Deals - Acquisition, Mergers, Divestitures

Oxy Outmaneuvers Competition in Battle for Anadarko as Chevron Walks Away

Chevron announced that it will not make a counterproposal to Anadarko Petroleum's superior deal with Occidental Petroleum and will allow the four-day match period to expire.

Accordingly, Chevron anticipates that Anadarko will terminate their pending $33B merger agreement.

Oxy CEO Vicki Hollub outmaneuvered Chevron to seal with deal with Anadarko. Here is the timeline of events:

- April 12th: Oxy had originally submitted a stronger original offer for Anadarko, but it had "structural issues" according to Anadarko, causing them to go with the Chevron deal

- April 29th: Anadarko resumed negotiations with Oxy

- May 5th: Coming to an $8.8B agreement with Total SA regarding the acquisition of Anadarko's international assets

- May 6th: Oxy submitted an offer that represented a 23% premium in relation to Chevron's pending deal

- May 7th: Anadarko's board deemed the Oxy offer "superior" to Chevron's - giving the latter a four day period to respond with a better offer, which Chevron declined today

Shale Experts CEO Rons Dixon commented on the development, noting: "I will not be surprised if the Anadarko board of directors are sued by shareholders for agreeing to accept the initial Chevron offer that included a $1 billion breakup fee, without giving Oxy an opportunity to make their offer public."

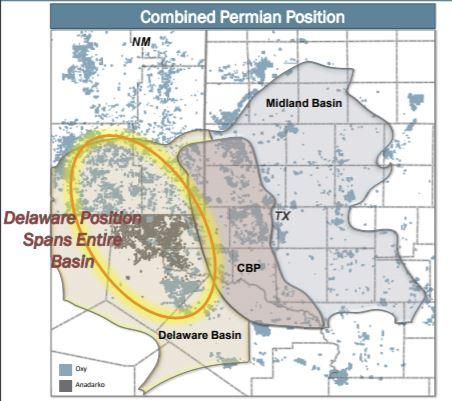

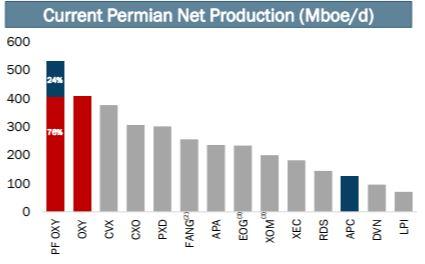

What Oxy + Anadarko Pro Forma Will Look Like (Delaware Basin)

Chevron's Chairman and CEO Michael Wirth commented: "Winning in any environment doesn't mean winning at any cost. Cost and capital discipline always matter, and we will not dilute our returns or erode value for our shareholders for the sake of doing a deal. Our advantaged portfolio is driving robust production and cash flow growth, higher investment returns and lower execution risk. We are well positioned to deliver superior value creation for our shareholders."

Upon termination, Anadarko will be required to pay Chevron a termination fee of $1 billion.

Recent Deals/Transactions

| Date Annouced | Category | Headline | Buyer(s) | Seller(s) | Value ($mm) |

|---|---|---|---|---|---|

| 09/02/2025 | E&P | Crescent Energy Acquires Vital |

|

|

|

| 07/10/2025 | E&P | Mach Resources Buys San Juan Gas Asset for $787 Million |

|

|

|

| 07/10/2025 | E&P | Mach Enters Permian Basin, Buys PE_backed Sabinal Assets for $500 Million |

|

|

|

| 06/05/2025 | E&P | Vermillion Energy Exits US, Sells Power River Basin Asset |

|

|

|

| 05/30/2025 | E&P | EOG Acquires Utica Liquids Focus Encino For $5.6 Billion |

|

|

|

| 05/13/2025 | E&P | TXO Partners Acquires White Rock Assets in the Elm Coulee Field |

|

|

|

| 05/07/2025 | E&P | Permian Resources Bolt-On Assets From APA Corp |

|

|

|

| 05/03/2025 | E&P | Riley Permian Acquires PE-Backed Silverback II For $142million |

|

|

|

| 04/22/2025 | E&P | EQT Acquires Olympus Energy Assets For $1.8 Billion |

|

|

|

| 04/01/2025 | E&P | TG Natural Resources Acquires Interest in Chevron’s Haynesville Asset |

|

|

|

| Total |

|