M&A Highlights: Q3 2019

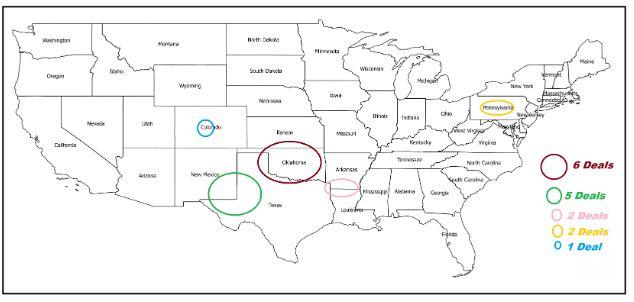

Deals Map

For the first time in recent quarters, the MidCon region has dominated the deal count compared to other plays. This development is highlighted by two deals: Apache's exit of the Western Anadarko (the company sold its assets to PE-backed Presidio Petroleum) and Contango's bid for bankrupt White Star Petroleum's assets.

In the Permian, Oxy signed a JV deal with Ecopetrol to increase drilling activity in the Midland Basin. Additionally, PE-backed Spur Energy Partners acquired Concho's New Mexico Shelf Assets for $900 million.

In the DJ Basin, PDC has decided to acquire SRC Energy assets. The property fits perfectly into PDC's core DJ Basin position.

Callon has decided to take out Carrizo, striking a merger deal earlier in Q3. Most analysts were surprised that Callon was willing to give up its Pure-Play Permian status to acquire Carrizo's "sub-par" Eagle Ford property.

Deals Affecting Oilfield Services

The deals below will have a direct impact on drilling and completions businesses:

1. Spur Energy Partners acquisition of Concho's New Mexico Shelf assets. We expect to see Spur Energy add a rig or two to this area in 2020.

2. PDC's merger with SRC Energy - This deal will see a reduction in well count and rig count in 2020. PDC is planning on reducing its Watternberg well count in 2020 from (PDC + SRC) 178 to 125 (PDC proforma) which represents a 30% reduction in activity.

3. Callon's acquisition of Carrizo - Callon (porforma) is planning on increasing activity in 2020 to 9 rigs (7 in the Permian and 2 in the Eagle ford). The companies (Callon and Carrizo) is currently operating 7 rigs, however

4. Osaka Gas acquisition of Sabine's Haynesville Asset - We expect Osaka to add a rig or two to the property in 2020, even in a depressed natural gas price environment. We have already begun to see increase permit activity in and around the property.

Top Ten Deals for Q3 2019

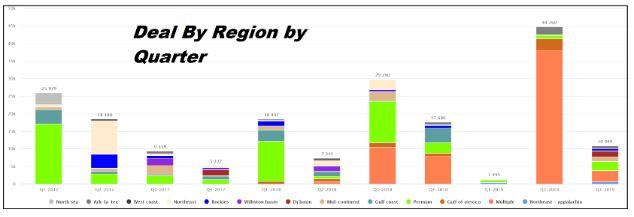

Deals by Quarter by Region

If we remove the conventional Alaska deal by Hilcorp from the deal flow, we would have another quarter of low deal flow. The quarter was dominated by two mergers.

- Callon Acquiring Carrizo

- PDC acquiring SRC Energy

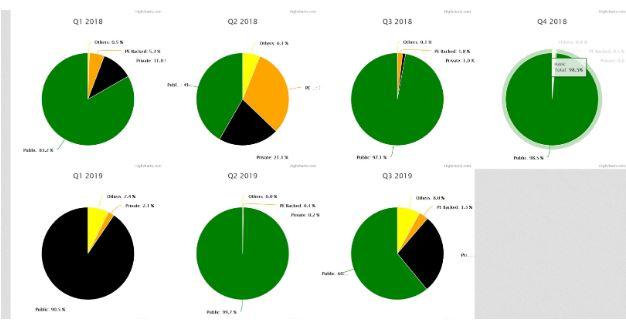

Who is Buying?

The market for assets is still dominated by public independents.

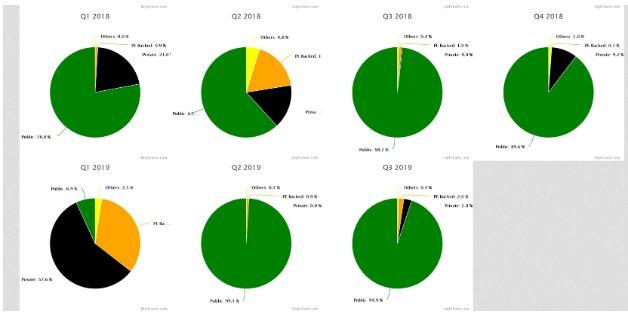

Who is Selling?

Recent Deals/Transactions

| Date Annouced | Category | Headline | Buyer(s) | Seller(s) | Value ($mm) |

|---|---|---|---|---|---|

| 09/02/2025 | E&P | Crescent Energy Acquires Vital |

|

|

|

| 07/10/2025 | E&P | Mach Resources Buys San Juan Gas Asset for $787 Million |

|

|

|

| 07/10/2025 | E&P | Mach Enters Permian Basin, Buys PE_backed Sabinal Assets for $500 Million |

|

|

|

| 06/05/2025 | E&P | Vermillion Energy Exits US, Sells Power River Basin Asset |

|

|

|

| 05/30/2025 | E&P | EOG Acquires Utica Liquids Focus Encino For $5.6 Billion |

|

|

|

| 05/13/2025 | E&P | TXO Partners Acquires White Rock Assets in the Elm Coulee Field |

|

|

|

| 05/07/2025 | E&P | Permian Resources Bolt-On Assets From APA Corp |

|

|

|

| 05/03/2025 | E&P | Riley Permian Acquires PE-Backed Silverback II For $142million |

|

|

|

| 04/22/2025 | E&P | EQT Acquires Olympus Energy Assets For $1.8 Billion |

|

|

|

| 04/01/2025 | E&P | TG Natural Resources Acquires Interest in Chevron’s Haynesville Asset |

|

|

|

| Total |

|