Drilling & Completions | Quarterly / Earnings Reports | Third Quarter (3Q) Update | Financial Results | Capital Markets | Capital Expenditure | Drilling Activity

Matador Resources Third Quarter 2021 Results

Matador Resources Co. reported its Q3 2021 results.

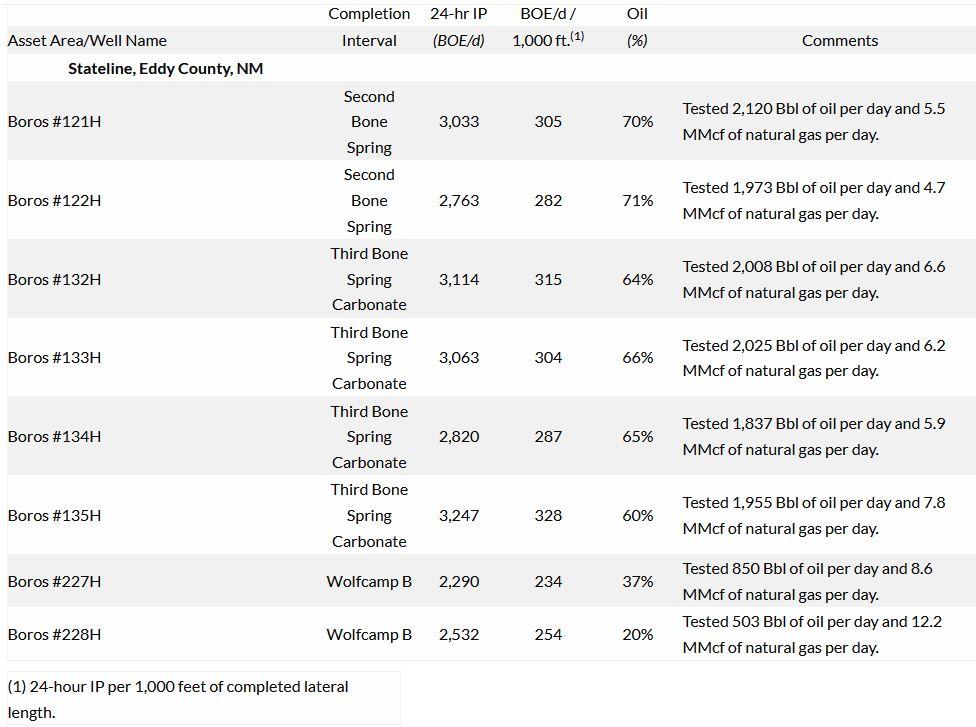

Significant Well Results

The following table highlights the 24-hour initial potential ("IP") test results from eight of the 13 most recent Boros wells turned to sales in the Stateline asset area in southeastern Eddy County, New Mexico, all of which are two-mile laterals. Four of these wells were completed in the Third Bone Spring Carbonate interval and were the first tests of this formation in the Company's Stateline asset area. Matador was very pleased with these test results and with the initial performance of these wells.

Test results from the two Second Bone Spring and the two Wolfcamp B completions are similar to those from other Boros or Voni wells completed in these intervals. Matador has included four additional Wolfcamp B wells in its next group of 11 Voni wells to be completed in the fourth quarter of 2021 to take advantage of the recent increase in natural gas prices. The other five Boros wells recently turned to sales-three Avalon completions and two First Bone Spring completions-are still cleaning up following completion operations on those wells. Given the lower reservoir pressure in these intervals, Matador expects to install artificial lift on these wells prior to establishing IP test results.

Joseph Wm. Foran, Matador's Chairman and CEO, commented, "On both our website and the webcast planned for tomorrow's earnings conference call is a set of six slides identified as `Chairman's Remarks' (Slides A through F) to add color and detail to my remarks. We invite you to review these slides in conjunction with my comments below, which are intended to provide context for the third quarter 2021 results compared to Matador's stated goals for the year.

Q3 Results Above Expectations

"The third quarter of 2021 was another excellent quarter for Matador with production and financial results above our expectations, including better-than-expected oil, natural gas and total oil equivalent production, record oil and natural gas revenues, record net income and record Adjusted EBITDA (see Slide A). San Mateo also had a great third quarter, including better-than-expected operating and financial results, while also closing three new third-party midstream opportunities during the quarter (see Slide B). The Board and I would like to acknowledge and express our sincere appreciation to both the Matador and San Mateo teams for their strong execution once again in the third quarter of 2021. Given these strong third quarter results and our continued confidence in Matador's growing operational and financial strength and our increasing ability to return value to shareholders, we were very pleased to announce yesterday that the Board doubled Matador's quarterly cash dividend from $0.025 per share, initiated earlier this year, to $0.05 per share, payable on December 1, 2021 to shareholders of record as of November 10, 2021.

"Net cash provided by operating activities in the third quarter was $291.2 million, a 13% sequential increase, leading to third quarter 2021 adjusted free cash flow of $147.5 million. This adjusted free cash flow included $6.0 million in performance incentives received by Matador from our midstream joint venture partner Five Point Energy LLC for wells turned to sales and connected to San Mateo during the third quarter. Given this strong free cash flow, Matador repaid $120 million in borrowings outstanding under its reserves-based revolving credit facility in the third quarter of 2021, and the Company has repaid another $20 million in October. As a result of these recent repayments totaling $140 million, Matador has reduced the current borrowings outstanding under its reserves-based revolving credit facility to $100 million, as compared to $475 million at the end of the third quarter of 2020. Matador's leverage ratio under the reserves-based revolving credit facility declined to 1.3x at the end of the third quarter, which marks Matador's lowest leverage ratio since mid-2018 (see Slide C). Paying quarterly dividends to shareholders, reducing debt and increasing the value of Matador's reserves, production and midstream assets were among Matador's key priorities for 2021, and we are very pleased with the progress we have made so far this year in all these areas.

Strong Well Results and Improved Capital Efficiency

"Matador's 2021 priorities and milestones are shown in Slide D, and we continue to execute well on this operating and capital efficiency plan for 2021. During the third quarter of 2021, we achieved our third key operational milestone when we turned to sales four wells in the Greater Stebbins Area. In addition, we achieved our fourth key operational milestone slightly ahead of schedule when we turned to sales the next 13 Boros wells in the Stateline asset area at various times primarily throughout September. We remain very pleased with the well results being achieved all across our acreage position in the Delaware Basin, and we were especially pleased this quarter with the test results and initial well performance from the first four wells completed in the Third Bone Spring Carbonate interval in the Stateline asset area (see Slide E).

"Matador's operating efficiencies continue to improve, including cost controls and progress reducing `days on wells,' in both our drilling and completion operations. These operating efficiencies helped to offset increased oilfield service costs and allowed us to keep our drilling and completion costs in check during the third quarter of 2021. Drilling and completion costs averaged approximately $650 per completed lateral foot in the third quarter of 2021 and averaged $655 per completed lateral foot in the first nine months of 2021, which was unchanged as compared to the first six months of 2021 (see Slide F). This improvement in capital efficiency through our transition to drilling and completing longer laterals has been and continues to be a high priority for Matador. As we have previously noted, Matador expects that 98% of the operated wells it turns to sales this year should have completed lateral lengths of two miles or longer, with an average completed lateral length of 10,400 feet.

Looking Ahead

"The fourth quarter of 2021 should continue to be pleasing for Matador and its stakeholders as we work to increase free cash flow, lower costs, reduce debt, pay dividends and grow the value of our oil and natural gas and midstream assets. Operationally, we expect to complete nine new wells in our Greater Stebbins Area, which should be turned to sales late in the fourth quarter of 2021, and 11 new Voni wells in our Stateline asset area, which should be turned to sales beginning in mid-February 2022. Although we expect higher-than-usual production volumes to be shut in while we complete these new wells during the fourth quarter of 2021, this production should be deferred for only a short time, and these fourth quarter completion operations should set us up for a great start to 2022."

Q3 Highlights:

Net Cash Provided by Operating Activities and Adjusted Free Cash Flow

- Third quarter 2021 net cash provided by operating activities was $291.2 million (GAAP basis), leading to third quarter 2021 adjusted free cash flow (a non-GAAP financial measure) of $147.5 million.

Net Income, Earnings Per Share and Adjusted EBITDA

- Third quarter 2021 net income (GAAP basis) was $203.6 million, or $1.71 per diluted common share, a 92% sequential increase from net income of $105.9 million in the second quarter of 2021, and a significant year-over-year increase from a net loss of $276.1 million in the third quarter of 2020. The change in net income between the year-over-year periods was significantly impacted by realized oil and natural gas prices of $69.73 per barrel and $6.27 per thousand cubic feet, respectively, in the third quarter of 2021, as compared to $38.67 per barrel and $2.27 per thousand cubic feet, respectively, in the third quarter of 2020. The year-over-year change in net income was also impacted by a non-cash full cost ceiling impairment of $251.2 million recorded in the third quarter of 2020, as compared to no such impairment recorded in the third quarter of 2021.

- Third quarter 2021 adjusted net income (a non-GAAP financial measure) was $148.6 million, or $1.25 per diluted common share, a 22% sequential increase from adjusted net income of $121.7 million in the second quarter of 2021, and an almost 13-fold year-over-year increase from adjusted net income of $11.6 million in the third quarter of 2020.

- Third quarter 2021 adjusted earnings before interest expense, income taxes, depletion, depreciation and amortization and certain other items ("Adjusted EBITDA," a non-GAAP financial measure) were $293.8 million, a 13% sequential increase from $261.0 million in the second quarter of 2021, and a 143% year-over-year increase from $121.0 million in the third quarter of 2020.

Oil, Natural Gas and Total Oil Equivalent Production Above Expectations

- As summarized in the table below, Matador's third quarter 2021 average daily oil, natural gas and total oil equivalent production all exceeded the Company's expectations for the third quarter. The majority of the production outperformance resulted from the 13 Boros wells in the Stateline asset area that were turned to sales late in the third quarter as opposed to early in the fourth quarter due to improved efficiencies in the Company's completion operations on those wells. The third quarter 2021 natural gas production outperformance also reflected additional working interests acquired on certain of the Company's previously existing wells and initial natural gas volumes associated with certain of the Company's mineral interests in the Haynesville shale, which the Company did not previously expect to receive in the third quarter.

Operating Efficiencies Keeping Drilling and Completion Cost Near Record Lows

- Drilling and completion costs for the 17 operated horizontal wells turned to sales in the third quarter of 2021 averaged approximately $650 per completed lateral foot, a decrease of 24% from average drilling and completion costs of $850 per completed lateral foot achieved in full year 2020. Drilling and completion costs associated with the 38 operated horizontal wells turned to sales in the first nine months of 2021 averaged approximately $655 per completed lateral foot, which was unchanged as compared to the first six months of 2021 and was primarily attributable to improved efficiencies in the Company's drilling and completion operations, which helped to offset increased oilfield service costs.

- As further discussed in the Company's press release dated October 20, 2021, Matador incurred capital expenditures for drilling, completing and equipping wells ("D/C/E capital expenditures") of approximately $121 million in the third quarter of 2021, or 14% below the Company's estimate of $140 million for D/C/E capital expenditures during the third quarter. Matador estimates that approximately $5 to $6 million of these savings were directly attributable to continued improvement in operational efficiencies resulting in lower-than-expected drilling and completion costs in the Delaware Basin. The remainder of these lower costs resulted primarily from the timing of both operated and non-operated drilling and completion activities, and most of these costs are currently expected to be incurred in the fourth quarter of 2021.

Credit Rating and Senior Unsecured Notes Upgrades and Initiations

- On September 7, 2021, Moody's Investors Service upgraded Matador's corporate credit rating from B2 to B1 and upgraded the issue-level rating of Matador's senior unsecured notes from B3 to B2.

- On September 29, 2021, Fitch Ratings, Inc. assigned Matador an initial corporate credit rating of B+ and assigned the Company's senior unsecured notes an issue-level rating of BB-.

Quarterly Cash Dividend Doubled

- On October 25, 2021, Matador announced that its Board of Directors amended the Company's dividend policy to double the quarterly cash dividends to be paid on its common stock to $0.05 per share from the Board's prior policy of $0.025 per share. Pursuant to this revised policy, the Board declared a quarterly cash dividend of $0.05 per share of common stock payable on December 1, 2021 to shareholders of record as of November 10, 2021.

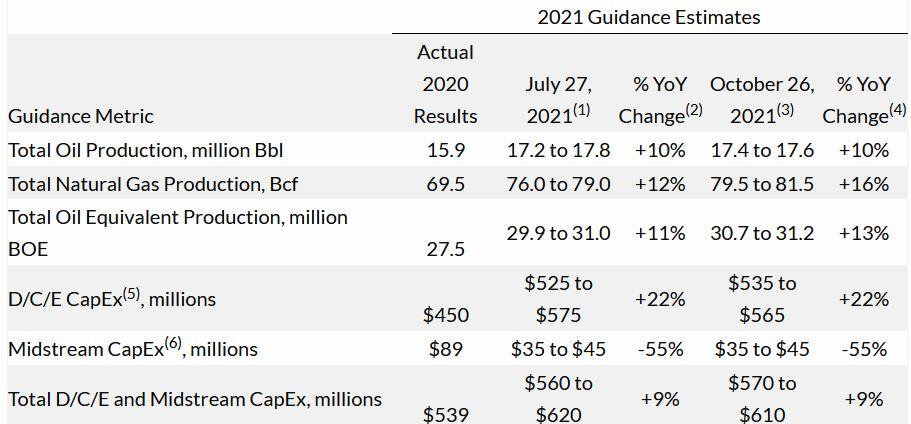

Full Year 2021 Guidance Update

As shown in the table below, effective October 26, 2021, Matador updated its full year 2021 guidance estimates for oil, natural gas and total oil equivalent production and D/C/E capital expenditures, which were originally provided on February 23, 2021 and previously affirmed on July 27, 2021. At October 26, 2021, Matador increased the midpoint of its full year 2021 total natural gas production guidance by 4%, from 77.5 billion cubic feet to 80.5 billion cubic feet, and increased the midpoint of its full year 2021 total oil equivalent production guidance by 2%, from 30.45 million BOE to 30.95 million BOE. The Company narrowed the expected ranges of its guidance for full year 2021 total oil production and D/C/E capital expenditures, but left the midpoints of its full year 2021 guidance for total oil production and D/C/E capital expenditures unchanged.

At October 26, 2021, Matador also affirmed its full year 2021 estimates for midstream capital expenditures of $35 to $45 million, which were previously updated on July 27, 2021.

The guidance estimates presented in the table above reflect the following updates or affirmations to Matador's anticipated operating plan for the remainder of 2021.

- Consistent with its original February 23, 2021 estimates, Matador still expects to turn to sales 49 gross (45.6 net) operated horizontal wells, with an average completed lateral length of 10,400 feet, during full year 2021. At October 26, 2021, the Company has turned to sales 38 gross (36.2 net) operated horizontal wells.

- Matador still plans to advance the next 11 Voni well completions in the Stateline asset area forward into the fourth quarter of 2021 as previously disclosed on July 27, 2021. These next 11 Voni well completions are expected to be turned to sales in a staggered fashion beginning in mid-February 2022. As previously disclosed, Matador expects to be able to complete these next 11 Voni wells during November and December 2021 without increasing its estimates for D/C/E capital expenditures for full year 2021.

- In August 2021, Matador began operating a fifth drilling rig on behalf of its midstream affiliate, San Mateo, for the purpose of drilling an additional salt water disposal well in the southern portion of the Company's Arrowhead asset area in Eddy County, New Mexico (the "Greater Stebbins Area"). This new salt water disposal well and the associated facilities are needed and expected to handle additional produced water volumes attributable to Matador's increased drilling and completion activity in the Greater Stebbins Area during 2021. The anticipated drilling and completion of this new salt water disposal well was included as part of San Mateo's 2021 capital expenditures budget as originally provided by the Company on February 23, 2021 and subsequently updated on July 27, 2021. Drilling operations on this salt water disposal well were completed in late September 2021, and this well is currently undergoing completion operations (see Matador's October 20, 2021 press release for additional details).

- Matador contracted this fifth drilling rig for a term of six months. As a result, in early October 2021, following the conclusion of drilling operations on the salt water disposal well, Matador moved this rig to its Rodney Robinson leasehold in the western portion of the Antelope Ridge asset area in Lea County, New Mexico. Matador expects to drill nine new wells there in the fourth quarter of 2021. These nine Rodney Robinson wells are anticipated to be completed in January and February 2022 and turned to sales before the end of the first quarter of 2022. As a result of the additional D/C/E cost savings of $5 to $6 million achieved in the third quarter of 2021, as noted above, Matador left the midpoint of its updated full year 2021 guidance for D/C/E capital expenditures unchanged at October 26, 2021, despite operating this fifth drilling rig during the fourth quarter of 2021.

Q4 2021 Completions and Production Cadence Update

Fourth Quarter 2021 Estimated Wells Turned to Sales

At October 26, 2021, Matador expects to complete and turn to sales eleven gross (9.4 net) operated horizontal wells in the Delaware Basin during the fourth quarter of 2021, all of which are two-mile laterals, including nine gross (8.0 net) wells in the Greater Stebbins Area and two gross (1.4 net) wells in the Ranger asset area.

Fourth Quarter 2021 Estimated Oil, Natural Gas and Total Oil Equivalent Production

The table below provides Matador's estimates, as of October 26, 2021, for the anticipated quarterly sequential changes in the Company's average daily total oil equivalent, oil and natural gas production for the fourth quarter of 2021. Matador estimates that its fourth quarter 2021 average daily total production should be approximately 81,500 BOE per day, including an estimated 46,000 barrels of oil per day and 212 million cubic feet of natural gas per day, or about 3% less than its previous fourth quarter 2021 estimates as provided on July 27, 2021. This decrease in estimated fourth quarter 2021 production results largely from an increased number of wells now expected to be shut in during the fourth quarter of 2021 as both the next nine wells in the Greater Stebbins Area and the next 11 Voni wells in the Stateline asset are completed during the fourth quarter.

In the Stateline asset area, these shut-ins are expected to include a significant number of the 39 currently producing wells at various times during the fourth quarter. Several of these wells are now expected to be shut in longer than originally anticipated during November and December of 2021, based upon the Company's experience in completing the 13 most recent Boros wells. These shut-in production volumes are expected to be restored in a staggered fashion during January 2022 as plugs are drilled out on the next 11 Voni wells following hydraulic fracturing operations and these wells are prepared to be turned to sales in mid-February 2022. The return of these shut-in volumes to production in early 2022, as well as the initial production associated with the next 11 Voni wells, is expected to contribute to a significant increase to the Company's anticipated production volumes in the first quarter of 2022 and throughout 2022. Matador expects to provide its estimated first quarter 2022 and full year 2022 production guidance, along with its full year 2022 guidance for estimated D/C/E capital expenditures and estimated midstream capital expenditures in late February 2022, as is customary for the Company.

|

Estimated Sequential Change in Q4 2021 |

|||

|

Period |

Average Daily Total |

Average Daily Oil |

Average Daily Natural |

|

Q4 2021 |

-9% to -10% |

-9% to -10% |

-9% to -11% |

Operations Update

Drilling and Completions Activity

At October 26, 2021, Matador was operating five drilling rigs throughout its various Delaware Basin asset areas. Two of these rigs were drilling the next nine wells on the Rodney Robinson leasehold in the western portion of the Company's Antelope Ridge asset area. One of these rigs was concluding drilling operations on the next group of 11 Voni wells in the Stateline asset area, and another was concluding drilling operations on the second of two Uncle Ches wells in the Ranger asset area. One of these rigs recently began drilling three Barnett Trust wells in the Wolf asset area. As noted above, Matador expects to complete and turn to sales eleven gross (9.4 net) operated horizontal wells in the Delaware Basin during the fourth quarter of 2021, all of which are two-mile laterals, including nine gross (8.0 net) wells in the Greater Stebbins Area and two gross (1.4 net) wells in the Ranger asset area.

Wells Completed and Turned to Sales

During the third quarter of 2021, Matador completed and turned to sales a total of 21 gross (17.2 net) wells in its various Delaware Basin operating areas. This total was comprised of 17 gross (16.5 net) operated wells and four gross (0.7 net) non-operated wells. The 17 operated wells included four gross (3.5 net) operated wells turned to sales early in the third quarter of 2021 in the Greater Stebbins Area (Arrowhead asset area), as well as the second group of 13 gross (13.0 net) Boros wells in the Stateline asset area. The 13 new Boros wells were originally anticipated to be turned to sales early in the fourth quarter of 2021, but Matador was able to turn these wells to sales at various times primarily throughout September 2021 resulting from improved efficiencies in the Company's drilling and completion operations on those wells.

Realized Commodity Prices

Oil Prices

Matador's weighted average realized oil price, excluding derivatives, was $69.73 per barrel in the third quarter of 2021, a 7% sequential increase from $64.90 per barrel in the second quarter of 2021, and an 80% year-over-year increase from $38.67 per barrel in the third quarter of 2020. Matador's weighted average oil price differential relative to the West Texas Intermediate ("WTI") benchmark, inclusive of the monthly roll and transportation costs, was ($0.79) per barrel in the third quarter of 2021, as compared to ($1.27) per barrel in the second quarter of 2021 and ($2.25) in the third quarter of 2020.

For the fourth quarter of 2021, Matador's weighted average oil price differential relative to the WTI benchmark price, inclusive of the monthly roll and transportation costs, is anticipated to be in the range of ($1.00) to ($1.50) per barrel.

Matador's realized loss on oil derivatives was approximately $52.8 million in the third quarter of 2021, and Matador had approximately 60% of its oil production hedged during the third quarter. These realized losses were primarily attributable to the significant increase in WTI oil prices during the first three quarters of 2021, resulting in WTI oil prices that were above the strike price for most of the Company's oil swaps (approximately $35 per barrel) and above the weighted average ceiling price of approximately $55 per barrel for the Company's costless collars. Matador has similar oil hedges in place for the fourth quarter of 2021, and these contracts all expire at the end of 2021.

At October 26, 2021, Matador has approximately two million barrels of oil hedged for full year 2022 using costless collars with a weighted average floor price of approximately $50 per barrel and a weighted average ceiling price of approximately $68 per barrel. Please see the accompanying slide presentation for a more complete summary of Matador's current hedging positions.

Natural Gas Prices

Matador's weighted average realized natural gas price, excluding derivatives, was $6.27 per thousand cubic feet in the third quarter of 2021, a 41% sequential increase from $4.46 per thousand cubic feet in the second quarter of 2021, and an almost three-fold increase from $2.27 per thousand cubic feet in the third quarter of 2020. NGL prices, and especially propane prices, continued to be strong in the third quarter, which contributed to the Company's weighted average natural gas price being well above the Company's expectations in the third quarter of 2021. For the third quarter of 2021, Matador's weighted average natural gas price differential relative to the Henry Hub benchmark price was +$1.95 per thousand cubic feet, as compared to +$1.48 per thousand cubic feet in the second quarter of 2021 and +$0.15 per thousand cubic feet in the third quarter of 2020. Matador is a two-stream reporter, and the revenues associated with its NGL production are included in the weighted average realized natural gas price.

For the fourth quarter of 2021, Matador's weighted average natural gas price differential relative to the Henry Hub benchmark price is anticipated to be in the range of +$1.50 to +$2.00 per thousand cubic feet, assuming NGL prices continue to remain strong throughout the fourth quarter.

Matador's realized loss on natural gas derivatives was approximately $4.6 million in the third quarter of 2021, and Matador had approximately 50% of its natural gas production hedged during the third quarter. These realized losses were primarily attributable to the significant increase in natural gas prices during the third quarter of 2021, resulting in natural gas prices that were above the weighted average ceiling price of approximately $3.60 per MMBtu for most of the Company's natural gas costless collars. Matador has approximately 13.9 billion cubic feet of natural gas hedged in the fourth quarter of 2021 using costless collars with a weighted average floor price of approximately $2.53 per MMBtu and a weighted average ceiling price of approximately $4.71 per MMBtu, and these contracts all expire at the end of 2021.

At October 26, 2021, Matador has approximately 8.3 billion cubic feet of natural gas hedged in the first quarter of 2022 using costless collars with a weighted average floor price of approximately $2.70 per MMBtu and a weighted average ceiling price of approximately $6.33 per MMBtu. Matador currently has no natural gas hedges in place beyond the first quarter of 2022.

Operating Expenses

On a unit of production basis:

- Production taxes, transportation and processing expenses increased 14% sequentially from $5.17 per BOE in the second quarter of 2021 to $5.90 per BOE in the third quarter of 2021. This increase was primarily attributable to increased production taxes associated with oil and natural gas revenues of $461.5 million, an all-time quarterly high, reported by Matador in the third quarter.

- Lease operating expenses decreased 2% sequentially from $3.39 per BOE in the second quarter of 2021 to $3.31 per BOE in the third quarter of 2021. Lease operating expenses in the third quarter reflected decreases in costs associated with workovers, chemicals and ad valorem taxes partially offset by expenses associated with servicing an increased number of wells over time.

- General and administrative expenses increased 3% sequentially from $2.88 per BOE in the second quarter of 2021 to $2.97 per BOE in the third quarter of 2021. General and administrative expenses in the third quarter reflected the reinstatement of employee compensation beginning in March 2021, which had been previously reduced beginning in March 2020 in response to the significantly lower oil and natural gas price environment at that time. In addition, no bonuses were awarded to Matador management and staff in 2020. General and administrative expenses also reflected an increase in stock-based compensation expense associated with the Company's cash-settled stock awards, the values of which are remeasured at each reporting period. Matador's share price increased 6% from $36.01 at June 30, 2021 to $38.04 at September 30, 2021.

San Mateo Highlights and Update

Operating Highlights and Financial Results

San Mateo's operations in the third quarter of 2021 were highlighted by better-than-expected financial results. Operationally, natural gas gathering and processing, oil gathering and transportation and water handling volumes achieved in the third quarter of 2021 were all similar to the respective volumes reported in the second quarter of 2021. Third quarter 2021 volumes do not include the full quantity of volumes that would have otherwise been delivered by certain San Mateo customers subject to minimum volume commitments (although partial deliveries were made in the third quarter), but for which San Mateo recognized revenues during the third quarter of 2021. San Mateo anticipates natural gas gathering and processing, water handling and oil gathering and transportation volumes should increase significantly in the first quarter of 2022.

During the third quarter of 2021, San Mateo closed three new midstream transactions with oil and natural gas producers in Eddy County, New Mexico, which are expected to generate additional natural gas gathering and processing, oil gathering and transportation and water handling volumes in future periods as these operators drill additional wells on the dedicated acreage. All of these new opportunities reflect additional business awarded to San Mateo by existing customers, which San Mateo believes is indicative of the quality of service it provides to all of its customers in the Delaware Basin.

Operating Highlights

During the third quarter of 2021, San Mateo:

- Handled an average of 284,000 barrels of produced water per day, a 1% sequential increase, as compared to 281,000 barrels per day in the second quarter of 2021, and a 21% year-over-year increase, as compared to 233,000 barrels per day in the third quarter of 2020.

- Gathered or transported an average of 42,500 barrels of oil per day, a 3% sequential decrease, as compared to 43,900 barrels per day in the second quarter of 2021, but a 39% year-over-year increase, as compared to 30,600 barrels per day in the third quarter of 2020.

- Gathered an average of 248 million cubic feet of natural gas per day, a 2% sequential decrease, as compared to 252 million cubic feet per day in the second quarter of 2021, but a 28% year-over-year increase, as compared to 193 million cubic feet per day in the third quarter of 2020.

- Processed an average of 232 million cubic feet of natural gas per day at its Black River Processing Plant, a 4% sequential increase, as compared to 223 million cubic feet per day in the second quarter of 2021, and a 54% year-over-year increase, as compared to 150 million cubic feet per day in the third quarter of 2020.

Financial Results

During the third quarter of 2021, San Mateo achieved better-than-anticipated financial results as described below.

- Net income (GAAP basis) of $29.5 million, a 10% sequential decrease from a record high of $32.6 million in the second quarter of 2021, but a 45% year-over-year increase from $20.3 million in the third quarter of 2020.

- Adjusted EBITDA (a non-GAAP financial measure) of $40.8 million, a 3% sequential decrease from a record high of $42.3 million in the second quarter of 2021, but a 46% year-over-year increase from $28.0 million in the third quarter of 2020.

- Net cash provided by San Mateo operating activities (GAAP basis) of $44.2 million, leading to San Mateo adjusted free cash flow (a non-GAAP financial measure) of $8.4 million.

Capital Expenditures

Matador's portion of San Mateo's capital expenditures was approximately $14.7 million in the third quarter of 2021, approximately 8% below the Company's estimate of $16.0 million for the quarter. During the fourth quarter of 2021, the Company expects to incur midstream capital expenditures of approximately $16.0 million associated primarily with San Mateo's new midstream opportunities and with new infrastructure San Mateo is adding to handle anticipated increased volumes from Matador. These midstream capital expenditures primarily reflect Matador's 51% share of San Mateo's estimated capital expenditures for the third and fourth quarters of 2021.

Related Categories :

Third Quarter (3Q) Update

More Third Quarter (3Q) Update News

-

Evolution Petroleum Corporation Fiscal Third Quarter 2023 Results

-

Civitas Resources Third Quarter 2022 Results

-

Murphy Oil Third Quarter 2022 Results

-

ConocoPhillips Third Quarter 2022 Results

-

California Resources Third Quarter 2022 Results

Permian News >>>

-

Why Surface-Only Inventory Predictions Are a Fool’s Errand

-

Occidental Eyes $10 Billion OxyChem Sale Amid Debt and Capital Discipline Push -

-

Permian Gas Gets New Highway: Transwestern’s 1.5 Bcf/d Desert Southwest Expansion -

-

WaterBridge Infrastructure Brings Delaware Basin Water Model to Wall Street -

-

OPEC+ Nudges Supply Higher: Why This Weekend’s Hike Echoes 2020—But Isn’t 2020

Permian - Delaware Basin News >>>

-

SM Energy Hits Record Output; Driven by Uinta

-

The Permian Play: How ExxonMobil Is Rewriting the Shale Narrative -

-

Large Cap E&P To Reduce Drilling & Completion Activity in 2026 -

-

$2.4B Deal Gives MPLX Sour Gas Edge in Permian -

-

Liberty Energy: Navigating the Frac Downturn with Efficiency, Innovation, and Strategic Focus -