Quarterly / Earnings Reports | Debt | Third Quarter (3Q) Update | Financial Results | Capital Markets

YPF SA Third Quarter 2020 Results; Puts Rigs Back to Work

YPF reported its Q3 2020 results.

Key Takeaways - Rig Additions in Q3

In August, conventional drilling activity was resumed in the Golfo San Jorge basin with 1 rig in August and 2 more were added in September, while unconventional activity resumed in September with 3 drilling rigs and 1 fracture set in the Neuquén basin. At the end of the quarter, our backlog of drilled but uncompleted wells (―DUC‖) remained unchanged, totaling 71 for shale oil and 10 for shale gas.

Highlights:

- Revenues increased by 19.5% on a sequential basis on the back of a significant recovery in fuels´ sales and stabilization in oil and gas output.

- When compared to the previous quarter, demand for refined products recovered significantly, driving a 41% increase in gasoline volumes sold and 22% in diesel.

- Higher volumes processed at our refineries which averaged a capacity utilization of 73% in the quarter, up from its lows of 47% in April, despite moving forward with a programmed major maintenance at our La Plata Refinery starting in September which had been suspended in April.

- Total hydrocarbon production was stabilized at 468.5 Kboed on gradual resumption in well activity, having mobilized over 35 rigs by September, including drilling, workover and pulling towers.

- Costs were kept under control as our efficiency program started delivering its initial results, growing by a meager 1% q/q, as operating expenses, excluding purchases and royalties, decreased 19%.

- Prices at the pump were adjusted twice during the quarter, accumulating, on average, an increase of 8% in Peso terms. However, when calculated in dollars, realized prices at the pump decreased by 25.3% and 19.8% y/y for diesel and gasoline, respectively.

- Net income for the quarter resulted in net loss of US$482 million, a significant improvement when compared to the loss of US$1,258 million in the previous quarter, but still in negative territory, as the effects of the pandemic continued having a toll on our economic results.

- Capex was kept at low levels, totaling US$257 million y/y), as we continued focusing on cash preservation. However, on a sequential basis, capex increased 59.2% as we gradually started to resume activity.

- Net debt amounted to US$7,203, down by US$184 million q/q, on the back of the partial recovery in cash flow from operations and a conservative approach towards investments, as financial prudency continued dictating our strategy to face the unexpected crisis.

Q3 Financials

Revenues for 3Q20, which amounted to US$2,327 million, decreased 29.7% y/y due to lower demand and prices in dollars. Demand continued to be impacted by the mandatory lockdown measures implemented in late March to prevent the circulation and spread of theCOVID-19virus. In addition, prices in dollars of our main products did not keep up with the devaluation of the peso. Despite this, the gradual easing of restrictions allowed for a recovery in demand, with revenues expanding by 19.5% q/q.

Diesel revenues – 36% of our total sales during the quarter – decreased 27.3% y/y due to lower prices (- 23.5%) and lower volumes sold(-4.8%).Gasoline sales – 15% of total revenues – followed the same trend and decreased by 47.6% also on lower prices(-19.8%)and volumes sold(-37.1%).

Natural gas revenues as producers in the local market – 13% of consolidated sales – went down 39.3% y/y due to lower prices and volumes, which decreased by 31.5% and 11.4%, respectively. This decrease in volumes was mainly explained by the natural decline of our fields given the reduction in activity. On the other hand, the decrease in prices is mainly due to the extension of contracts with the distribution companies, that took place last March and did not include an update on its price, and the lower prices resulting from the monthly auctions for power plants.

Other domestic sales in 3Q20, decreased 10.5% y/y as lower sales of jet fuel, crude oil, lubricants, asphalts, LPG and flours and grains, more than offset higher sales of fuel oil, and fertilizers.

Export revenues in decreased 23.1% y/y as higher volumes of crude oil and better volumes and prices for flours and soybean oil did not compensate the lower exports of jet fuel, natural gas and virgin naphtha.

Total Costs were US$2,180 million, 20.5% lower than 3Q19 as both production cost and purchases decreased. The reductions at lifting(-41.6%y/y), royalties(-31.6%y/y), and transportation costs(-49.5%y/y) – included in the Other category within Production Costs – were the consequence of the adjustment in the level of production, in addition to the security protocols established in each operation.

Depreciation decreased 12.8% compared to 3Q19 mainly due to a reduction in the asset base related to the impairments of PP&E and low level of activity.

As regards to purchases, the 31.2% y/y decline was mainly driven by:

- A reduction in imports of fuels on lower imported values of diesel(-75.0%)and jet fuel(-95.9%).

- A contraction in crude oil purchases from third parties as volumes and prices decreased by 57.2% and 15.1%, respectively.

- Higher purchases of natural gas from other producers for resale in the retail distribution segment (residential customers and small businesses) and to large customers (power plants and industries) mainly due to higher prices by 24.5%.

During 3Q20, a negative stock variation of US$61 million was recorded, mainly due to the consumption of inventories. On the other hand, during 3Q19 there was a positive stock variation of US$15 million, mainly due to an accumulation of inventories.

Selling and Administrative expenses increased 3.4% y/y mainly driven by higher personnel expenses, charges for depreciation of fixed assets, and provisions, which offset lower costs in outsourcing services, institutional advertising, and charges for the transportation of products (lower rates paid for domestic transport of fuels in dollars).

Non-recurring charge for the deterioration of intangible assets during the quarter reached US$19 million mainly related to awrite-offof exploration rights in Meseta Buena Esperanza, located in the province of Neuquén, as no activity is expected to take place in the block in the near term and our outlook of lower gas prices. This figure compares with the impairments on PP&E of US$821 million in 3Q19 – CGU Gas Neuquina Basin – and US$850 during 2Q20 – CGU Gas of the Neuquina and Austral Basins.

In addition, a charge of US$85 million in connection to the Voluntary Retirement Program implemented by the Company was included during the quarter.

Financial results, net, for 3Q20 represented a loss of US$98 million, compared to the US$549 million gain posted in 3Q19, mainly as FX gains related to the impact that the devaluation has on our net liabilities were US$645 million lower (US$100 million in 3Q20 versus US$745 million in 3Q19). Additionally, net interest expense amounted to US$230 million during 3Q20, improving by 13.2% y/y, as a result of a lower average debt compared to the same period of 2019.

As a whole, net income for the quarter represented a loss of US$482 million, compared to a loss of US$252 million over the same period of 2019.

Adjusted EBITDA decreased 59.9% y/y, but recovered 13x q/q. The decrease over the same period of last year is mainly related to the decline in volumes sold and lower prices measured in dollars for all our main products as mentioned above. On a sequential basis, the recovery was the result of an improvement in demand for refined products coupled with a 3.6% decline in our total production costs.

The EBITDA and Adjusted EBITDA calculations are modified by certain items that have a different treatment on our Financial Statements based on accounting rules as follow:

- 3Q20: Includesstand-bycosts for US$65 million, charges related to the Voluntary Retirement Program for US$85 million, and a US$6 million provision related to Decree No. 1053/2018, but excludes the impairment of intangible assets for US$19 million.

- 2Q20: Includesstand-bycosts for US$83 million, and a US$118 million provision related to Decree No. 1053/2018, but excludes the impairment of PP&E for US$850 million, and the US$65 million gain related to the sale of an 11% stake in Bandurria Sur.

- 3Q19: Includesstand-bycosts for US$12 million but excludes the impairment of PP&E for US$821 million.

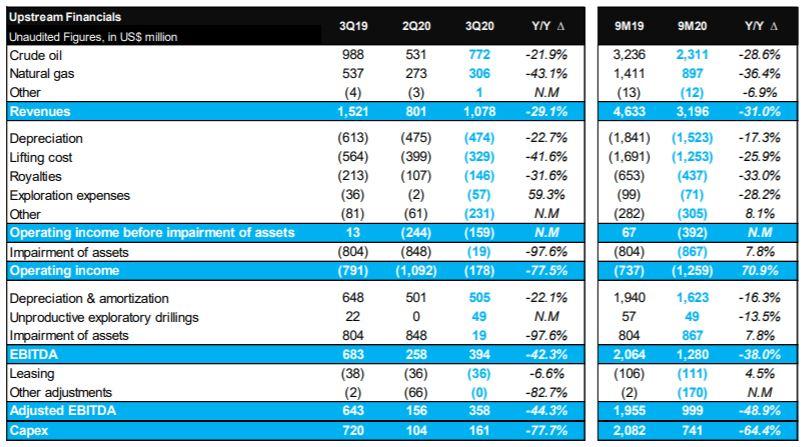

Revenues decreased 29.1% compared to 3Q19, reaching US$1,078 million, but experienced a 34.6% expansion q/q. The reason behind que y/y behavior was a reduction in both oil and natural gas sales. Crude oil revenues decreased 21.9% as the price decreased by 17.4% and volumes follow the downtrend, contracting 10.9%. For natural gas, sales declined y/y as prices and output went down by 31.9% and 19.4%, respectively. On the contrary, the sequential expansion in Upstream sales was mainly backed by the stabilization of output and the recovery in oil prices – crude oil sales expanded 45.3% q/q.

Operating cost for the period also decreased y/y mainly due to the following:

- Lifting costs decreased 41.6% y/y mainly due to the decrease in activity, and subsequent adjustments in the level of production, in addition to the security protocols established in each operation.

- Royalties went down by 31.6% y/y, principally due to lower production. Royalties in connection with crude oil decreased 29.1%, while the charge related to natural gas declined by 37.4%.

- Transportation costs (included in the Other category) of US$29 million decreased by 42.1% mainly due to lower activity.

Expenses related to equipment and service shutdowns (stand by) amounted to US$65 million during the quarter, which compares to the US$12 million in 3Q19 and US$83 million during 2Q20. This is mainly due to the halt in the execution of projects to guarantee the safety of the personnel involved to prevent the spread of theCOVID-19virus, and to adapt our level of production to market needs.

Exploration expenses increased 59.3% in relation to 3Q19 mainly due to higher negative results from unproductive exploratory drilling in the current quarter.

On a per unit basis, our cash cost of US$15.0/boe decreased y/y and q/q despite the resumption in activity. When compared to a year ago, the decrease in both lifting and royalties is mainly related to the lower activity level. Sequentially, a further reduction in lifting cost – mainly due to effects that took place during 2Q20 and a gradual increase in activity – more than offset higher royalties as sales expanded.

Total hydrocarbon production for 3Q20 decreased 11.6% y/y to 468.5 Kboed as activity was affected by the mandatory lockdown measures. We adjusted activity to guarantee the safety of the personnel involved in the operations and to adapt to the level of production necessary to meet market needs. As a result, crude oil production declined 10.9%, to 202.4Kbbld, mainly onlockdown-drivenlosses. Natural gas decreased 19.4%, to 35.2 Mm3d, driven by the natural decline of our fields due to the decrease in activity which was exacerbated by the context of excess supply. In turn, NGL production increased 57.1% given that during 2019 a fire in DOW’s Ethylene plant limited the use of the installed capacity of MEGA to produce Ethane.

During August, the reactivation of tower equipment and services began, which allowed for a stabilization in production on a sequential basis (+0.4%).

Output from our shale areas reached 103.1 Kboed, being stable y/y (+0.1%) and recovering 4.0% over last quarter. This was due to an increase in our shale oil production (+10.9% y/y and 13.8% q/q), more than offsetting the decrease in shale gas output, driven by the reopening of wells in Loma Campana while no new unconventional wells were connected during the quarter.

The average realization price for crude oil during 3Q20 decreased by 17.4% to US$ 40.1/bbl.

However, there were two different pricing trends. During July and August, Decree No. 488/2020 was in force, which established a reference price for Medanito quality crude at US$45/bbl. This Decree was rendered invalid on August 28th as Brent traded above US$45/bbl for ten consecutive days. Since then, the local crude is priced at export parity, which means a lower price for Medanito, but a higher price for Escalante, making our average price being almost unaltered.

The average realization price for natural gas for the quarter was US$2.7/MMBTU, including US$0.12 of subsidies. The y/y decrease was the consequence of the excess offer in natural gas in the market.

In 3Q20, capex totaled US$161 million, 77.7% below 3Q19 still affected by the lower level of activity. However, investments expanded 54.6% q/q, as we have been gradually resuming activity in provinces where we have already reached agreements with the unions and vendors.

In August, conventional drilling activity was resumed in the Golfo San Jorge basin with 1 rig in August and 2 more were added in September, while unconventional activity resumed in September with 3 drilling rigs and 1 fracture set in the Neuquén basin. At the end of the quarter, our backlog of drilled but uncompleted wells (―DUC‖) remained unchanged, totaling 71 for shale oil and 10 for shale gas.

Regarding exploration, no wells were drilled during the quarter and the 2D seismic that was suspended due to COVID has not yet been resumed. On the contrary, we acquired 3,000km of 2D seismic in the CAN_102 block (offshore), and we are currently processing it.

Corporate & Other

This business segment involves mainly corporate costs and other activities that are not reported in any of the previously mentioned business segments.

Corporate adjusted EBITDA for 3Q20 represented a loss of US$49 million, improving 12.2% y/y, mainly driven by fewer losses coming from our controlled companyA-EvangelistaS.A. – due to higher-than-usuallosses in ongoing projects that negatively affected results in 3Q19.

Liquidity & Capital

Net cash flows provided by operating activities amounted to US$666 million in 3Q20, 44.3% y/y less mainly due to a decrease in Adjusted EBITDA, partially offset by a decrease in working capital that includes, among others, the collection of three installments from the ―Plan Gas Bonds‖. Operating cash flow expanded by 33.7% q/q mainly due to the recovery in profitability.

Net cash flows from investing activities were of US$279 million, decreased 65.0% y/y as we adjusted our investments to preserve liquidity. Total cash investments during the period were significantly reduced by 76.2% y/y to US$191 million, including purchases of materials and payments due from previous periods. In addition, during the quarter, financial assets position increased for a net amount of US$88 million.

Net cash flows from financing activities amounted to negative US$730 million mainly driven by a negative net borrowing figure of US$403 million(-3.6%y/y) and interest payments of US$251 million (+3.2% y/y). During the quarter, we successfully managed to refinance 58.7% of our 2021 bonds (Class XLVII) after concluding the market friendly liability management exercise on July 31, 2020. As a result of the operation, we retired old notes for a total of US$587.3 million and issued new 2025 amortizing notes (Class XIII) for US$542.8 million. In addition, we paid down debt maturities including amortizations of local bonds for US$105 million and global bonds for US$159 million.

The previously described cash generation, together with the Company’s investment in Argentine sovereign bonds and Treasury notes (US$220 million at market value), resulted in a position of cash and cash equivalents of US$1,004 million as of September 30, 2020.

Debt

As of September 30, 2020, YPF’s consolidated net debt totaled US$7.203 billion, decreasing by US$184 million q/q driven by better profitability. During the quarter we decided to voluntary reduce our cash position by US$298 million given the high cost of carrying most of our liquidity in pesos. The peso portion of our cash and cash equivalents increased to 61% – versus 51% in 2Q20 and 22% in 3Q19 – as Communication ―A‖ 7030 from the Argentine Central Bank restricts corporations from holding liquid assets abroad if they want to continue having access to the official FX market.

We used part of this amount and the excess cash generated by the improvement in profitability to reduce our debt levels. Consequently, at the end of September, our total debt decreased by 5.6% q/q to US$8,207 million.

Despite the improvement in profitability, ournet-debt-to-last-twelve-month-adjusted-EBITDAratio was 3.7x higher than the 2.9x ratio in 2Q20 due to the deterioration of our EBITDA over the most recent quarters.

Related Categories :

Third Quarter (3Q) Update

More Third Quarter (3Q) Update News

-

Evolution Petroleum Corporation Fiscal Third Quarter 2023 Results

-

Civitas Resources Third Quarter 2022 Results

-

Murphy Oil Third Quarter 2022 Results

-

ConocoPhillips Third Quarter 2022 Results

-

California Resources Third Quarter 2022 Results

South America News >>>

-

Kosmos Energy Ltd. First Quarter 2023 Results

-

California Resources Corporation First Quarter 2023 Results -

-

Berry Corporation First Quarter 2023 Results -

-

Hess Corporation First Quarter 2023 Results -

-

Shell Fourth Quarter, Full Year 2022 Results -