Quarterly / Earnings Reports | Third Quarter (3Q) Update | Financial Results | Offshore | Capital Markets | Corporate Strategy

Shell Third Quarter 2020 Results

Shell announced reported its Q3 2020 results.

Future Strategy

The company also detailed a cash allocation framework that will enable it to reduce debt, increase distributions to shareholders, and allow for disciplined growth as it reshapes its business for the future of energy. Ongoing work to reshape Shell’s portfolio is expected to deliver continued cash generation to grow its low-carbon businesses as well as to increase shareholder distributions, making a compelling investment case.

In confirming its progressive dividend policy, Shell announces a dividend per share growth by around 4% to 16.65 US cents for the third quarter 2020 and annually thereafter, subject to Board approval.

The cash allocation framework includes a target to reduce net debt to $65 billion (from $73.5 billion as of September 30, 2020) – and, on achieving this milestone, a target to distribute a total of 20-30% of cash flow from operations to shareholders. Increased shareholder distributions will be achieved through a combination of Shell’s progressive dividend and share buybacks. Remaining cash will be allocated to disciplined and measured capex growth and further debt reduction, targeting AA credit metrics through the cycle.

Shell’s decisive steps this year have significantly strengthened its financial resilience, allowing the acceleration of strategic plans and providing clarity on cash priorities. These actions support Shell's ambition to become a net-zero energy emissions business by 2050 or sooner, in step with society and its customers.

CEO Ben van Beurden said: "Our sector-leading cash flows will enable us to grow our businesses of the future while increasing shareholder distributions, making us a compelling investment case.

"We must continue to strengthen the financial resilience of our portfolio as we make the transition to become a net-zero emissions energy business. Our decisive actions taken earlier in the year have solidified our operational and cash delivery. The strength of our performance gives us the confidence to lay out our strategic direction, resume dividend growth and to provide clarity on the cash allocation framework, with clear parameters to increase shareholder distributions."

Chair of the Board of Royal Dutch Shell, Chad Holliday commented: "The Board has reviewed Shell’s recent performance and its plans to grow its businesses of the future, and we are confident that Shell can sustainably grow its shareholder distributions as well as invest for growth.

As a result, the Board has decided to increase the dividend per share to 16.65 US cents for the third quarter 2020. The Board has additionally approved a cash allocation framework for Shell which, on reducing its net debt to $65 billion, will target total shareholder distributions of 20-30% of cash flow from operations."

Shell will continue with its strong capital discipline, including annual Cash capex of between $19 and $22 billion in the near term and a focus on reducing net debt. Shell will continue its relentless high grading of the portfolio with expected divestment proceeds of $4 billion a year on average.

Energy Transition Strategy

Shell will reshape its portfolio of assets and products to meet the cleaner energy needs of its customers in the coming decades. The key elements of Shell’s strategic direction include:

- Ambition to be a net-zero emissions energy business by 2050 or sooner, in step with society and its customers.

- Grow its leading marketing business, further develop the integrated power business and commercialise hydrogen and biofuels to support customers’ efforts to achieve net-zero emissions.

- Transform the Refining portfolio from the current fourteen sites into six high-value energy and chemicals parks, integrated with Chemicals. Growth in Chemicals will pivot to more performance chemicals and recycled feedstocks.

- Extend leadership in liquefied natural gas (LNG) to enable decarbonisation of key markets and sectors.

- Focus on value over volume by simplifying Upstream to nine significant core positions, generating more than 80% of Upstream cash flow from operations.

- Enhanced value delivery through Trading and Optimisation.

A comprehensive strategy update, with details on the future shape of the Shell portfolio, actions to deliver the net-zero ambition, and a full financial outlook will be presented on February 11, 2021.

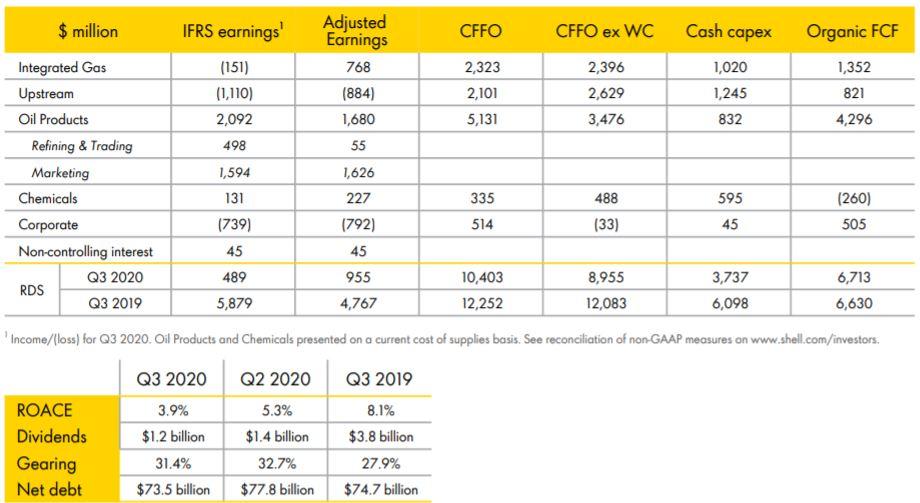

Q3 2020 Results

- Resilient earnings in a challenging macroeconomic environment.

- Record Marketing earnings driven by increased sales mix of high-margin premium products and higher non-fuel sales from our convenience retail stores.

- Strong cash flow performance proving the resilience of our integrated business model and strong cost discipline.

- Further strengthening of the balance sheet with net debt reducing by $4.4 billion to $73.5 billion.

Integrated Gas & New Energies

- Low realised LNG prices due to price lag in oil-linked term contracts.

- LNG trading and optimisation results below average.

- Volumes negatively impacted by LNG maintenance activities.

Production: 830 - 870 thousand boe/d

Liquefaction volumes: 7.9 - 8.5 million tonnes

Upstream

- Lower demand and lower oil and gas prices driving lower Adjusted Earnings.

- Production 14% lower compared with Q3 2019 due to OPEC+ curtailments, lower gas demand and hurricanes in US Gulf of Mexico.

- Realised liquid prices 10% below Brent, in line with historical averages; offset by low effective tax rate while in a loss position.

Production: 2,300 - 2,500 thousand boe/d

Oil Products

- Record Marketing performance in the quarter driven by higher margins and volume recovery in Retail, Lubricants and B2B businesses.

- Continued weakness in refining margins and lower utilisation mainly due to lower demand and economic optimisation of the plants.

- Lower opex as a result of underlying structural cost reduction and lower maintenance cost and Marketing spend driven by lower activity.

- Trading and optimisation results below average.

Sales volumes: 4,000 - 5,000 thousand b/d

Refinery utilisation: 69% - 77%

Chemicals

- Lower Intermediate margins due to lower demand in most segments offset by relative strength in Solvents (used for cleaning and disinfectants) and Polyols (used in products such as furniture and insulation).

- Tax credit due to recognition of a deferred tax asset.

Sales volumes: 3,500 - 3,900 thousand tonnes

Manufacturing plant utilisation: 77% - 85%

Corporate

- Net debt decreased by $4.4 billion to $73.5 billion. Helped by higher free cash flow, including a working capital inflow.

- Gearing decreased by 1.3% to 31.4% driven by net debt reduction.

- Long-term debt issuance was $3.9 billion.

Adjusted earnings: net expense of $3,200 - $3,500 million for the full year 2020. This excludes the impact of currency exchange rate effects.

Q3 2020 Portfolio Developments

- During the quarter, the CrossWind consortium, a joint venture between Shell (79.9% interest) and Eneco (20.1% interest), was awarded the tender for the subsidy-free offshore wind farm Hollandse Kust (noord) in the Netherlands. The wind farm has a planned installed capacity of 759 MW and is expected to help meet the objectives of the Dutch Climate Accord and the EU’s Green Deal. Both companies have already taken their final investment decisions on the project. This investment is part of Shell's ambition for a new wind-to-hydrogen value chain.

- During the quarter, Shell completed the sale of its Appalachia shale gas position in the USA for $541 million paid fully in cash, less closing adjustments. The transaction has an effective date of January 1, 2020.

- In August, Shell took the final investment decision to contract the Mero-3 floating production, storage and offloading (FPSO) vessel to be deployed at the Mero field within the offshore Santos Basin in Brazil. This production system has a daily operational capacity rate of 180,000 barrels of oil equivalent, with production coming online over the next four years.

Related Categories :

Third Quarter (3Q) Update

More Third Quarter (3Q) Update News

-

Evolution Petroleum Corporation Fiscal Third Quarter 2023 Results

-

Civitas Resources Third Quarter 2022 Results

-

Murphy Oil Third Quarter 2022 Results

-

ConocoPhillips Third Quarter 2022 Results

-

California Resources Third Quarter 2022 Results

Asia - Pacific News >>>

-

Why Surface-Only Inventory Predictions Are a Fool’s Errand

-

Occidental Eyes $10 Billion OxyChem Sale Amid Debt and Capital Discipline Push -

-

Permian Gas Gets New Highway: Transwestern’s 1.5 Bcf/d Desert Southwest Expansion -

-

WaterBridge Infrastructure Brings Delaware Basin Water Model to Wall Street -

-

OPEC+ Nudges Supply Higher: Why This Weekend’s Hike Echoes 2020—But Isn’t 2020

Gulf of Mexico News >>>

-

SM Energy Hits Record Output; Driven by Uinta

-

The Permian Play: How ExxonMobil Is Rewriting the Shale Narrative -

-

Large Cap E&P To Reduce Drilling & Completion Activity in 2026 -

-

$2.4B Deal Gives MPLX Sour Gas Edge in Permian -

-

Liberty Energy: Navigating the Frac Downturn with Efficiency, Innovation, and Strategic Focus -