Top Story | Rates of Return | Forecast - Production | Capital Markets | Capital Expenditure | Private Equity Activity

Seven Generations Chops $200 Million From Recently Announced 2016 Plans

Seven Generations Energy Ltd. is deferring about $200 million of previously planned, discretionary capital investment in 2016 due to the recent 30 percent decrease in commodity pricing and the resulting expectation of reduced cash flow. Despite this deferral, 7G maintains 2016 production guidance of between 100,000 and 110,000 barrels of oil equivalent per day (boe/d), which is about 75 percent higher than 7G's record production in 2015 of more than 60,000 boe/d.

Capital investment in 2016 is now expected to be between $900 million and $950 million, about 18 percent lower than when 7G's 2016 capital budget was first announced in early November, and about 30 percent lower than the Company's capital investment in 2015.

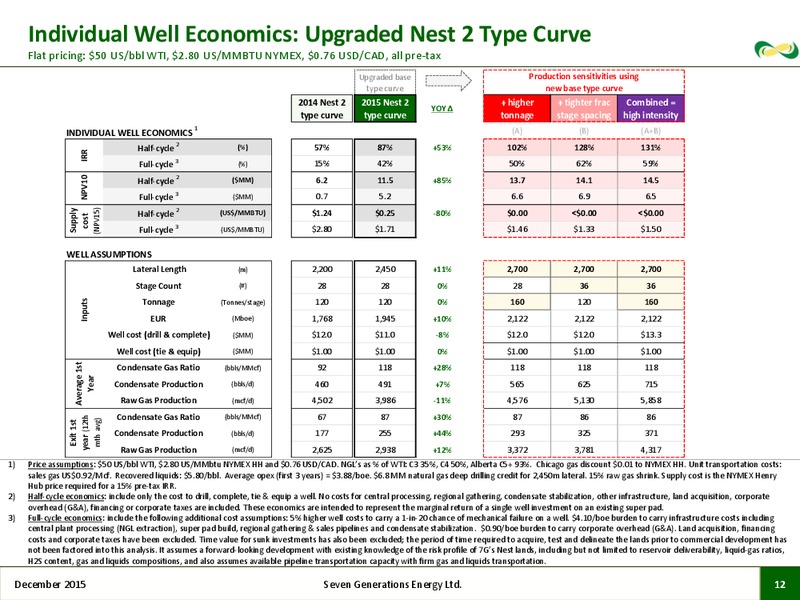

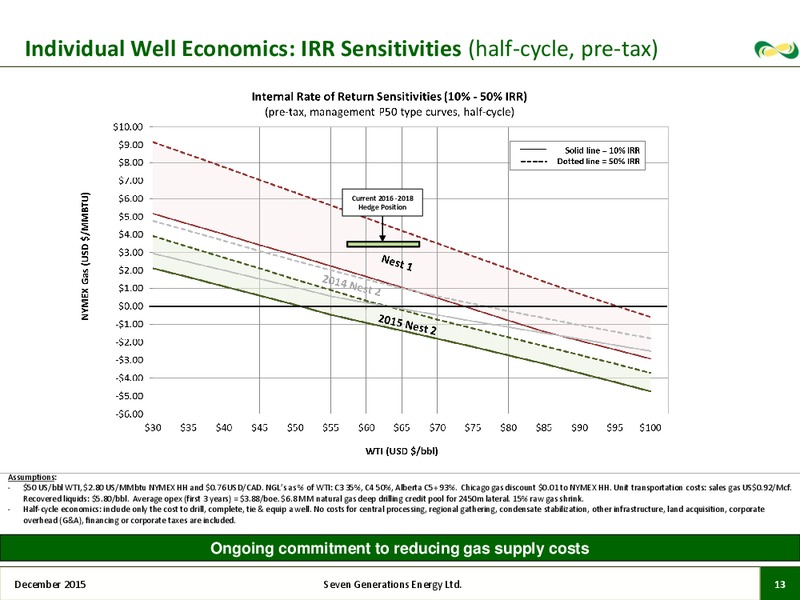

Well Economics

Pat Carlson, 7G's Chief Executive Officer, said: "We are deferring a portion of our 2016 investments to maintain financial strength and reduce risk associated with debt leverage ratios. Our investment thesis and our growth profile remain strong. They are built upon delivering the lowest-cost supply to the over-supplied North American market. We've seen commodity prices fall to what we expect to be unsustainable levels. Until they recover, we are taking prudent steps to focus our Kakwa River Project investments on our most profitable, low-cost growth. This deferral of planned 2016 investment is not expected to significantly impact 2016 production guidance. If low prices persist, and the capital deferrals remain, we have contingency plans in place to manage and minimize the financial impact of the Company's Alliance Pipeline transportation commitments in 2017."

Early 2016 capital investment to complete construction on major processing facilities

Marty Proctor, 7G's President and Chief Operating Officer, said: "Our high-priority 2016 capital investments include a portion of the originally planned drilling program, plus completing and tying in our inventory of about 60 wells that are already in the construction process. These wells are expected to grow production to our original 2016 target levels and support some of our planned 2017 growth. We are also building Super Pads, gathering pipelines and completing major production facilities, including a second 25,000 barrel-per-day condensate stabilizer at the Karr facility and our new Cutbank natural gas plant and associated pipelines.

"Our 2016 investment profile is weighted towards the first part of the year as we complete these well-advanced facility construction projects and reduce our drilling fleet from the current 10 rigs to about five for most of the year."

Scheduled to start up in the second quarter, the Cutbank plant is expected to take 7G's processing capacity at Kakwa from the current 250 million cubic feet per day (MMcf/d) to about 500 MMcf/d of liquids-rich natural gas. In 2016, the Company has contracted firm transportation capacity on Alliance Pipeline that averages approximately 350 MMcf/d, and that Alliance capacity is scheduled to incrementally step up to 500 MMcf/d in late 2018.

Proctor added: "The excess processing capacity we are building, and will hold between now and late 2018, gives us latitude to speed up or slow down our growth rate while taking advantage of opportunities to market third-party natural gas as well."

2015 production tops guidance

Production in 2015 averaged slightly more than 60,000 boe/d, which tops the Company's 2015 production guidance of 55,000 to 60,000 boe/d. Preliminary estimates indicate that production in December, when 7G's firm liquids-rich natural gas delivery capacity on Alliance increased to 250 MMcf/d, averaged about 87,000 boe/d, and fourth quarter production averaged about 77,500 boe/d.

Proctor said: "We just completed a very successful operational year marked by more productive and lower cost wells, strong year-end production growth, advanced start-up of our new Lator 2 natural gas processing plant, and improved safety. Our 2015 production increased more than 90 percent, up from 31,136 boe/d in 2014.

"Cost optimization improved throughout 2015. Preliminary accounting indicates that 2015 capital investment is expected to be near the mid-point of 7G's guidance range of between $1.30 billion and $1.35 billion. We expect capital efficiencies gained in 2015, due to faster drilling, more effective well completions and construction optimization at our new processing facilities, will at least continue, and likely improve further in 2016. We are drilling longer wells and implementing larger hydraulic fractures as part of our standard completions and both innovations are expected to improve recoveries of liquids rich natural gas."

Managing market risk

Chris Law, 7G's CFO, commented: "Despite the deterioration of commodity prices and the weaker Canadian dollar, our risk management program continues to fortify our near and longer-term financial strength through the execution of a methodical, three-year, rolling hedging program. With higher prices in the futures market, we have been able to forward sell liquids and natural gas at prices that provide threshold rates of return on planned capital investments.

The Canadian dollar weakness also means that 7G's US-dollar denominated debt increases on its balance sheet purely due to the currency exchange effect. A portion of 7G's natural gas and liquids are sold in US dollars, which helps offset the decline in the Canadian dollar and mitigates debt servicing costs. However, implied Canadian dollar debt metrics are inflated due to this currency movement.

Related Categories :

Canada News >>>

-

Topaz Energy Expands Montney Royalty Footprint -

-

Vermillion Closes Saskatchewan Asset Sale -

-

MEG Energy Rejects Strathcona Resources' $6 Billion Takeover Offer

-

Large Permian E&P Cuts Capex;Outlines New D&C Plans, 2024

-

Petrus Resources Ltd. First Quarter 2023 Results

4.jpg&new_width=60&new_height=60&imgsize=false)

6.jpg&new_width=60&new_height=60&imgsize=false)