Finance & Investing | Top Story | Financial Trouble | Capital Markets | Corporate Strategy

Silverbow Resources Board Adopts 'Poison Pill' Strategy

SilverBow Resources Inc.'s board has unanimously adopted a limited-duration stockholder rights plan (a so-called poison pill strategy) following "significant accumulations" of the company's outstanding common stock.

Activist investor Kimmeridge Energy reported owning 14.7% of Silverbow's stock in its latest SEC filing.

The Rights Plan is effective immediately.

Marcus C. Rowland, Independent Chairman of the Board said: "SilverBow's Board is committed to acting in the best interests of all of the Company's stockholders, and will continue to take actions that we believe will drive long-term value. We want investors to realize the full value of their investment and receive fair and equal treatment, which is what the Rights Plan is designed to ensure."

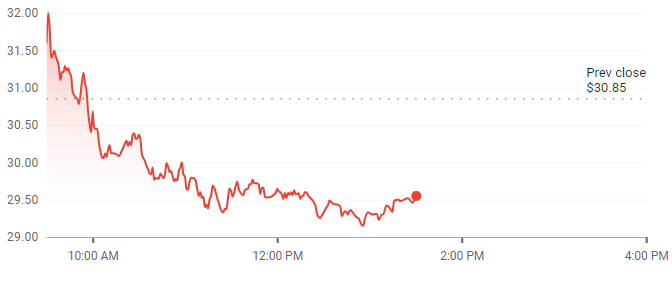

The company's stock fell over 4% following the announcement.

Source: Google Finance

Additional Information on the Rights Plan

The rights will be exercisable only if a person or group acquires 15% or more of the Company's outstanding common stock. Each right will entitle stockholders to buy one one-thousandth of a share of a new series of junior participating preferred stock at an exercise price of $160.00.

If a person or group acquires 15% of the Company's outstanding common stock, each right will entitle its holder (other than such person or members of such group) to purchase for $160.00, a number of Company common shares having a market value of twice such price. In addition, at any time after a person or group acquires 15% of the Company's outstanding common stock, the Company's Board of Directors may exchange one share of the Company's common stock for each outstanding right (other than rights owned by such person or group, which would have become void).

Prior to the acquisition by a person or group of beneficial ownership of 15% of the Company's common stock, the rights are redeemable for one cent per right at the option of the Board of Directors.

Certain synthetic interests in securities created by derivative positions-whether or not such interests are considered to constitute beneficial ownership of the underlying common stock for reporting purposes under Regulation 13D of the Securities Exchange Act-are treated as beneficial ownership of the number of shares of the Company's common stock equivalent to the economic exposure created by the derivative position, to the extent actual shares of the Company's stock are directly or indirectly held by counterparties to the derivatives contracts.

The dividend distribution will be made on October 5, 2022, payable to stockholders on that date and is not taxable to stockholders. The rights will expire on the earliest of (i) the close of business on the first day following the date of the Company's first annual meeting of its stockholders following the date of the rights plan and (ii) June 30, 2023, unless the rights are earlier redeemed or exchanged.

A copy of the stockholder rights plan will be contained in a Form 8-K to be filed with the Securities and Exchange Commission.

Related Categories :

Finance & Investing

More Finance & Investing News

-

Peak Resources Pumps the Brakes on IPO

-

CrownRock Wasted No Time Sellling Oxy Shares It Acquired

-

Baytex Energy Corp. First Quarter 2023 Results

-

Bonterra Energy Second Quarter 2022 Results

-

Range Resources Second Quarter 2022 Results

Gulf Coast News >>>

-

Why Surface-Only Inventory Predictions Are a Fool’s Errand

-

OPEC+ Nudges Supply Higher: Why This Weekend’s Hike Echoes 2020—But Isn’t 2020

-

SM Energy Hits Record Output; Driven by Uinta

-

Refracs That Compete: Eagle Ford Wells Return to Life

-

Large Cap E&P To Reduce Drilling & Completion Activity in 2026 -