Finance & Investing | Debt | Deals - Acquisition, Mergers, Divestitures | Exclusives / Features | Capital Markets

Shale 3.0: Capital Discipline in 2019

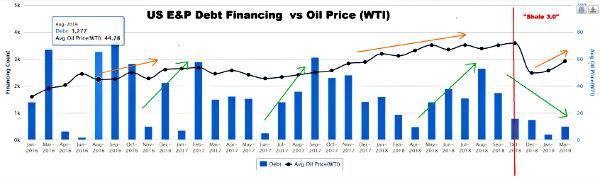

'Shale 3.0' is the new mandate on E&Ps from Wall Street - which is calling on operators to finance operations from cash flow. Below is our first chart, which shows that operators are starting to attempt to live within their cash flow.

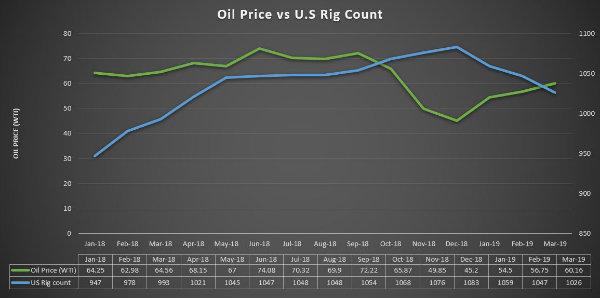

A look at oil price (WTI) vs. rig count shows that, even with a 40% increase in oil price ($60/barrel WTI), operators are continuing to shed rigs.

Capital discipline is the new name of the game.

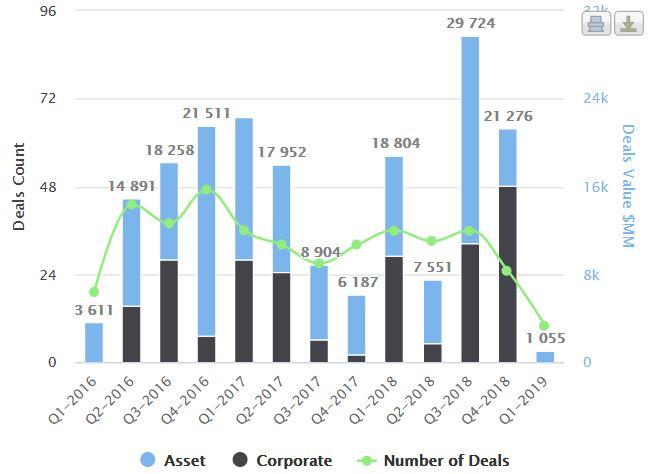

Our next chart shows the former tendency of E&Ps to finance their operations using debt. The mantra in 'Shale 2.0' was to increase spending as commodity prices rise through the issuance of debt.

The chart below shows a new behavior - previously when oil prices rose, debt financing activity would also increase. However in the new 'Shale 3.0', we are not seeing as many debt financings occurring despite rising oil prices - marking a divergence from what we saw in the past.

Deal Activity Also Takes Hit

In this new era of 'Shale 3.0', even M&A activity is not spared. Below are three transactions that have been cancelled as a result of changes in the equity market:

- Blank-check E&P Dissolves; Unable to Complete Acquisition

- Penn Virginia & Denbury calls off Merger

- Earthone Energy, Sabalo Terminate Merger Agreement

Related Categories :

Exclusives / Features

More Exclusives / Features News

-

Coterra’s Strategic Pivot: Realigning Rig Activity and Capital Deployment in 2025

-

Comstock Delivers Strong Q1 2025 — Olajuwon Pickens #1 Steals the Spotlight -

-

Shale Experts Frac Maket Forecast 2024 -

-

Seventeen (17) E&Ps; To Use 47 Frac Crews To Complete 2,800 Wells In 2024 -

-

Contrary to The Noise, U.S. Oil Production will Likely Growth 4-5% In 2024; A look Inside -

United States News >>>

-

Petrus Resources Ltd. First Quarter 2023 Results

4.jpg&new_width=60&new_height=60&imgsize=false)

-

Battalion Oil Corporation First Quarter 2023 Results

5.jpg&new_width=60&new_height=60&imgsize=false)

-

Amplify Energy Corporation First Quarter 2023 Results -

-

Denbury Inc., First Quarter 2023 Results

-

Evolution Petroleum Corporation Fiscal Third Quarter 2023 Results