Finance & Investing | Top Story | Debt | Capital Markets | Debt Exchange/Swaps

Hedge Fund Buys $33MM Debt Load from Bakken-Focused E&P

A private hedge fund has bought up a chunk of Northern Oil & Gas' debt, according to a report by Reuters.

Angelo, Gordon & Co. purchased $33 million worth of the company's debt as it looks to bolster Northern Oil's cash reserves. The report also stated that Angelo hinted at a possible debt or equity exchange for Northern Oil in the near future.

The firm owns a ~10% stake in Northern Oil, making it the company's second largest investor. The largest stakeholder is hotel mogul Robert Rowling, who owns over 22% of Northern Oil.

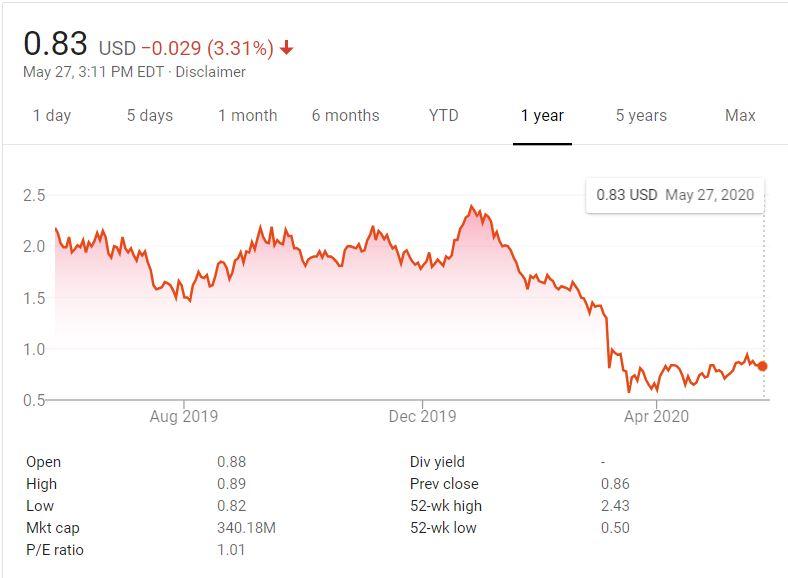

Northern Oil Stock Price - Last 12 Months

Northern Oil's stock has been hit hard by the commodity price downturn, coming in at less than $1.00/share this week (down ~64% from a high of $2.30 in late December 2019).

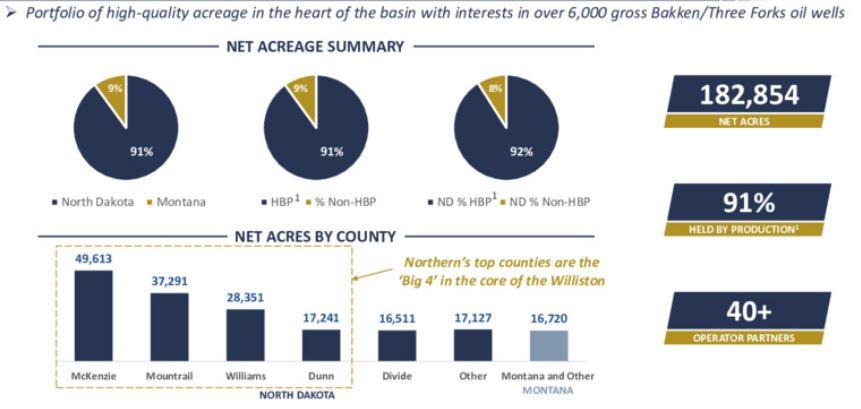

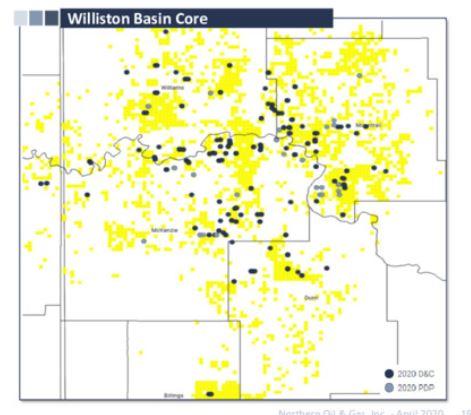

Northern Oil Asset Snapshot

Northern Oil & Gas Inc. is a non-op company with operations focused in the Bakken.

Related Categories :

Finance & Investing

More Finance & Investing News

-

Peak Resources Pumps the Brakes on IPO

-

CrownRock Wasted No Time Sellling Oxy Shares It Acquired

-

Baytex Energy Corp. First Quarter 2023 Results

-

Silverbow Resources Board Adopts 'Poison Pill' Strategy

-

Bonterra Energy Second Quarter 2022 Results

Rockies News >>>

-

SM Energy Hits Record Output; Driven by Uinta

-

Large Cap E&P To Reduce Drilling & Completion Activity in 2026 -

-

Baker Hughes Solid Y/Y Performance Amidst US Frac Market Slowdown -

-

Halliburton Warns of Deepening U.S. Frac Slowdown -

-

Oilfield Service Report : 13 New Leads/Company Formation & Contacts YTD

Williston Basin News >>>

-

PE Firm Seeds Four New E&P Startups in Strategic Push In 2025 -

-

Schlumberger Shows Steady Resilience Amid Market Volatility -

-

Civitas Provides Update on Current Rigs & Frac Crews -

-

IOG forms Partnership with PE-Firm First Reverse To Fund DrillCo's -

-

Intel Bits : E&P Operators Cut Frac Crews/ Rigs For Remainder of 2025; A Detailed Look