Drilling & Completions | Quarterly / Earnings Reports | Third Quarter (3Q) Update | Deals - Acquisition, Mergers, Divestitures | Financial Results | Capital Markets | Capital Expenditure | Capex Decrease

WPX Energy Third Quarter 2020 Results; Merger with Devon on Track

WPX Energy reported its Q3 2020 results.

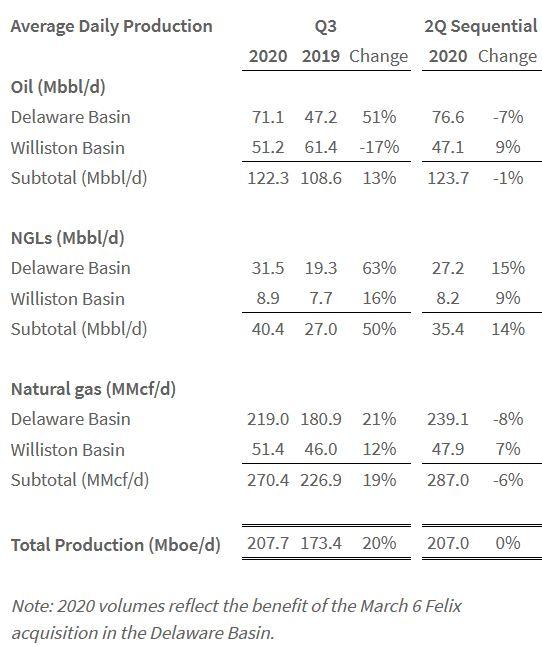

WPX reported third-quarter oil volumes of 122,300 barrels per day, in line with second-quarter results as expected stemming from the effects of prior curtailments and reduced development activity.

- Current oil rate of approx. 140,000 bbl/d already at the year-end target

- Increasing 4Q oil target to 137,000-143,000 bbl/d

- Reducing 2020 full-year CAPEX by another $50 million

- Raising 2020 free cash flow projection by 50% to more than $300 million

- Reducing LOE to $5.10-$5.40 per BOE for full-year 2020, a 14% improvement

- Attractive Bone Spring results in the Delaware Basin

- Merger with Devon on track, creating a leading U.S. energy company

Releases All Frac Crews

WPX released all four of its completion crews during the second quarter in response to the COVID-19 impact on oil demand and commodity prices. WPX now has two crews deployed in the Delaware Basin and one in the Williston Basin after starting to resume completions in July.

Cuts 2020 Capex by Another $50MM

Current oil volumes are approximately 140,000 bbl/d due to strong well results in both of WPX's basins. WPX now plans to average 137,000-143,000 bbl/d in the fourth quarter while reducing capital spending by another $50 million to a new estimate of $1.0-$1.1 billion for full-year 2020.

Financial Highlights for Q3

- WPX reported an unaudited third-quarter loss from continuing operations attributable to common shareholders of $148 million, or a loss of $0.26 per share on a diluted basis.

- The loss primarily was driven by a $110 million net loss on derivatives resulting from non-cash forward mark-to-market changes in the company's hedge book, and a loss on the extinguishment of debt.

- As underlying forward commodity prices improved in the quarter, the value of hedging contracts was reduced from levels recorded at June 30.

- Excluding the forward mark-to-market changes in derivatives and other items, WPX posted adjusted net income from continuing operations (a non-GAAP financial measure) in third-quarter 2020 of $60 million, or income of $0.11 per share. A reconciliation accompanies this press release.

- Adjusted EBITDAX (a non-GAAP financial measure) hit $389 million in the quarter, up 8 percent from $361 million a year ago. A reconciliation accompanies this press release.

- Free cash flow from operations (a non-GAAP financial measure) was $79 million in third-quarter 2020 and $241 million for the first three quarters of the year.

- WPX now expects to generate more than $300 million of free cash flow in 2020, up 50 percent from its most recent estimate of $200 million.

Merger Update

As previously announced on Sept. 28, WPX and Devon Energy have entered into an agreement to combine in an all-stock merger of equals, making the combined entity the fifth largest independent oil producer in the country.

Integration plans are underway, led by a transition team comprised of senior leaders from each company. Additionally, the team is tasked with capitalizing on the synergies and operational efficiencies that contribute to the significant upside of the combined company.

Under the terms of the agreement, WPX shareholders will receive a fixed exchange ratio of 0.5165 shares of Devon common stock for each share of WPX common stock owned. Devon shareholders will own approximately 57 percent of the combined company and WPX shareholders will own approximately 43 percent of the combined company on a fully diluted basis.

The transaction is expected to close in the first quarter of 2021 and has been unanimously approved by the boards of directors of both companies.

WPX CEO Rick Muncrief commented: "Our proposed merger is on track and is proving to be a transformational event not only for our two companies, but for our industry as a whole based on events that have unfolded since our announcement.

"Consolidation is a strategic step that reduces costs, improves margins and accelerates the return of capital to shareholders in very meaningful ways.

"WPX has been a leader in our peer group, and the combined company will provide us with even more strength and capacity to deliver value through disciplined management and an unwavering focus on profitable, per-share growth," Muncrief said.

"Our teams are committed to closing the transaction as quickly as possible in order to begin executing on the performance improvement opportunities we know already exist today."

"I want to commend WPX employees for their continued professionalism and commitment to a smooth integration despite the personal impacts that will undoubtedly occur at all levels of our organization as we act boldly on behalf of shareholders," Muncrief added.

Ops Update

Delaware BasinWPX's Delaware production in the Permian averaged 139.1 Mboe/d in the third quarter compared with 143.7 Mboe/d in the most recent quarter and 96.7 Mboe/d a year ago. The year-over-year increase is driven by WPX's acquisition of Felix Energy.

WPX completed 13 Delaware wells during the third quarter, including promising results from delineation work in various Bone Spring benches.

Four wells in the 3rd Bone Spring Lime hit respective 24-hour highs of 4,255 Boe/d, 3,804 Boe/d, 3,697 Boe/d and 3,602 Boe/d ranging from 53 to 65 percent oil. After 30 days of production, the four wells had a combined average of 3,004 Boe/d per well.

Third-quarter Delaware completions also include a 2nd Bone Spring Sand well - the CBR 9-4H-56-1-321H well - that hit a 24-hour high of 4,159 Boe/d (62 percent oil) during initial production and averaged 3,742 Boe/d over its first 30 days.

A third-quarter Wolfcamp A well - the CBR 9-4I-56-1-428H well - hit a 24-hour high of 3,877 Boe/d (45 percent oil) during initial production and averaged 3,043 Boe/d over its first 30 days.

Delaware D&C costs continue to improve. The average cost for recent 2-mile laterals on the CBR 9-4 and 10-3 pads in the Stateline area that included the Bone Spring wells was $5.9 million per well.

Williston BasinWilliston Basin production averaged 68.7 Mboe/d in third-quarter 2020 compared with 63.3 Mboe/d in the most recent quarter and 76.8 Mboe/d a year ago.

WPX completed 16 Williston wells during the third quarter, including nine wells in the Three Forks formation and seven wells in the Bakken formation.

The highest 24-hour rate for the third-quarter Williston completions was 8,686 Boe/d (84 percent oil) on the Omaha Woman 24-13-12 HD well, which is a three-mile lateral.

All four wells on the Omaha Woman drilling pad are three-mile laterals, which had a combined average of nearly 5,700 Boe/d per well during initial production.

WPX's third-quarter Williston completions also include the four-well Wolverine pad, which had a combined average exceeding 3,800 Boe/d per well during initial production. The top well on the pad - the Wolverine 21-22HD well - hit a 24-hour high of 4,922 Boe/d (84 percent oil). All four wells are two-mile laterals.

3Q Production

Total production volumes of 207.7 Mboe/d in third-quarter 2020 were comparable with second-quarter 2020 and were 20 percent higher than the same period a year ago. Liquids volumes accounted for 78 percent of third-quarter 2020 production.

Oil volumes of 122,300 bbl/d in third-quarter 2020 were comparable with second-quarter 2020 despite service outages affecting rates for portions of the quarter in both of its basins. Third-quarter 2020 volumes were up 13 percent vs. the same period a year ago.

Total capital spending in third-quarter 2020 was $256 million, predominantly from $236 million in D&C activity for operated wells and $6 million for midstream infrastructure.

For the remainder of 2020, WPX has 91,800 bbl/d of oil hedged with fixed price swaps at a weighted average price of $53.06 per barrel and 20,000 bbl/d with fixed price collars at a weighted average floor price of $53.33.

For 2021, WPX has 64,878 bbl/d of oil hedged with fixed price swaps at a weighted average price of $41.35 per barrel and 240,000 MMBtu/d of natural gas hedged with fixed price swaps at a weighted average price of $2.62 per MMBtu.

Q3 Financials

Total product revenues of $491 million in third-quarter 2020 were 15 percent lower than the same period a year ago stemming from lower commodity prices.

Total product revenues of $1,267 million during the first three quarters of 2020 were 23 percent lower than the same period a year ago stemming from lower commodity prices.

For the first three quarters of the year, WPX posted a net loss from continuing operations attributable to common shareholders of $770 million, or a loss of $1.46 per share on a diluted basis.

Adjusted net income from continuing operations for the first three quarters of 2020 was $159 million, or income of $0.30 per share. A reconciliation accompanies this press release.

During the third quarter, DD&A, lease operating expenses, taxes and G&A expense all declined on a per-Boe basis vs. a year ago. Notably, LOE declined 20 percent, from $6.02 per Boe a year ago to $4.81. WPX is now projecting LOE of $5.10-$5.40 per BOE for full-year 2020, an improvement of 14 percent vs. the company's original midpoint estimate for the year.

For the first three quarters of 2020, adjusted EBITDAX (a non-GAAP financial measure) was $1,168 million, or 14 percent higher than $1,028 million for the same period in 2019. Reconciliations for non-GAAP financial measures are available in the tables that accompany this press release.

The weighted average gross sales price during third-quarter 2020 - prior to revenue deductions - was $38.97 per barrel for oil (down 28 percent vs. a year ago), $1.66 per Mcf for natural gas (down 8 percent) and $12.43 per barrel for NGL (up 4 percent).

WPX's total liquidity at the close of business on Sept. 30, 2020, was approximately $1.7 billion, including cash, cash equivalents and all of its $1.5 billion available revolver capacity.

Related Categories :

Third Quarter (3Q) Update

More Third Quarter (3Q) Update News

-

Evolution Petroleum Corporation Fiscal Third Quarter 2023 Results

-

Civitas Resources Third Quarter 2022 Results

-

Murphy Oil Third Quarter 2022 Results

-

ConocoPhillips Third Quarter 2022 Results

-

California Resources Third Quarter 2022 Results

Permian News >>>

-

Why Surface-Only Inventory Predictions Are a Fool’s Errand

-

Occidental Eyes $10 Billion OxyChem Sale Amid Debt and Capital Discipline Push -

-

Permian Gas Gets New Highway: Transwestern’s 1.5 Bcf/d Desert Southwest Expansion -

-

WaterBridge Infrastructure Brings Delaware Basin Water Model to Wall Street -

-

OPEC+ Nudges Supply Higher: Why This Weekend’s Hike Echoes 2020—But Isn’t 2020

Permian - Delaware Basin News >>>

-

SM Energy Hits Record Output; Driven by Uinta

-

The Permian Play: How ExxonMobil Is Rewriting the Shale Narrative -

-

Large Cap E&P To Reduce Drilling & Completion Activity in 2026 -

-

$2.4B Deal Gives MPLX Sour Gas Edge in Permian -

-

Liberty Energy: Navigating the Frac Downturn with Efficiency, Innovation, and Strategic Focus -