Service & Supply | Oilfield Services | Frac Markets - Pressure Pumping | Deals - Acquisition, Mergers, Divestitures

Nextier Acquires Fellow Pressure Pumper For $268 Million

NexTier Oilfield today announced that it has reached an agreement to acquire 100% of the ownership interests of Alamo Pressure Pumping for $268 million. The transaction is expected to be completed by August 31, 2021.

Transaction Details

The transaction valuation is approximately $268 million, which includes (i) cash consideration of $100 million (ii) the issuance of 26 million shares of NexTier's common stock, (iii) the assumption by the Company of certain existing liabilities, including $38 million of equipment obligations, and (iv) $30 million of post-closing services to be provided to Alamo E&P. The Purchase Agreement also provides for (a) potential earn-out payments, payable in the event Alamo achieves certain EBITDA levels through year-end 2022, (b) Tier II equipment upgrade payments (determinable following completion of upgrades), and (c) various purchase price adjustments. The common stock issuable as part of the closing reflects an ownership by sellers of approximately 10.7% of the pro-forma Company, and is subject to certain lock-up provisions.

The transaction valuation of approximately $268 million reflects approximately $582 per horsepower for 460,000 horsepower of primarily next-gen equipment. In addition, assuming $80 million of Alamo achieved EBITDA in 2022i, reflecting the threshold for earn-out payments to occur, the transaction valuation reflects an estimated multiple of approximately 3.4x.

Consolidating 2 leading providers of low carbon well completion solutions in the Permian Basin

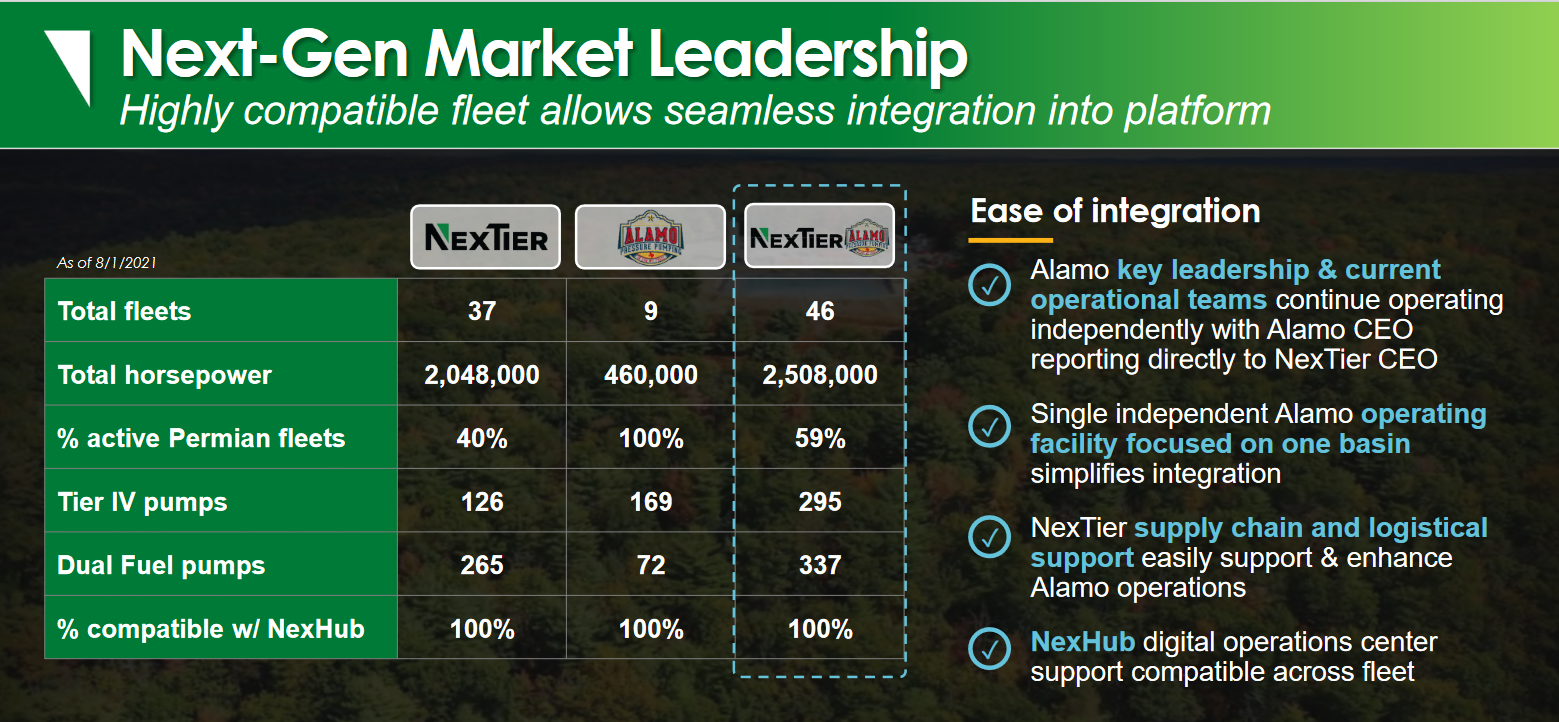

- Adds 9 highly utilized, primarily CAT Tier IV, young hydraulic fracturing fleets to NexTier's asset base

- Fortifies NexTier as the leader in CAT Tier IV Dual Fuel technology

- Expects to capture minimum $10 million annualized cost synergies within 6 months of closing

- Maintains strong and flexible balance sheet with $272 million estimated pro-forma liquidity and no near-term debt maturities

- Retains Alamo's key leadership & current operational teams intact with Alamo CEO reporting directly to NexTier CEO

Management Commentary

"The acquisition of Alamo accelerates and magnifies the impact of our next generation technology strategy, providing NexTier with significant opportunities for deploying gas-powered equipment and complimentary integrated solutions into a market with high and increasing demand," said Robert Drummond, President & Chief Executive Officer of NexTier. "Combined, we will operate the third largest base of active hydraulic horsepower across the U.S. and the largest base of next generation equipment in the Permian, improving our scale with highly-utilized fleets for an efficient customer base. We are impressed with Alamo's performance and their successful track record in the Midland basin. Therefore, other than enhancement by our last-mile logistics, NexHub and digital tools, operational integration will be minimal. Joe McKie, the Alamo President and CEO, will continue to lead the Alamo division of NexTier and report directly to me."

"NexTier remains focused on maintaining a strong financial position with attractive cash, liquidity, and leverage positions," said Kenny Pucheu, Executive Vice President and Chief Financial Officer of NexTier. "Today's acquisition accelerates our path to free cash flow generation in early 2022. With no near-term debt maturities, we expect to drive cash flow back onto the balance sheet through expanded Tier IV Dual Fuel capacity and anticipated higher utilization. This transaction is a win-win, as it immediately expands our gas-powered equipment capacity, accelerating speed to market by avoiding the significant time lag associated with organically growing our low carbon fleet, with added benefit of not increasing market capacity. In sum, we are acquiring a highly utilized base of next generation equipment at an attractive relative valuation, upholding our commitment to delivering value to shareholders."

Recent Deals/Transactions

| Date Annouced | Category | Headline | Buyer(s) | Seller(s) | Value ($mm) |

|---|---|---|---|---|---|

| 09/02/2025 | E&P | Crescent Energy Acquires Vital |

|

|

|

| 07/10/2025 | E&P | Mach Resources Buys San Juan Gas Asset for $787 Million |

|

|

|

| 07/10/2025 | E&P | Mach Enters Permian Basin, Buys PE_backed Sabinal Assets for $500 Million |

|

|

|

| 06/05/2025 | E&P | Vermillion Energy Exits US, Sells Power River Basin Asset |

|

|

|

| 05/30/2025 | E&P | EOG Acquires Utica Liquids Focus Encino For $5.6 Billion |

|

|

|

| 05/13/2025 | E&P | TXO Partners Acquires White Rock Assets in the Elm Coulee Field |

|

|

|

| 05/07/2025 | E&P | Permian Resources Bolt-On Assets From APA Corp |

|

|

|

| 05/03/2025 | E&P | Riley Permian Acquires PE-Backed Silverback II For $142million |

|

|

|

| 04/22/2025 | E&P | EQT Acquires Olympus Energy Assets For $1.8 Billion |

|

|

|

| 04/01/2025 | E&P | TG Natural Resources Acquires Interest in Chevron’s Haynesville Asset |

|

|

|

| Total |

|