, the Company projects full-year and fourth quarter 2020 adjusted free cash flow in excess of $350 million and $100 million, respectively.

In the third quarter, the Company invested approximately $35 million while delivering total production of 17.7 million Boe, or approximately 192,000 Boe per day, and oil production of 6.0 million Bbls, or approximately 65,000 Bbls per day. In the fourth quarter, the Company expects to invest approximately $110 million operating both a Wattenberg drilling rig and completion crew throughout the quarter with minimal planned investments in the Delaware Basin. Both total production and oil production are expected to decrease less than ten percent in the fourth quarter compared to the third quarter and average approximately 175,000 Boe per day and 60,000 Bbls per day, respectively.

In Wattenberg, the Company operated one drilling rig throughout the third quarter and a completion crew for the month of September, resulting in 17 spuds and two turn-in-lines ("TIL") for the quarter. Due to a lack of new TILs and the timing of returning to production previously shut-in, high GOR wells, average daily production was relatively flat while average daily oil production decreased approximately six percent on a sequential basis. Additionally, the Company has realized several Wattenberg drilling and completion efficiencies throughout 2020, including improved extended reach lateral spud-to-spud drill times to an average of six days, and an increase in the number of completion stages per day. These efficiencies may result in a slightly accelerated cadence of spuds and TILs in the fourth quarter of 2020 and all of 2021.

The Company is currently inactive from both a drilling and completion standpoint in the Delaware Basin; however, due to late second quarter TILs, oil production and total production in the third quarter increased eight and ten percent, respectively, compared to the second quarter.

Hedging Overview

In the fourth quarter of 2020, the Company has approximately 4.1 million Bbls of oil hedges at a weighted-average floor price of approximately $58 per Bbl. The Company's remaining swaps and costless collars represent approximately 70 percent of its projected oil volumes through year-end. Approximately 40 percent of the Company's estimated gas production in the fourth quarter of 2020 is protected at approximately $2 per Mcf. PDC's 2021 hedge positions protect nearly 45 percent of its estimated oil volumes and 55 percent of its projected natural gas volumes at weighted-average floor prices of approximately $45 per barrel and $2.45 per Mcf, respectively.

The Company's hedging strategy is predicated on systematically layering in oil and natural gas swaps and costless collars, as well as evaluating basis swaps and physical hedges when appropriate.

Oil and Gas Production, Sales and Operating Cost Data

Crude oil, natural gas and NGLs sales, excluding net settlements on derivatives, increased to $315 million in the third quarter 2020 compared to $307 million in the comparable 2019 period. The increase in sales between periods was due to a 39 percent increase in production being partially offset by a 26 percent reduction in sales price to $17.79 per Boe from $24.18 per Boe. The decrease in sales price per Boe was driven by a 29 percent decrease in weighted-average oil price outweighing a ten percent and 18 percent increase in weighted-average realized natural gas and NGL prices, respectively. The increase in production between periods was due to the merger with SRC Energy, Inc. ("SRC") in January 2020. The combined revenue from crude oil, natural gas and NGLs sales and net settlements received on commodity derivative instruments increased 24 percent between periods to $382 million from $309 million.

Production costs for the third quarter of 2020, which include LOE, production taxes and TGP, were $76 million, or $4.32 per Boe, compared to $61 million, or $4.77 per Boe, in the third quarter of 2019. LOE improved 26 percent between periods to $2.11 per Boe from $2.87 per Boe. The improvement in LOE per Boe is primarily due to efficiency-gains realized through compressor management and reduced overtime as well as vendor price concessions. TGP increased 59 percent between periods to $1.38 per Boe in the third quarter of 2020 from $0.87 per Boe in the comparable 2019 period. The increase between periods was primarily due to the accounting treatment of new transportation agreements and amendments to existing crude oil sales contracts resulting in increases to both TGP and realized prices.

Financial Results

Net loss for the third quarter of 2020 was approximately $31 million, or $0.31 per diluted share, compared to net income of $16 million, or $0.25 per diluted share in the comparable 2019 period. The year-over-year change was due to the increase in commodity price risk management loss, partially offset by the decrease in depreciation expense between periods. Adjusted net income, a non-U.S. GAAP financial measure defined below, was $104 million in the third quarter of 2020 compared to adjusted net loss of $25 million in the comparable 2019 period. The year-over-year change is primarily due to the increase in realized settlements of derivatives in the quarter.

Net cash from operating activities for the third quarter of 2020 was approximately $280 million compared to $234 million in the comparable 2019 period. Adjusted cash flows from operations, a non-U.S. GAAP metric defined below, was approximately $260 million in the third quarter of 2020 compared to approximately $202 million in the comparable 2019 period. The year-over-year increase in each metric was primarily due to the increase in realized settlements of our derivatives between periods.

G&A, which includes cash and non-cash expense, was $32 million, or $1.84 per Boe, in the third quarter of 2020 compared to $41 million, or $3.23 per Boe, in 2019. Third quarter 2019 G&A includes approximately $5 million, or $0.42 per Boe, of legal-related expenses primarily associated with the SRC acquisition. Excluding these expenses would have resulted in third quarter 2020 G&A per Boe reflecting a 35 percent improvement between periods.

Related Categories :

Third Quarter (3Q) Update

More Third Quarter (3Q) Update News

-

Evolution Petroleum Corporation Fiscal Third Quarter 2023 Results

-

Civitas Resources Third Quarter 2022 Results

-

Murphy Oil Third Quarter 2022 Results

-

ConocoPhillips Third Quarter 2022 Results

-

California Resources Third Quarter 2022 Results

Rockies News >>>

-

Why Surface-Only Inventory Predictions Are a Fool’s Errand

-

OPEC+ Nudges Supply Higher: Why This Weekend’s Hike Echoes 2020—But Isn’t 2020

-

SM Energy Hits Record Output; Driven by Uinta

-

Large Cap E&P To Reduce Drilling & Completion Activity in 2026 -

-

Baker Hughes Solid Y/Y Performance Amidst US Frac Market Slowdown -

Rockies - DJ Basin News >>>

-

Halliburton Warns of Deepening U.S. Frac Slowdown -

-

Oilfield Service Report : 13 New Leads/Company Formation & Contacts YTD

-

PE Firm Seeds Four New E&P Startups in Strategic Push In 2025 -

-

Schlumberger Shows Steady Resilience Amid Market Volatility -

-

Civitas Provides Update on Current Rigs & Frac Crews -